您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

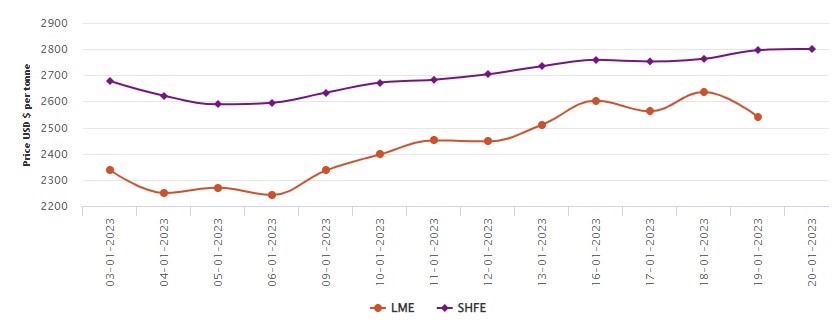

LME aluminium opened at US$2,638 per tonne on Thursday and closed at US$2,583.5 per tonne, a drop of US$54.5 per tonne or 2.07 per cent.

On January 19, Thursday, the LME aluminium cash bid price plummeted by US$96 per tonne or 3.64 per cent, and the LME aluminium official settlement price stooped down by US$95 per tonne or 3.6 per cent, closing at US$2,539 per tonne and US$2,541 per tonne. The market will be under immense fluctuations as the Russia-Ukraine war has been going on for almost a year now, and Europe's oil/energy crisis is on the verge of evoking a nationwide recession.

The 3-month bid price recorded a plunge of US$89.50 per tonne or 3.36 per cent, officially resting at US$2,570.50 per tonne, and the 3-month offer price saw a decline of US$91 per tonne or 3.42 per cent to halt at US$2,571 per tonne.

December 24 bid price and December 24 offer price stood at US$2,707 per tonne and US$2,712 per tonne on Thursday, with a uniform descend of US$73 per tonne or 2.62 per cent.

LME aluminium opening stock recorded a massive fall of 4,550 tonnes or 1.16 per cent to settle at 385,850 tonnes.

Live warrants totalled 187,075 tonnes with no measurable change at all. Cancelled warrants read 198,775 tonnes, with a drop of 4,550 tonnes or 2.24 per cent.

Only the 3-month Asian Reference Price came in at US$2,612.07 per tonne after it slashed down by US$11.25 per tonne or 0.43 per cent.

SHFE aluminium price

Today, on January 20, the SHFE benchmark aluminium price has clocked at US$2,801 per tonne, with an elevation of 0.18 per cent or US$5 per tonne.

The most-traded SHFE 2302 aluminium contract opened at RMB 19,065 per tonne overnight before closing at RMB 19,015 per tonne, down RMB 50 per tonne or 0.26 per cent.

The most-traded SHFE 2303 aluminium closed up 1.38 per cent or RMB 260 per tonne at RMB 19,070 per tonne, with open interest down 798 lots to 192,683 lots.

Responses