您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

In September 2025, the operating rate of China's primary aluminium alloy industry showed a steady upward trend, while aluminium alloy wheel hub exports hit a new record high, injecting strong momentum into the industry's development. In terms of operating rate performance, the preliminary operating rate for China's primary aluminium alloy industry in September was 57.7 per cent, up 0.9 per cent M-o-M and up 2.4 per cent Y-o-Y.

Primary aluminium alloy: Operating rate rebounds after fluctuations, showing production resilience during peak season

In September, the operating rate for primary aluminium alloy gradually rebounded after experiencing fluctuations. In the first week of the month, the operating rate edged up 0.2 per cent M-o-M to 56.6 per cent, indicating a slow recovery pace at the beginning of the peak season. The overall boost in operating rates was limited due to factors such as the diversion of liquid aluminium by the resumption of production in primary processing sectors like aluminium billet and weak orders from small and medium-sized enterprises. Entering the second week, the intensity of capacity release in the industry strengthened, and the operating rate increased by 1 percentage point M-o-M to 57.6 per cent. Top-tier and large-scale enterprises, leveraging stable order backlogs and mature supply chain systems, maintained consistent capacity release, becoming the core force driving the rise in the operating rate; although small and medium-sized enterprises saw improved willingness to operate, their order stability was insufficient, and their capacity release intensity still lagged behind that of leading enterprises. In the third week, the operating rate experienced a slight correction of 0.2 percentage points to 57.4 per cent. A short-term slowdown in downstream procurement led to minor adjustments in operations for some enterprises; however, most enterprises remained confident in the September peak season, albeit adopting a more cautious approach towards short-term capacity expansion. In the week leading up to the National Day holiday, the primary aluminium alloy operating rate rose 1 per cent M-o-M to 58.4 per cent. After aluminium prices retreated from highs and stabilised, stockpiling sentiment intensified before the holiday among some enterprises using aluminium ingots as raw material. Meanwhile, record-high aluminium alloy wheel hub exports in August significantly boosted enterprise production confidence. Coupled with the absence of large-scale high-temperature-induced production restrictions during holidays domestically this year, stable downstream operations led to stable or slightly increased production pace for primary alloy.

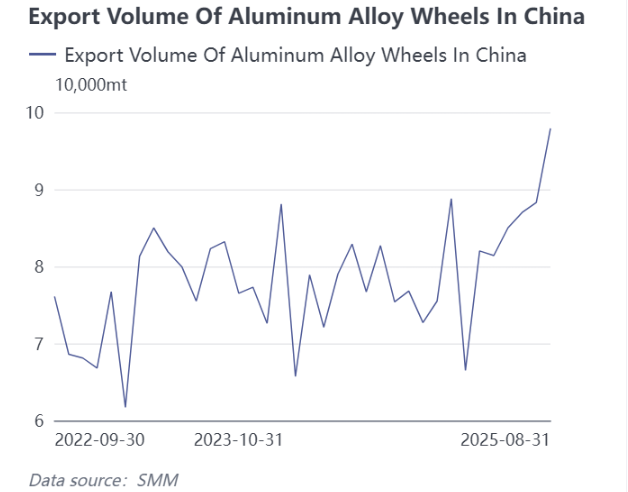

The primary aluminium alloy PMI for September was 59.7 per cent, a slight increase of 0.3 percentage points from 59.4 per cent in August, continuing its stable trend above the 50 mark. Breaking down the components: the production index was 68.6 per cent, which, although slightly lower than 70.2 per cent in August, remained at a high level; the new orders index was 66.7 per cent, also maintaining a high level, echoing the 1 per cent M-o-M increase in the primary aluminium alloy operating rate to 58.4 per cent in late September. Amid relatively unstable changes in the operating capacity of primary processing sectors like aluminium billet, the production side of primary aluminium alloy continued to exert effort, with order performance being particularly strong, especially the notably substantial export situation for downstream finished products. China's aluminium alloy wheel hub exports in August increased significantly by 9,600 tonnes to 97,900 tonnes compared to July, up 10.9 per cent M-o-M and up 18.4 per cent Y-o-Y, hitting a three-year high, which greatly enhanced enterprise production confidence, indicating a relatively optimistic outlook for industry production and order performance. The finished product inventory index was 43.1 per cent, a noticeable decrease from 53.0 per cent in August, while the purchasing volume index was 59.8 per cent, indicating inventories are in a more reasonable range and procurement activities are relatively active, suggesting enterprises maintain a steady pace in inventory management and raw material procurement. The new export orders index was 59.5 per cent, still performing well, although uncertainties remain in external demand, and the impact of factors such as Sino-US tariffs requires continued monitoring. Regarding the industry outlook, although the primary aluminium alloy PMI performed well in September, with only one week left before the 8-day National Day holiday, most enterprises maintained normal production based on stable orders, but production pace may slow down slightly during the holiday, and the operating rate may decline somewhat. SMM maintains a relatively positive expectation for the primary aluminium alloy PMI in October; however, challenges remain for the industry to sustain its good performance. Attention should be paid to the actual recovery of demand after the National Day holiday and changes in various external factors, while also monitoring the impact of overseas demand growth momentum and domestic production pace during the traditional "September-October peak season" on the industry.

In August, China's aluminium alloy wheel hub exports surged by 9,600 tonnes to 97,900 tonnes, up 10.9 per cent M-o-M and 18.4 per cent Y-o-Y, reaching the highest monthly export volume in nearly three years. By export destination, demand from traditional markets such as the US, Japan, and Mexico remained stable in July-August, while the average export price to countries like France saw a notable increase in August. The robust growth in overseas demand significantly boosted production confidence among aluminium wheel hub export enterprises.

According to an SMM survey, the domestic aluminium wheel hub industry demonstrated strong production resilience during the 2025 National Day holiday, with disruptions from the dual-holiday period falling to a multi-year low. Leading enterprises, supported by stable orders on hand, maintained normal production schedules throughout the holiday. Only a small number of companies opted for holiday breaks of 3–8 days, with the average break duration shortening Y-o-Y. Key drivers included steady order volumes during the September-October peak season and the absence of large-scale high-temperature-induced production restrictions this year, which kept overall production schedules tight and operating rates stable. Meanwhile, robust overseas demand pushed China’s aluminium alloy wheel hub exports in August to a nearly three-year monthly high, further bolstering production confidence. From an operational perspective, leading enterprises have established mature holiday production support systems, including sufficient raw material stockpiling before the holiday and years of uninterrupted holiday production experience, ensuring strong continuity in output.

In the short term, the primary aluminium alloy industry lacks clear positive catalysts to drive a significant rise in operating rates. Production pace may slow down slightly during the National Day holiday, with operating rates expected to decline marginally. However, against the backdrop of the traditional September-October peak season, most enterprises maintain stable orders on hand, and overseas demand shows a favorable growth trend. If downstream demand, particularly end-use consumption, continues to recover, the industry is expected to maintain a positive development trajectory. At the same time, close attention should be paid to the actual recovery of demand after the holiday, uncertainties in external demand, and the impact of external factors such as US-China tariffs on the industry.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses