您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

The US dollar rebounded against a basket of foreign currencies on Monday and continued to stay above 97 keeping pressure on LME base metals. Though better-than-expected economic data in China weakened it in the mid-week, strong retail sales and labour data bolstered the US dollar on later. LME aluminium had a flat run over the week. The LME aluminium cash contract started the week flat from last week at US$1843.50 per tonne and continued with a downward trend without much fluctuation. The contract was traded within a tight range of US$1839-US$1844 per tonne over last week closing at US$1839 per tonne on Thursday. On Friday, there was no trading due to Good Friday holiday. 3-months aluminium price ended the week at US$ 1854.50 per tonne. LME aluminium is expected to trade between US$1,840-1,860 per tonne over the week.

The LME aluminium opening stock dropped to 1053925 tonnes. Live Warrants totalled at 664950 tonnes, and Cancelled Warrants were 388975 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1845 per tonne.

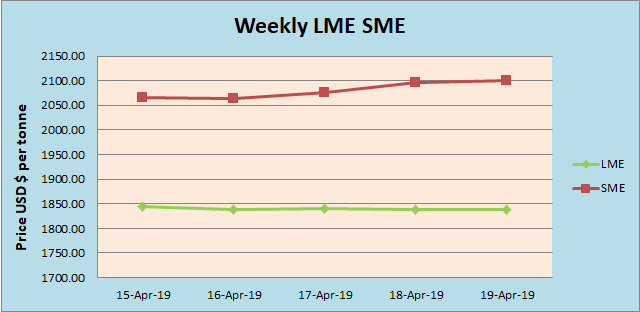

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange saw an upbeat week supported by positive market fundamentals. The prices moved within a higher range of US$ 2064- 2100 per tonne over the week, reaching the highest on Friday. The difference between LME and SME aluminium now stands at about US$ 261.

China’s stronger-than-expected economic data for Q1 supported SHFE aluminium contract. The contract was further supported by falling inventories of primary aluminium and aluminium billet across social warehouses in the China markets and a strong downstream consumption data. The most-active SHFE June contract is expected to trade between RMB 14,000-14,150 per tonne in the next week. News of capacity shutdown prompted longs in Shanghai to aggressively load up positions for three consecutive days. However, potential resumption of suspended capacity is expected to limit the upward room in the contract in the near term.

Responses