您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

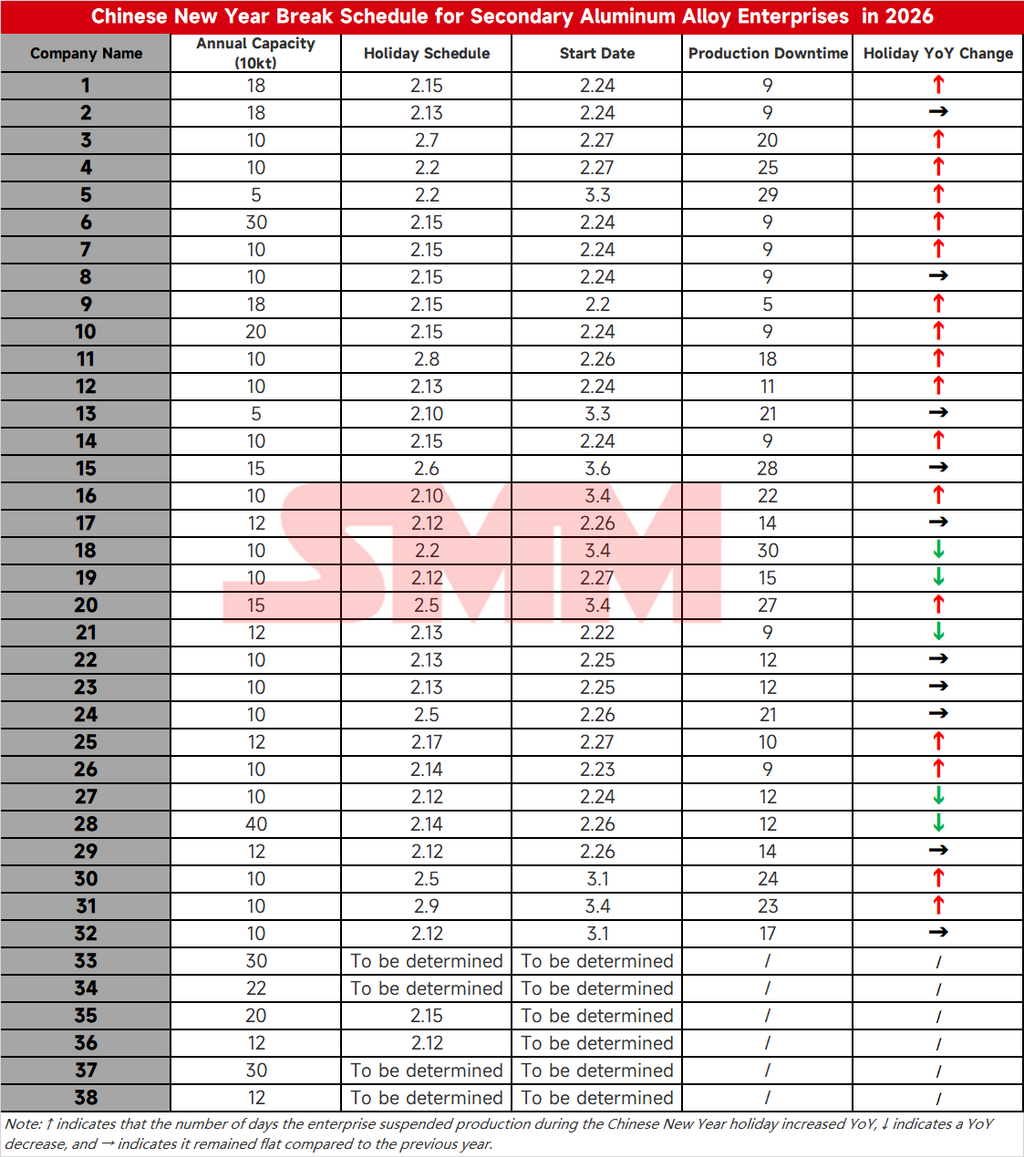

According to the latest SMM tracking, the Chinese New Year break schedules for secondary aluminium alloy producers have been successively released. The specific production schedules are as follows:

{alcircleadd}

Source: https://news.metal.com/

According to the SMM survey, most secondary aluminium alloy enterprises suspended production between February 5 and 13 during the 2026 Chinese New Year holiday, with the resumption of work concentrated around the eighth day of the first lunar month or the Lantern Festival. The average furnace shutdown period was expected to last 8–20 days, about two days longer Y-o-Y. The extended shutdown period was mainly due to a combination of factors, including significantly increased volatility in aluminium prices, widespread early production cuts by downstream enterprises, and tightening policies along with ongoing environmental protection-related controls. Against this backdrop, industry orders and operating rates were projected to pull back significantly in February. Currently, aluminium liquid direct supply enterprises, which need to align with downstream clients' production schedules, are expected to finalise specific holiday arrangements by early next week.

Demand side, pre-holiday stockpiling sentiment remained weak. On one hand, orders at downstream enterprises continued to weaken, with high aluminium prices significantly squeezing profit margins. On the other hand, as the holiday approached, downstream purchasing sentiment turned cautious. Even though aluminium prices pulled back noticeably this week, transaction improvements were limited, with procurement mainly focused on rigid restocking. The survey indicated that concentrated restocking was unlikely in the industry before the holiday, and demand-side drivers for prices remained insufficient.

Post-holiday, the pace of production resumptions in the industry was generally slow, and demand recovery remained to be seen. Against the backdrop of delayed order recovery and slow transmission of end-use demand, rapid volume expansion was unlikely in the short term. Secondary aluminium alloy prices were expected to continue fluctuating at highs, with the price centre facing some downward pressure.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses