您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

The US dollar increased on Wednesday as weak economic data from some major economies caused concerns over global growth, and sparked demand for safe havens. The dollar index rose 0.71% to 96.81 in late trading. US President Donald Trump said on Wednesday that the US stock market suffered "a little glitch" in December but that it would go up once he negotiates trade deals with China and others.

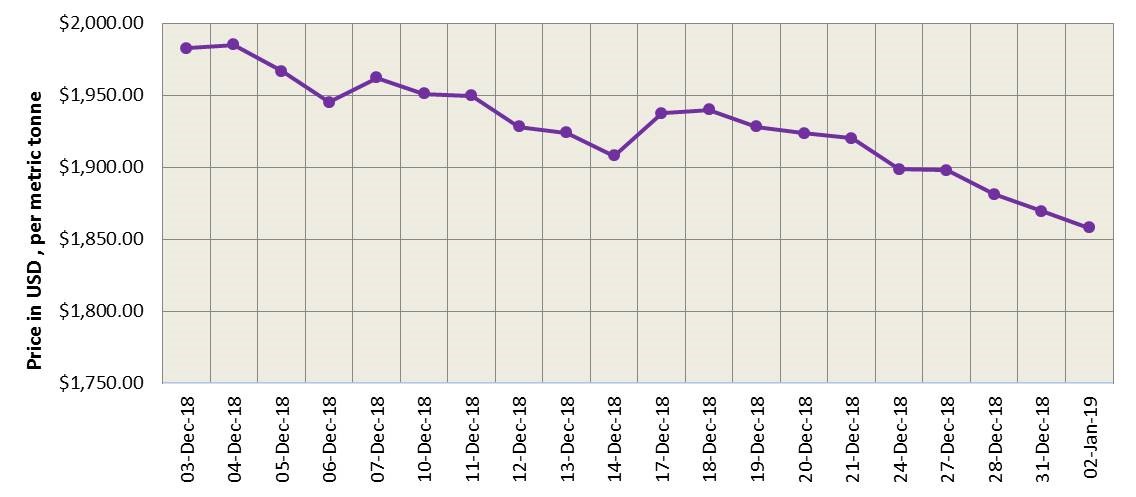

{alcircleadd}Base metals fell for the most part as LME aluminium slumped 3.16%. SHFE aluminium dropped 0.48%. LME aluminium closed at US$1858 per tonne on January 2, 2018, further down from US$ 1869.50 per tonne on Monday December 31. Then LME aluminium slumped to the lowest since January 2017 overnight as the US dollar strengthened. Shanghai Metals Market maintains that macroeconomic pessimism will weigh on aluminium prices this year. Today, LME aluminium is likely to trade at US$1,770-1,810 per tonne.

As on January 2, LME aluminium cash (bid) price stood at US$ 1857per tonne, LME official settlement price stands at US$ 1858per tonne; 3-months bid price stands at US$ 1845.50per tonne, 3-months offer price is US$ 1846.50 per tonne; Dec 19 bid price stands at US$ 1987 per tonne, and Dec 19 offer price stands at US$ 1992 per tonne.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1857 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange dropped to US$ 1930 per tonne today from US$ 1942 per tonne on January 2.

As shorts significantly loaded up their bets, the SHFE 1902 contract fell to RMB 13,385 per tonne yesterday, a low since the end of January 2017. It ended 1.54% lower at RMB 13,395 per tonne. Downbeat economic data and gains in social inventories over the New Year’s Day holiday unnerved the market. The SHFE 1902 contract then dipped in line with its LME counterpart, and settled at RMB 13,375 per tonne. We see it trading at RMB 13,220-13,350 per tonne today with spot discounts at RMB 80-40 per tonne. The contract is unlikely to rebound significantly in the short term.

Responses