您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

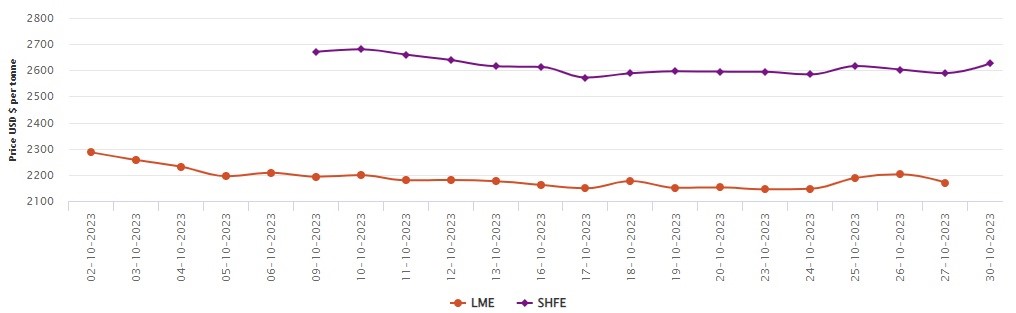

LME aluminium opened at US$2200 per tonne last Friday, with its low and high at US$2187 per tonne and US$2230.5 per tonne, respectively, before closing at US$2225.5 per tonne, up US$29 per tonne or 1.32 per cent.

On Friday, October 27, both LME aluminium cash bid price and LME aluminium official settlement price dropped by US$32 per tonne or 1.45 per cent to close at US$2,170 per tonne and US$2,170.50 per tonne.

As per the London Metal Exchange (LME) data, both the 3-month bid price and the 3-month offer price dropped by US$24 per tonne or 1.08 per cent to clock at US$2,191 per tonne and US$2,192 per tonne.

December 24 bid price and December 24 offer price contracted by US$22 per tonne or 0.94 per cent to reside at US$2,308 per tonne and US$2,313 per tonne. LME aluminium opening stock closed at 478725 tonnes. Live warrants and Cancelled warrants settled at 203800 tonnes and 274925 tonnes.

LME aluminium 3-month Asian Reference Price lost US$11 per tonne or 0.47 per cent to stop at US$2,205.56 per tonne.

SHFE aluminium price

Today, on October 30, the Shanghai Futures Exchange (SHFE) aluminium price has grown by US$38 per tonne or 1.46 per cent to reach US$2,627 per tonne.

At last Friday’s night session, the most-traded SHFE 2312 aluminium contract opened at RMB 18925 per tonne, with its low and high at RMB 18925 per tonne and RMB 19145 per tonne before closing at RMB 19140 per tonne, up RMB 235 per tonne or 1.24 per cent.

Responses