您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

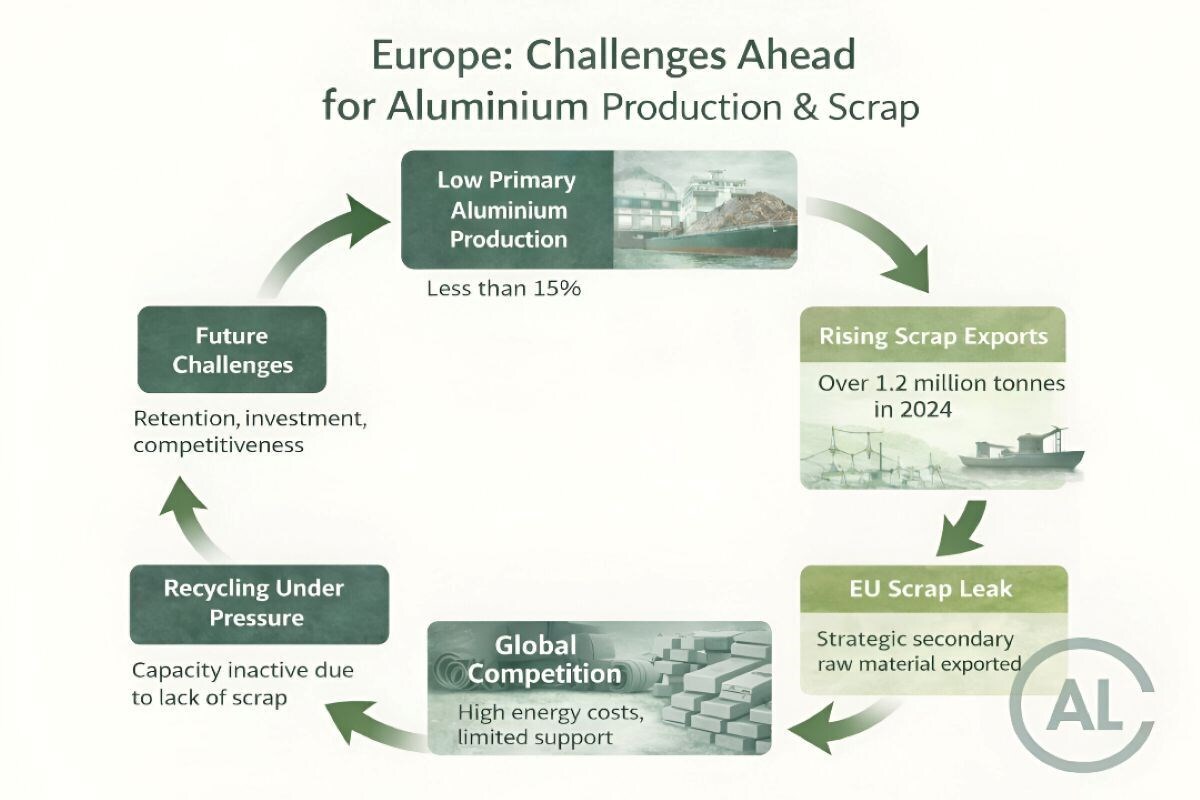

Mario Conserva, Secretary General of the Federation of Aluminium Consumers in Europe (FACE), recently voiced his concern for Europe’s aluminium scrap export scenario, highlighting dire circumstances that await. Seconding the CEO of Novelis Europe, Emilio Braghi, who drew attention to the matter, Conserva shared the same opinion. Both fear that by producing less than 15 per cent of primary aluminium, Europe may lose the secondary resource by exporting most of the aluminium scrap to Asia and the US.

{alcircleadd}Explore- Most accurate data to drive business decisions with Outlook 2026 insights across the value chain

Referring to an interview between Corriere della Sera and Emilio Braghi, Mario Conserva mentioned that in 2024, the EU exported a huge quantity of aluminium scrap, which “exceeded 1.2 million tonnes — an all-time high, with a significant share heading to Asia.” The figure, according to Braghi, accounts for “approximately 10-11 per cent of global trade volumes, with the majority of shipments going to Asia.” Meanwhile, due to the lack of raw materials, the European recycling capacity remains inactive.

Conserva reiterated the essentiality Braghi assigned to aluminium scrap, noting, “scrap is not waste, but an essential input for a competitive and low-emission industry.” Observing how the giant export record is jeopardising Europe’s investment, recycling and employment, he commented, “In a global market where energy costs, industrial incentives and trade distortions allow some countries to 'buy' large quantities of scrap, prices are rising internationally, and European operators, without similar support, are left behind.”

Also read: China's aluminium scrap prices surge to a record high

Both Braghi and Conserva have focused attention on the point that at present, Europe produces even less than 15 per cent of primary aluminium. At this point, “Europe cannot afford a scrap leak that subtracts value, raises prices and puts thousands of recycling SMEs under pressure,” as stated by Conserva.

The EU exports raw materials to China, where they are processed and exported back to the continent. Braghi commented, “If this trend continues, there is also the risk of losing the recycling industrial base,” the only remaining pillar of the European value chain. Losing the base would mean losing the opportunity to “combine industrial competitiveness and decarbonization objectives.”

To avoid an irreparable structural dependence on reimported finished products, Conserva believes it is high time to “recognise aluminium from scrap as a strategic secondary raw material on an equal footing with raw aluminium, to strengthen its traceability and quality, and to introduce targeted measures to retain the material in Europe, supporting investment and competitiveness of the downstream supply chain.”

Must read: Key industry individuals share their thoughts on the trending topics

Responses