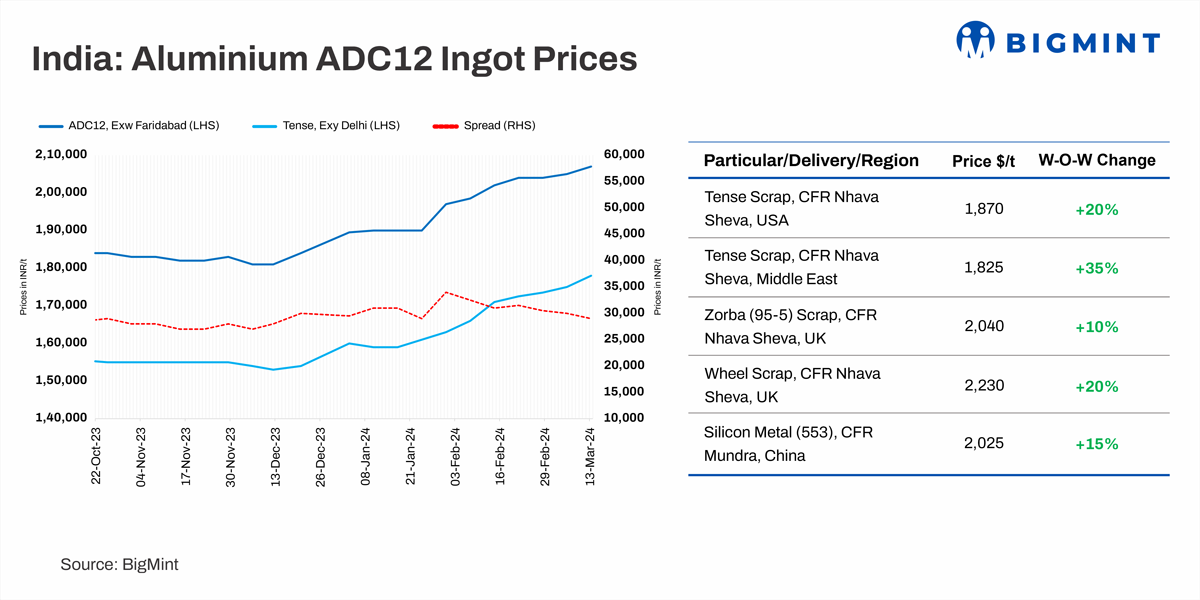

Spot prices for Aluminium ADC12 alloy ingots (automobile equivalent grade) surged by INR 2,000 per ton to reach INR 207,000 per tonne week-on-week, excluding GST, in ex-works Delhi. This uptick was driven by a notable increase in local tense scrap prices across north and south India, where persistent shortages remain a significant concern, as reported by BigMint assessments.

Currently, tense scrap offers in Chennai are at INR 173,000 per tonne. However, actual trade levels are observed within the range of INR 172,000 to INR 172,500 per tonne. Furthermore, the spot price for ADC12 in Chennai is approximately INR 210,000 to INR 212,000 per tonne ex-works, excluding GST.

Market dynamics: Insights from participants

This week, ADC12 prices have remained strong, driven mainly by the limited availability of tense scrap. These higher price levels are putting pressure on the capacity utilization of medium-sized manufacturers in the northern area.

Although there is demand for ADC12 in the market, overall activity is moderate. Suppliers in the southern region are hesitant to sell ADC12 for less than INR 210,000 per tonne. However, some buyers are managing to procure the material at slightly lower rates, around INR 208,000 per tonne, from their regular suppliers.

The price trend of aluminium alloy ingots consistently maintains upward movement, followed by strengthening raw material prices amid a tight supply chain and procuring it on premium bids, like losing an appropriate conversion spread. It barely hovers around INR 30,000/t, even if we consider the OEM price for Mar'24, shared by a medium-scale alloy producer.

Another manufacturer shared that the ADC12 ingots supply chain seems to be a concern due to current market dynamics. The tight availability of casting scrap restrains most manufacturers from booking new orders specifically for new buyers.

In Delhi, reference prices for silicon 553 are around INR 193,000-195,000/t, exw with a credit payment term, excluding GST.

Pricing trend

Based on yesterday's assessment, import tense scrap prices from the Middle East, particularly from the UAE, rose by $35/t to $1,825/t. Tense (6-7%) from the US was heard at $1,870/t, up by $20/t. The price for Zorba 95-5 from the UK stood at $2,040/t CFR Nhava Sheva.

However, three-month futures for aluminium were currently at $2,263/t, reflecting a $30/t rise w-o-w. China-origin silicon 553 prices were around $2,025/t CIF Mundra, up $15/t w-o-w.

Domestic market

In the domestic space, scarcity of raw materials, particularly tense scrap, has kept prices on the higher side. Tense scrap prices are at INR 178,000/t, exy-Delhi (excluding GST).

Recent offers, deals

ADC12 was bought at INR 209,000-210,000/t, ex Chennai - 70 t.

ADC12 bought at INR 212,000/t, ex Chennai (45 days credit) - 10 t.

ADC12 traded at INR 207,000/t ex Delhi ~20 t.

ADC12 traded at INR 210,000/t ex Delhi ~ 25 t.

Outlook

Given the prevailing market dynamics, where a consistently constrained supply chain of raw materials and delayed shipments of overseas scrap have impacted domestic prices, coupled with positive sentiments about the upcoming monthly price settlements by automobile companies, there is a potential for further price increases in the near term.

Received under the content exchange agreement with SteelMint

Responses