您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

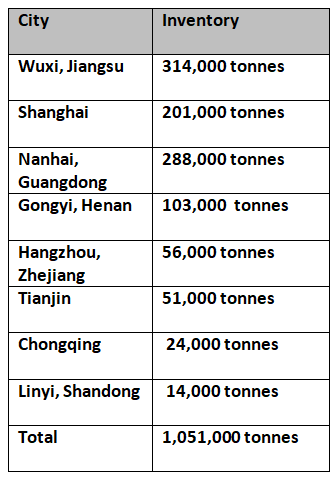

According to Shanghai Metals Market, the social inventories of primary aluminium, as of August 15, have recorded a week-on-week rise for the third straight week. SMM data shows that stocks across eight major consumption areas, including SHFE warrants, have increased by 1,000 tonne from a week ago to come in at 1.051 million tonnes.

Increasing cargoes arrival at Wuxi and weakening demand in Guangdong in a low season could be the two primary causes for this weekly growth in primary aluminium inventories.

{alcircleadd}In Wuxi, Jiangsu, the inventories have grown by some 10,000 tonnes, while that in Nanhai, Guangdong by some 14,000 tonnes. In other major markets like Shanghai, Gongyi, Henan; Linyi, Shandong; and Chongqing, the inventories have dipped.

The chart below indicates the current status of primary aluminium inventories in more details:

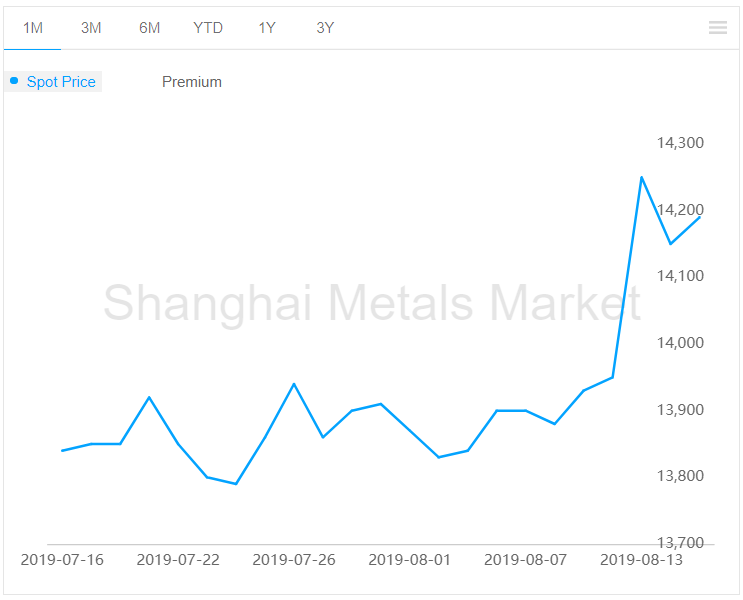

But despite the rise in inventories, the A00 aluminium ingot price has recorded a growth of RMB 40 per tonne to RMB 14,190 per tonne, as of Thursday, August 15, found Shanghai Metals Market.

Today, while the aluminium ingot price has risen across all the major markets in China, Gongyi has witnessed a sharp drop of RMB 90 per tonne to RMB 14,010 per tonne. Tianjin among all has seen the highest price rise of RMB 60 per tonne to stand at RMB 14,170 per tonne.

On the growth of A00 aluminium ingot price, the aluminium alloy (A356) price has increased by RMB 100 per tonne to RMB 14,900 per tonne.

Responses