您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

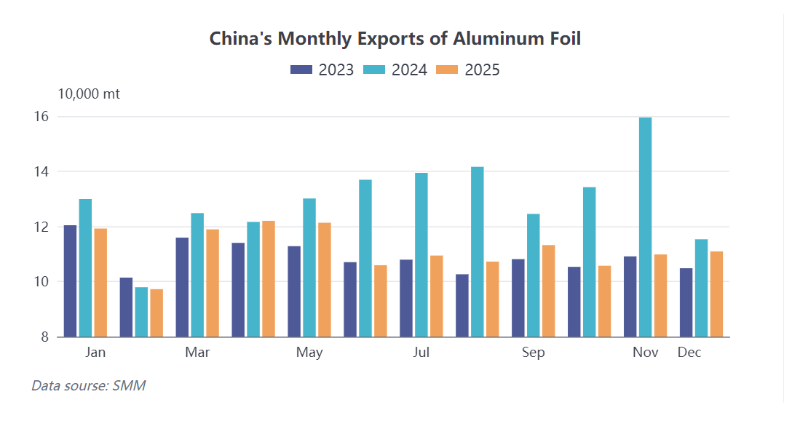

According to customs data, China's aluminium foil exports (customs tariff codes 76071110, 76071120, 76071190, 76071900, 76072000) totalled 110,900 tonnes in December 2025, up 1 per cent M-o-M from November but down 4 per cent Y-o-Y. Cumulative aluminium foil exports for full-year 2025 reached approximately 1.3407 million mt, down 13.8 per cent Y-o-Y.

{alcircleadd}

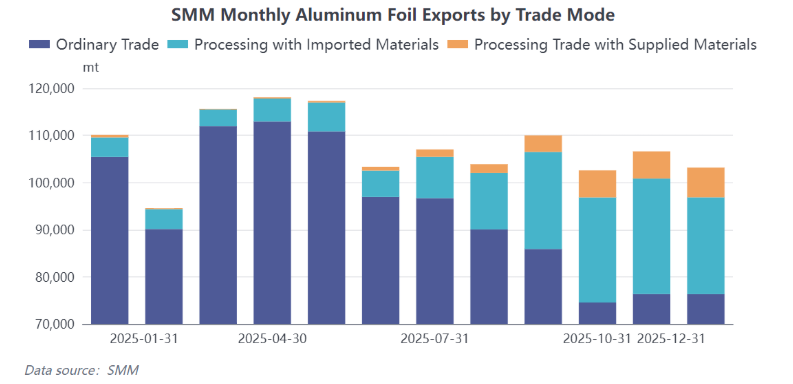

By trade mode, aluminium foil exports via Processing Trade with Imported Materials amounted to about 20,500 tonnes in December 2025, accounting for 18.5 per cent of the total, while exports via Processing Trade with Supplied Materials reached 6,300 tonnes, representing 5.6 per cent. For full-year 2025, aluminium plate/sheet and strip exports via Processing Trade with Supplied Materials and Processing Trade with Imported Materials were 20,500 tonnes and 137,200 tonnes, respectively, together accounting for 12.25 per cent of total exports.

International anti-dumping measures against China remain a long-term core constraint on aluminium foil exports. High anti-dumping duties imposed by several major markets have forced export orders to shift to overseas production sites or to markets without restrictions. This "forcing effect" continues to evolve. Meanwhile, the formal implementation of the EU's Carbon Border Adjustment Mechanism (CBAM) has introduced a new "green barrier" for aluminium foil exports. Although aluminium foil production is a downstream segment of aluminium processing, the carbon emission intensity of the entire production process will face strict scrutiny. CBAM not only increases compliance costs and administrative burdens but also fundamentally requires export enterprises to upgrade their carbon management systems comprehensively; otherwise, they will face competitive disadvantages in terms of cost.

On the other hand, global green transition and electrification trends present structural opportunities for aluminium foil: demand for power battery foil used in NEVs and foil for energy storage systems continues to grow; expansion of overseas food preservation and prepared meal industries supports packaging foil demand; industrialisation and consumption upgrading in emerging markets such as Southeast Asia and the Middle East create additional space. The market is shifting from broad-based growth to structural differentiation.

In summary, the growth momentum of the aluminium foil industry is gradually shifting to new sectors such as new energy and high-end packaging. Anti-dumping measures and CBAM are reshaping competitive thresholds from the perspectives of trade rules and green standards, respectively. The aluminium foil export market is now in a critical period characterised by overlapping "resilience tests" and "development variables."

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses