您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

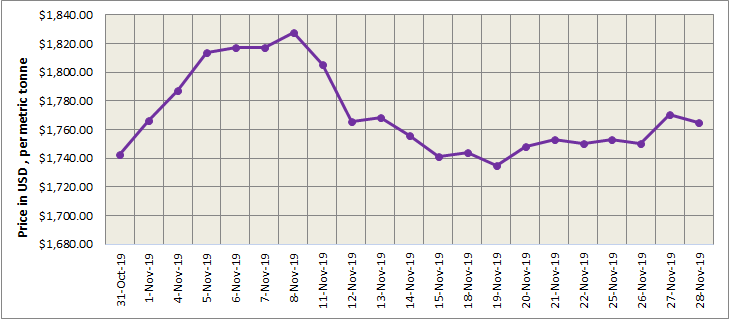

The US dollar edged down but held in its recent range on Thursday against a basket of other currencies as investors monitored friction between the US and China over the Hong Kong protests. LME base metals closed lower on Thursday and aluminium shed 0.8%. The SHFE complex performed similarly overnight.

A higher aluminium LME inventory and anticipation of capacity expansion in china checked LME aluminium’s upward momentum. LME Three-month LME aluminium fell 0.76% to US$1,758.5 per tonne on Thursday, and is expected to hover between US$1,755-1,770 per tonne today.

{alcircleadd}

As on November 28, Thursday, LME aluminium cash (bid) price stood at US$ 1764.50 per tonne, LME official settlement price stands at US$ 1765 per tonne; 3-months bid price stands at US$ 1756 per tonne, 3-months offer price is US$ 1756.50 per tonne; Dec 20 bid price stands at US$ 1815 per tonne, and Dec 20 offer price stands at US$ 1820 per tonne.

The LME aluminium opening stock dropped slightly to 1230300 tonnes. Live Warrants totalled at 1067000 tonnes, and Cancelled Warrants were 163300 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1763 per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE (Shanghai Future Exchange) dropped to US$ 2004 per tonne today November 29, 2019.

A sharp drop in social inventories of primary aluminium lifted the most-liquid SHFE 2001 contract, which climbed to an intraday high of RMB13,815 per tonne and ended 0.55% higher on the day at RMB13,810 per tonne. The SHFE 2001 contract closed flat at RMB 13,765 per tonne overnight yesterday. Prospects for an expansion of primary aluminium capacity in China are keeping aluminium prices in a bearish mode. Weiqiao’s plan to move 2 million tonne of capacity from Shandong to Yunnan will ease supply pressure in the first half of 2020 and offer some support to SHFE aluminium. The SHFE 2001 contract is expected to trade between RMB 13,700-13,800 per tonne today. Spot premiums are seen at RMB 90-130 per tonne over the SHFE 1912 contract.

Responses