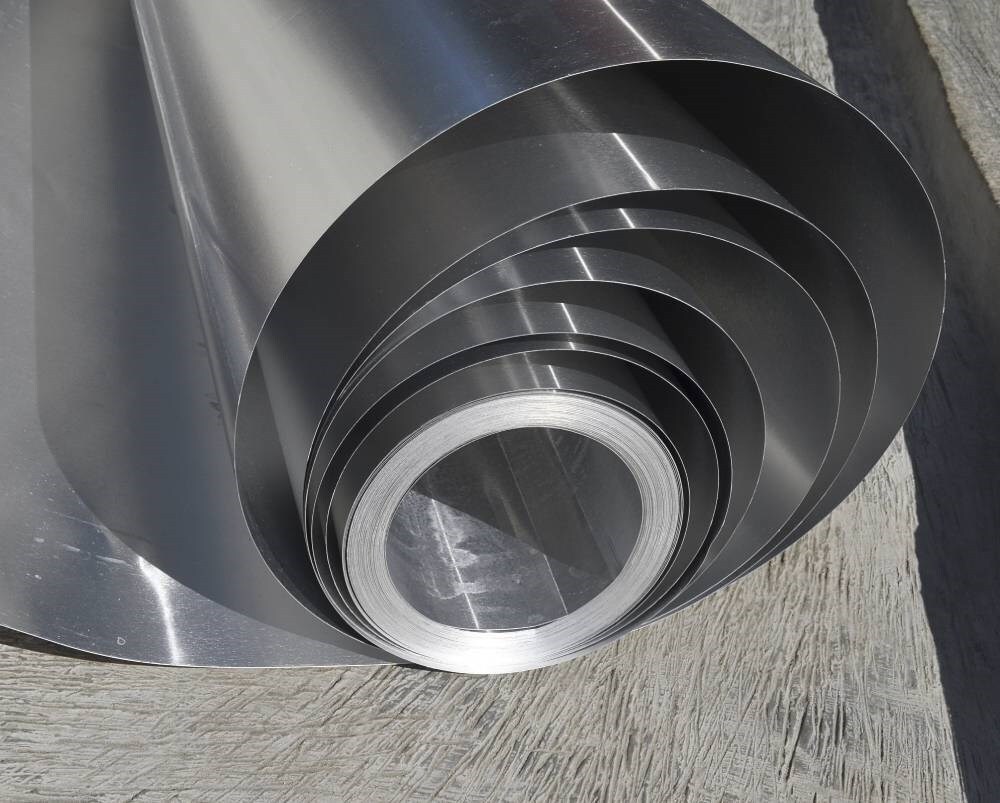

Shyam Metalics mainly deals in various aluminium products, including aluminium foils used in packaging, electronics and in various other end products. The data of Q2 FY26 for the company shows varied performance for its products. Among all other products, the overall performance of the company in average realisation for Aluminium Foil products has increased by 6.18 per cent.

In Q2 FY26, Shyam Metalics have produced 5,274tonnes of aluminium foil, which has decreased from the previous Q1 FY26, which was 5,440 tonnes. Thus, it has decreased to about 3.05 per cent in this quarter. Although the quantity produced has decreased, the revenue has shown an increase in realisation.

In Q1 FY26, the Avg. Realisation is INR 3,88,570 per tonne ( USD 4,376.54 per tonne). In comparison to it in Q1 FY26, the Avg. Realisation was INR 3,65,945 per tonne (USD 4,121.71 per tonne).

The overall increase in realisation accounts to about 6.18 per cent. This postulates the fact that the increase in realisation despite reduced volumes underscores Shyam Metalics’ effective pricing strategy and focus on high-margin products. Thus, the Aluminium Foil segment emerged as a key stabiliser in Shyam Metalics’ among all its diversified portfolio during Q2 FY26. This has helped the organisation to maintain overall growth momentum amid mixed performances across all its huge product lines.

The decline in overall aluminium foil production during Q2 FY26 could be attributed to some of the factors. Shyam Metalics mostly prioritised higher-value products for the time being, leading to less production but with high realisation.

Additionally, maintenance activities have temporarily reduced output within the organisation. The company have mainly focused on maintaining a profitability index by selling high-value products rather than maximising volume.

Recently, the company has also enhanced its overall range of portfolio products, including SEL Tiger Roofing Sheets and side-slitted HR coils.

Read More: Eural unveils lead-free aluminium alloy for next-gen automotive solutions

Responses