您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

The US dollar index was little changed on Monday as investors awaited this week’s crucial US Federal Reserve meeting. LME base metals closed mixed on Monday and aluminium nudged up. SHFE base metals performed similarly and aluminium stayed flat.

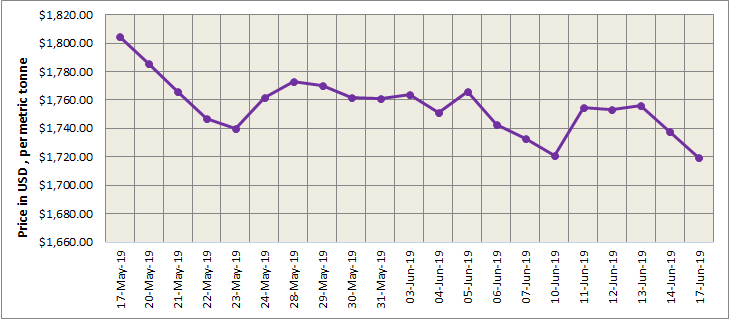

LME continued its downward trend on the first day of the week. LME cash contract closed lower at US$ 1719.5 per tonne. Three-month LME aluminium slid to a low of US$1,745 per tonne, the lowest since January 11, 2017, on Monday before it rebounded to close overnight at US$1,758.5 per tonne. It is expected to trade rangebound between US$1,740-1,800 per tonne today.

{alcircleadd}

As on June 17, Monday, LME aluminium cash (bid) price stood at US$ 1719 per tonne, LME official settlement price stands at US$ 1719.50 per tonne; 3-months bid price stands at US$ 1754 per tonne, 3-months offer price is US$ 1754.50 per tonne; Dec 20 bid price stands at US$ 1870 per tonne, and Dec 20 offer price stands at US$ 1875 per tonne.

The LME aluminium opening stock dropped to 1055075 tonnes. Live Warrants totalled at 682800 tonnes, and Cancelled Warrants were 372275 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1753 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange (SME) also dropped to US$ 1995 per tonne today from US$ 2002 per tonne on Monday.

The most-active SHFE August contract traded below the daily moving average yesterday and shorts depressed it to RMB 13,800 per tonne. Pressure from shorts again weighed the contract to RMB 13,765 per tonne, the lowest since the end of March. It rebounded and ended at RMB 13,810 per tonne, down 0.79% on the day, below all moving averages. The SHFE June contact was delivered at a settlement price of RMB 13,905 per tonne with a volume of 72,050 tonnes.

As longs added and shorts cut their positions, the most active SHFE August contract recovered from earlier losses to close flat at RMB 13,825 per tonne overnight. Pessimism surrounding alumina will weigh on SHFE aluminium. A high greenback and weak fundamentals will put pressure while falling social inventories will offer support. The SHFE 1908 contract is expected to trade between RMB 13,700-14,000 per tonne today, with spot premiums of up to RMB 20 per tonne over the July contract.

Responses