您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

In recent years, people often explained aluminium prices using familiar demand stories like construction cycles, auto production, sentiment from China, and seasonal buying. However, as we approach 2026, a larger factor affecting price behaviour is hard to overlook: supply is less flexible than it once was.

{alcircleadd}Even in a slower-growing economy, aluminium prices can remain elevated if the market lacks enough capacity to absorb shocks. This is exactly what we are seeing now: tightness driven by a mix of structural constraints and not just one-time disruptions.

AL Circle’s upcoming Global Aluminium Industry Outlook 2026 frames this tightening as the result of multiple interconnected factors across the value chain, not one isolated event.

Structural deficits are replacing cyclical balance

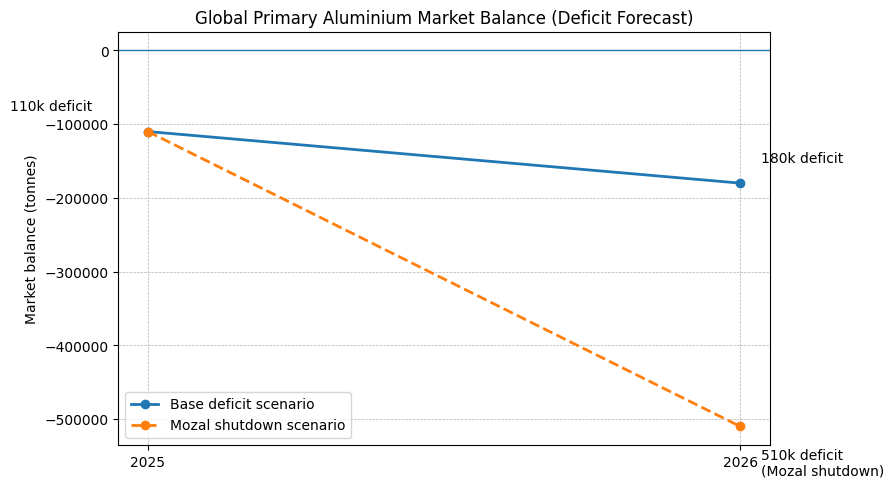

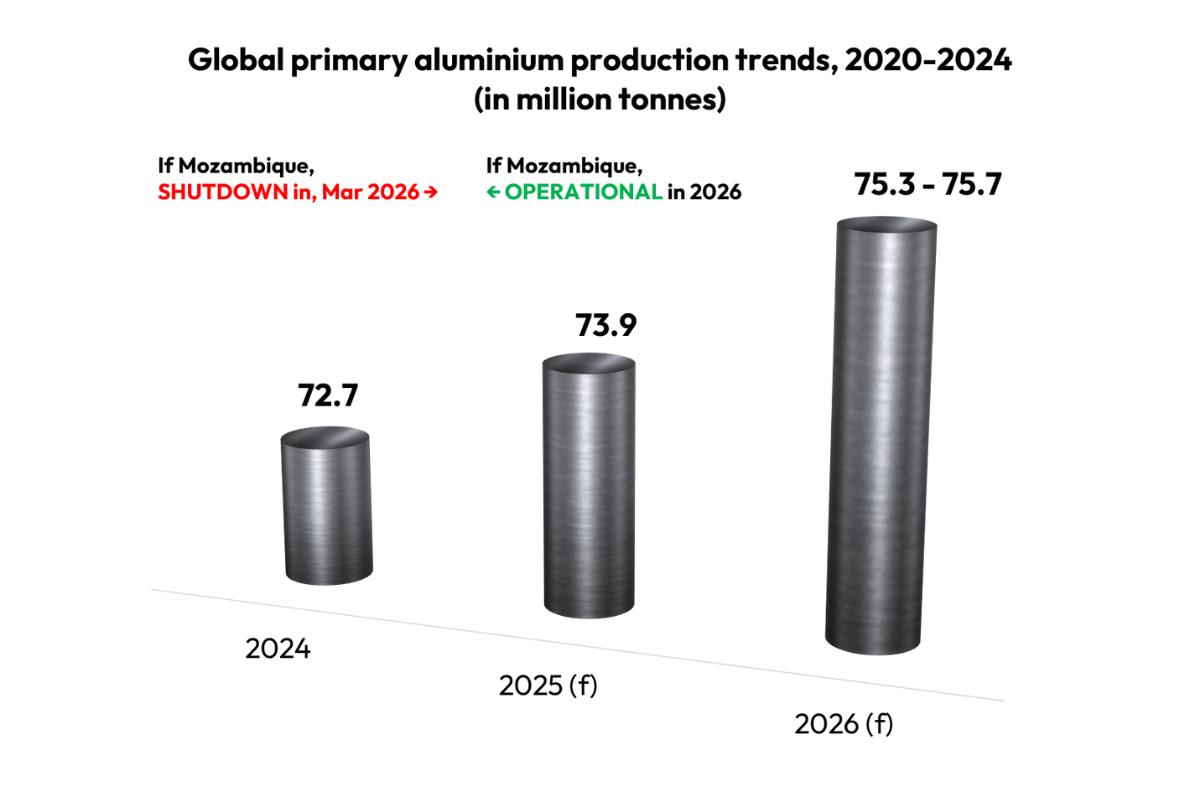

It is not about whether the deficit number seems big or small. The Outlook 2026 suggests the primary aluminium market will stay in deficit through 2026. Even modest shortfalls can matter significantly when inventories are low, and supply responses are slow.

In earlier cycles, the market had some cushion. Reduced capacity could be restarted, or surplus supply could help. Today, that cushion is thinner. Restarting production is not just a simple switch; it depends on power access, costs, environmental rules, and proving bankable economics.

The outcome is a market that feels structurally tighter. In such a market, it takes little, a surprise outage, a logistics issue, or a policy change, to push prices higher or keep them elevated.

China’s capacity cap has redefined global supply flexibility

China remains the most influential player in aluminium supply, but its influence on the global market has changed.

As mentioned in the Outlook 2026, China has set a primary aluminium capacity cap of around 45 million tonnes. Stricter enforcement of energy and environmental regulations has weakened the market's ability to rely on China for additional supply growth.

In simple terms, global demand can no longer count on China to always "fill the gap."

That shift has real pricing implications:

Energy and power risks have become central to supply tightness

If there is one theme that captures the aluminium supply outlook into 2026, it is this: electricity is not just a cost anymore; it is the gatekeeper.

The Outlook 2026 identifies energy availability and long-term power pricing as key factors for the competitiveness of primary aluminium. This risk is real. In many regions, production is limited not by the demand for metal but by the confidence in stable, affordable power:

This situation keeps supply “below potential”. Even if nameplate capacity exists, market behaviour reflects the lack of power security, which affects prices.

