您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

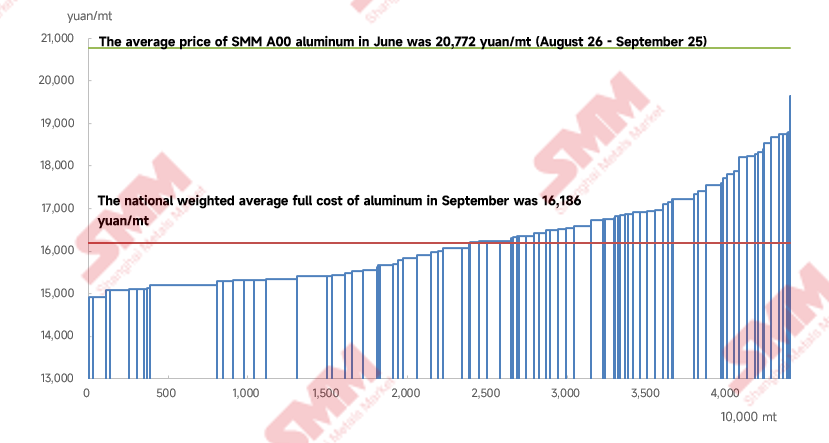

According to SMM data, the average tax-inclusive full cost of China's aluminium industry in September 2025 was RMB 16,186 per tonne, down 1.5 per cent m-o-m and 6.4 per cent y-o-y, mainly due to the decline in the average monthly alumina price and lower costs during the period. Data from SMM shows that the monthly average of the SMM Alumina Index in September was RMB 3,113 per tonne (August 26–September 25), and the weighted average alumina cost for the national aluminium industry fell 4.3 per cent m-o-m. The average SMM A00 spot price was about RMB 20,772 per tonne (August 26–September 25), with the average profit in the domestic aluminium industry at approximately RMB 4,586 per tonne.

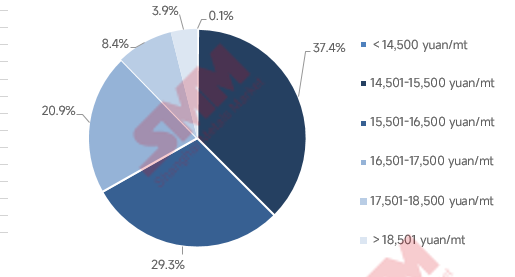

By the end of September 2025, domestic operating aluminium capacity reached 44.05 million tonnes, with the lowest full cost at about RMB 13,540 per tonne and the highest full cost at around RMB 19,657 per tonne. If calculated using monthly average prices, 100 per cent of the operating aluminium capacity in China was profitable in September.

Cost side, from a breakdown perspective:

Alumina raw material side, SMM data indicates the monthly average of the SMM Alumina Index in September was RMB 3,113 per tonne (August 26–September 25). During the month, both domestic and international alumina markets were in surplus, leading to price declines and a lower monthly average price. Entering October, the alumina supply-demand balance remains in surplus, and spot alumina prices are expected to remain in the doldrums in the short term, with the monthly average price projected to fall further. The alumina raw material cost for aluminium production is anticipated to decrease further in October.

In the auxiliary material market, prebaked anode prices edged up in September, while fluoride salt prices weakened slightly with a stable-to-soft trend, leading to a modest rebound in auxiliary material costs. In October, prebaked anode prices are expected to rise slightly; aluminium fluoride, due to rising fluorite raw material costs, is projected to see a noticeable increase, and aluminium auxiliary material costs are forecast to move higher.

Electricity prices, in September, were largely stable. Entering October, no significant variables affecting electricity prices have been identified so far, and prices are expected to remain largely stable.

In October 2025, alumina costs are projected to decline, auxiliary material costs are expected to rise, and electricity costs are forecast to remain stable. Overall, the impact of alumina dominates, and aluminium costs are anticipated to decrease further. Taking everything into account, SMM expects the average tax-inclusive full cost for China's aluminium industry in October 2025 to be around RMB 15,800–16,200 per tonne.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses