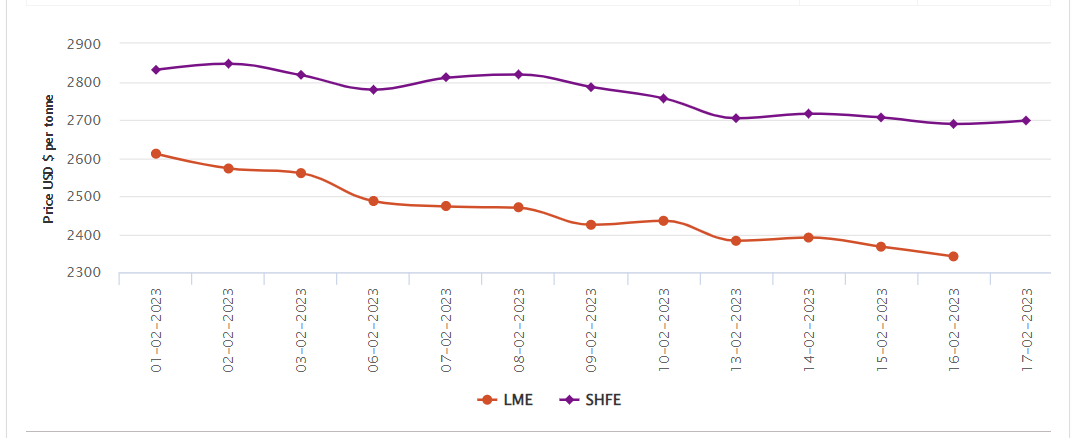

Three-month LME aluminium opened at US$2,389 per tonne on Thursday, February 16, and closed at US$2,418 per tonne, an increase of US$33.50 per tonne or 1.4 per cent.

On Thursday, February 16, both LME aluminium cash bid price and LME aluminium official settlement price extended fall for the second day by US$25.50 per tonne or 1.07 per cent from the previous day to total US$2,341 per tonne and US$2,341.50 per tonne, respectively.

3-month bid price and 3-month offer price shrank by US$11 per tonne or 0.46 per cent to peg at US$2,381 per tonne and US$2,382 per tonne. December 24 bid price and December 24 offer price dropped by US$5 per tonne to close at US$2,555 per tonne and US$2,560 per tonne, respectively.

LME aluminium opening stock decreased 4,325 tonnes to settle at 597,825 tonnes. Live warrants totalled 452,075 tonnes and Cancelled warrants amounted to 145,750 tonnes.

LME aluminium 3-month Asian Reference Price stood at US$2,394 per tonne on February 16, down by US$5.82 per tonne from US$2,399.82 per tonne on February 15.

SHFE aluminium price

On Friday, February 17, the SHFE aluminium benchmark price has gained US$10 per tonne to close the week at US$2,698 per tonne.

The most-traded SHFE 2303 aluminium closed down 0.03 per cent or RMB 5 per tonne at RMB 18,485 per tonne, with open interest down 5,462 lots to 170,536 lots.

The most-traded SHFE 2303 aluminium contract opened at RMB 18,495 per tonne overnight before closing at RMB 18,510 per tonne, up RMB 120 per tonne or 0.65 per cent.

Responses