Why recycling alone cannot close the supply gap

Secondary aluminium is undeniably becoming more important, and rightly so. However, the Outlook 2026 points out that recycling cannot bear the entire supply burden in the medium term, despite industry desires.

_0_0.png)

Scrap availability is inconsistent. Quality limitations are real. Alloy requirements cannot always be met with recycled materials. Additionally, scrap flows are becoming increasingly affected by trade controls and export restrictions.

While recycling is vital for reducing emissions and achieving long-term sustainability goals, primary aluminium remains essential, especially for high-quality, specific alloy needs.

In other words, recycling helps, but it does not eliminate supply tightness by itself.

What this market structure means for metal trade

For metal traders, tightening supply shifts the market from volume-driven trading to risk-oriented positioning.

When deficits continue and supply flexibility shrinks, as estimated in the Outlook 2026, price direction becomes more sensitive to disruptions like power constraints, trade measures, inventory changes, and regional price shocks.

This situation presents stronger opportunities for arbitrage, timing, and regional flow optimisation. However, it also increases the cost of being incorrect in procurement timing, exposure management, and premium movements.

In this type of market, traders need clearer visibility into factors that influence balance: triggers for deficits, restart timelines, policy changes, and scrap availability. Those who grasp these pressure points will be better prepared to protect margins and create smarter contracts.

_0_0.png)

For buyers or manufacturers, this environment requires a shift in mindset. When supply risk dominates, the focus should shift from “buying cheap” to buying securely.

The Outlook 2026 suggests an increasing need to:

For producers, the questions become more strategic:

In both cases, success relies less on predicting the next price movement and more on understanding where supply pressures will appear first.

ALSO EXPLORE: ALUMINIUM 2026: From operating deficit to structural backwardation.

How the Global Aluminium Industry Outlook 2026 helps navigate pricing challenges

The challenge in today’s aluminium market is that prices are not driven by a single main factor; they are shaped by a system of constraints.

That is why the Global Aluminium Industry Outlook 2026 goes beyond simple forecasts. It provides stakeholders with a clearer framework to interpret price behaviour through:

The real challenge now is not just reacting to price changes. It is the understanding what supports prices and what might break that support. The Outlook 2026 report helps the industry make better decisions under uncertainty, whether about hedging, contracting, expansion planning, or strategic sourcing.

Responses