您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

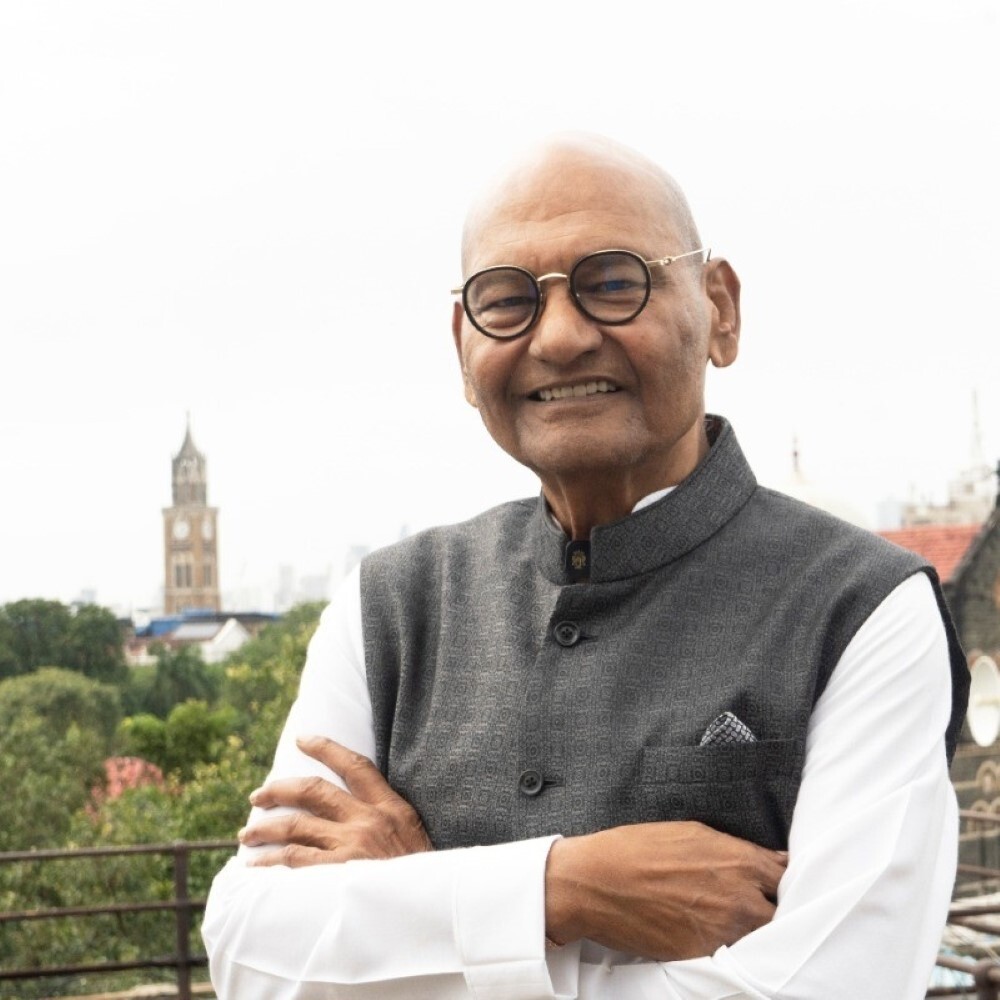

Anil Agarwal, the Chairman of Indian mining conglomerate Vedanta Limited, has divulged the intention to position itself as a global leader in the transition metals, energy, technology and critical minerals, dubbed "Vedanta 2.0" for the next growth phase. The firm has also announced its FY25 recorded revenue and EBITDA, future growth plans and demerger progress.

Image source: linkedin.com

While addressing the stakeholders about the group's annual report, Mr Agarwal highlighted its position at a pivotal inflexion point, backed by a record financial performance, robust cost leadership and the near-completion of its value-unlocking demerger exercise. He further emphasised the importance of the group's organisational realignment, greater focus on vertical integration and its expanding role in supporting India's infrastructure development and energy transition.

Owing to this, Anil Agarwal, Chairman of Vedanta Limited, said, "FY 2024-25 stands out as a year of strong performance for Vedanta. We delivered our highest-ever revenue of INR 1,50,725 crore (USD 18.05 billion). In comparison, our EBITDA jumped 19 per cent to INR 43,541 crore (USD 5.21 billion ), delivering industry-leading margins of 34 per cent - all achieved in a challenging environment," he said in his letter to stakeholders."

He adds, "Our aluminium and zinc operations maintained their industry-leading cost positions, ranking in the top quartile and decile, respectively, of the global cost curve. Zinc International, Iron Ore, and Steel businesses also delivered robust improvements, reinforcing Vedanta's leadership across multiple sectors."

In the financial year 2024-25, the company initiated crucial corporate actions to widen its cash reserves. This corporate action raised INR 8,500 crore (USD 1.02 billion) via qualified institutional placement. Additionally, the offer to initiate a sale at Hindustan Zinc helped raise INR 3,134 crore (USD 375.21 million), enabling the business to hold a cash reserve of INR 33,000 crore (USD 3.95 billion).

…and so much more!

SIGN UP / LOGINResponses