您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

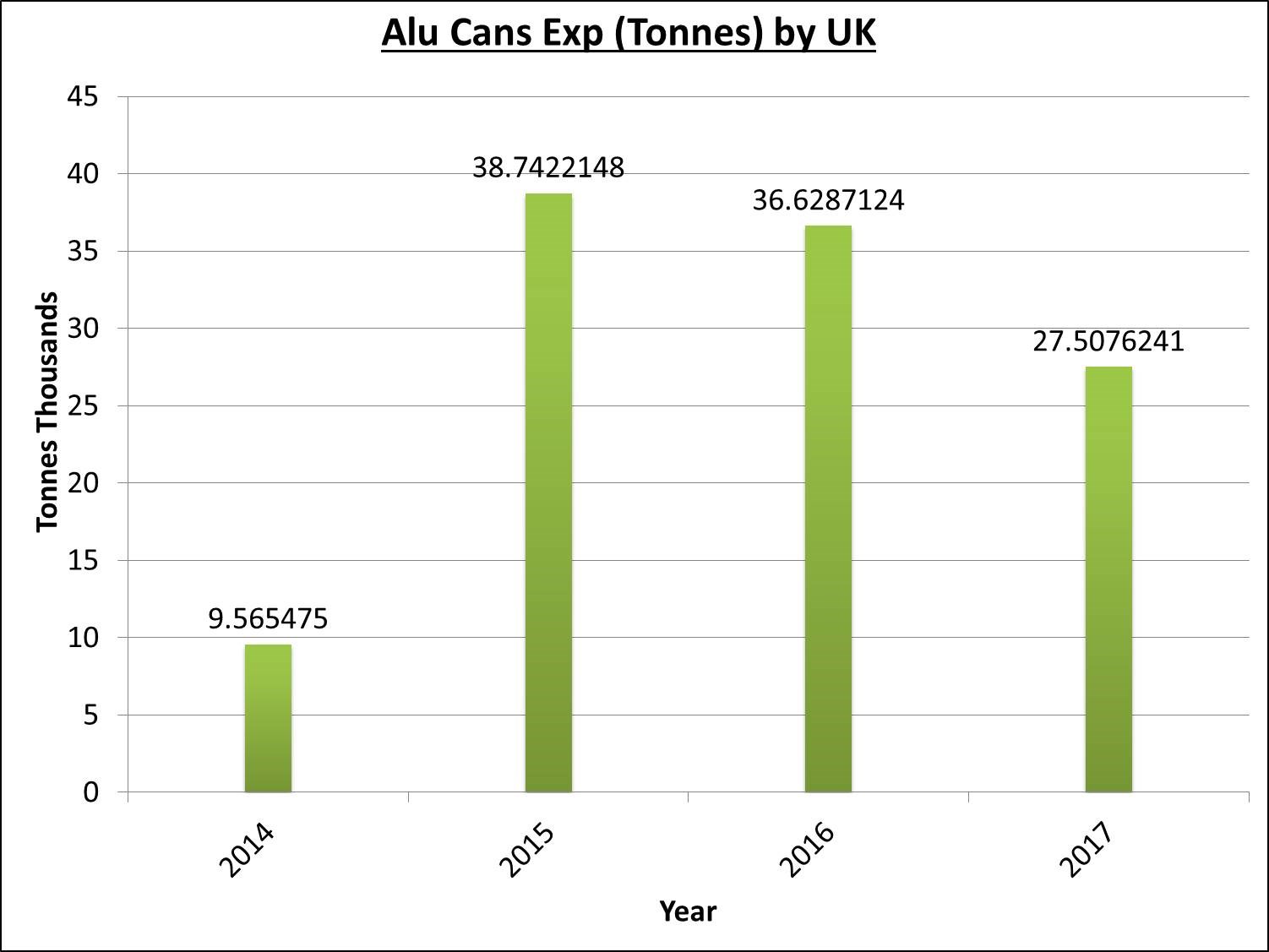

Aluminium can export from UK is slated to witness a significant drop in 2017, after a gradual year-on-year decline since 2015. The largest beverage can market in Europe- UK reached 70 per cent aluminium beverage can recycling rate milestone in 2016. At a time when the country is endeavouring to make the European metal packaging sector's ambition of reaching and exceeding an average 80 per cent metal rate by 2025, this drop in export volume is somewhat baffling.

Global export-import data shows, UK’s aluminium can export took a huge leap from 9565 tonnes in 2014 to 38,742 tonnes in 2015. Since then, export volume has been dropping. Last year, aluminium can export totalled 36629 tonnes, down 5.45 per cent year-on-year.

{alcircleadd}

It is estimated that UK will export 27508 tonnes of aluminium cans in 2017, a decrease in volume by 29 per cent since 2015.

However, the earnings from export will increase significantly in 2017. From US$174 million in 2016, value of total aluminium can export will reach US$995 million in 2017. This huge divergence of value from export volume can be explained through the change in macroeconomic scenario and dollar-GBP rate relation.

The main countries where UK has been exporting its aluminium cans include Austria, Australia, Belgium, Canada, Norway, Netherlands, France, Germany, Spain, Sweden, USA, and India.

Exports notwithstanding, UK has been contributing majorly to Europe’s metal packaging recycling objectives.

"We remain convinced that future growth in aluminium recycling performance is achievable within the current system, subject to a few revisions which will ensure all recycling is accurately reported and that behavior change programs are properly funded on a fair and equitable basis," said Rick Hindley, executive director of the Aluminium Packaging Recycling Organisation, Alupro.

Responses