您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

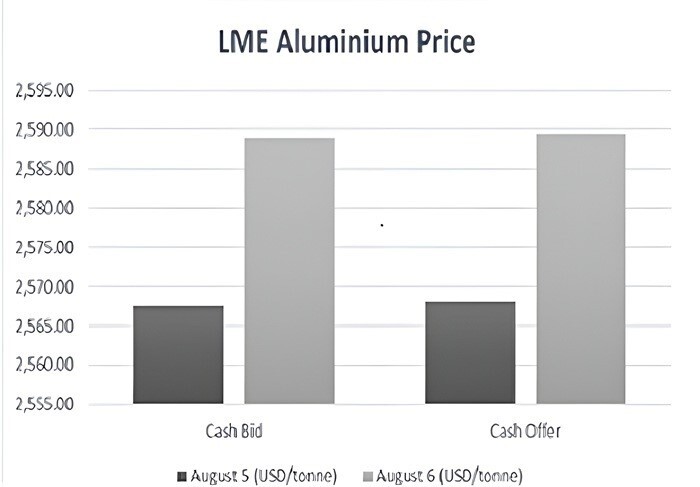

LME aluminium prices saw modest gains on August 6, with both spot and forward contracts reflecting upward momentum. Inventory levels also continued to rise, signalling a gradual build-up in supply.

The LME aluminium cash bid price rose to USD 2,589 per tonne on August 6, marking a 0.84 per cent increase from USD 2,567.5 per tonne on August 5. The cash offer price climbed by 0.84 per cent as well, from USD 2,568 per tonne to USD 2,589.5 per tonne.

The 3-month bid price increased by 0.98 per cent, from USD 2,566 per tonne to USD 2,591 per tonne, while the 3-month offer price rose by 0.92 per cent, from USD 2,568 per tonne to USD 2,591.5 per tonne.

Looking further ahead, the December 26 bid price jumped to USD 2,652 per tonne, up 1.03 per cent from USD 2,625 per cent while the December 26 offer price rose by 1.03 per cent, from USD 2,630 per tonne to USD 2,657 per tonne.

The LME 3-month Asian Reference Price also recorded a gain, climbing 1.81 per cent from USD 2,562.50 per tonne on August 5 to USD 2,609 per tonne on August 6.

On the inventory front, LME aluminium opening stock rose by 0.41 per cent, from 466,025 tonnes to 467,925 tonnes. Live warrants increased by 0.17 per cent, reaching 453,700 tonnes from 452,950 tonnes, while cancelled warrants rose significantly by 8.8 per cent, from 13,075 tonnes to 14,225 tonnes.

Meanwhile, the Platts alumina price remained flat at USD 373.19 per tonne on both days.

Also read: World Recycled ALuminium Market Analysis Industry forecast to 2032

Responses