您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

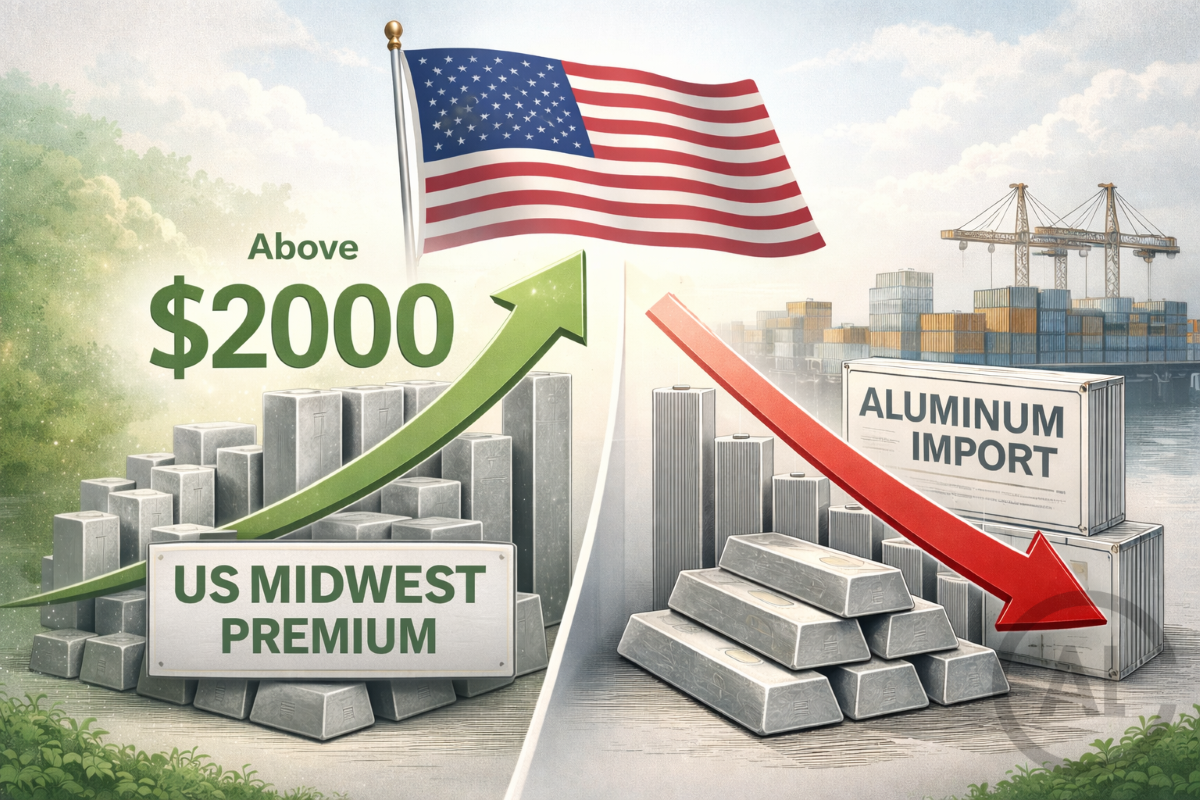

Ever since the US President Donald Trump’s tariff imposition, the market witnessed its regional aluminium premium rise, exceeding USD 1 per pound. Consequently, for the first time, the US Midwest Premium for aluminium has surged to an all-time high at USD 2,182 per tonne. According to the Fastmarkets report, this development occurred on January 28.

{alcircleadd}Explore- Most accurate data to drive business decisions with Global ALuminium Industry Outlook 2026 across the value chain

In early June, the Trump administration imposed a 50 per cent tariff on aluminium imports, with the premium hitting a record above 64 cents. The US Midwest Premium, a surcharge over the London Metals Exchange (LME), has more than doubled and remained on a rising trend since then.

On January 8, 2026, the premium exceeded USD 2000 for the first time, closing at USD 2004.24 per tonne.

The price graph for LME Aluminium Premium Duty Paid US Midwest in the H2 of 2025 shows a significant hike. From USD 1,300 per tonne on July 1, it hit an all-time high of USD 1,950.15 per tonne on November 10, reaching USD 1,971.09 per tonne on December 31.

Impact on imports

As a rule of law, the premium hike weighed on import volume through 2025. According to the official data, the US primary aluminium import volume in Q1 2025 was around 1.07 million tonnes, which in Q2 slipped by 23.25 per cent to 834,552 tonnes. Q3 import volume declined further, amounting to 687,586 tonnes, marking a 17.6 contract sequentially. Declines in each quarter resulted in a cumulative plunge of 35.6 per cent from Q1 to Q3, leading to tightened supply in the market.

Why the price volatility?

Volatility stemmed from the US tariffs doubled to 50 per cent in June 2025 under Section 232, ending exemptions and sparking uncertainty, pre-buying rushes followed by destocking, retaliatory measures from China and the EU, and global supply strains like disruptions in Europe and low LME stocks, causing frequent price revisions.

…and so much more!

SIGN UP / LOGINResponses