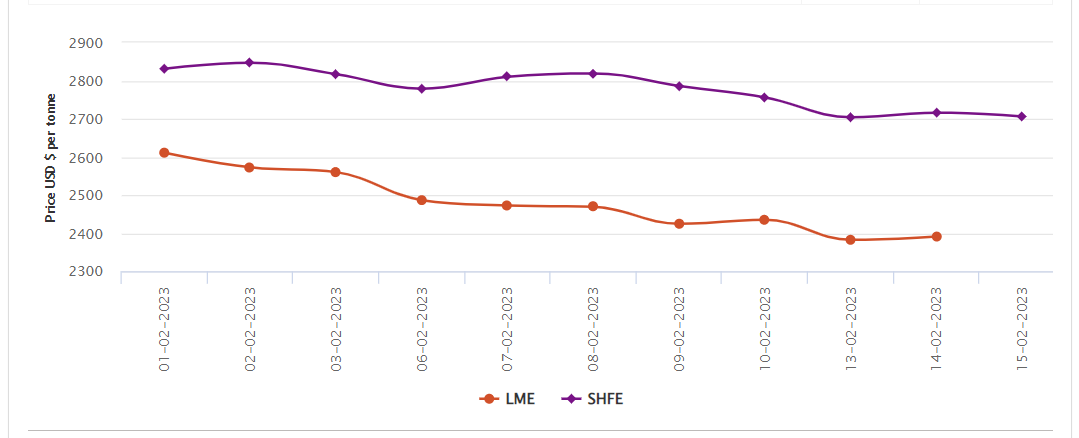

After touching a 5-week low on Monday, February 13, both LME aluminium cash bid price and LME aluminium official settlement price grew by US$7.50 per tonne and US$8.50 per tonne the next day to stand at US$2,389 per tonne and US$2,391 per tonne, as of February 14.

But the 3-month bid price and 3-month offer price continued to record a drop by US$4 per tonne from February 13 to settle at US$2,419 per tonne and US$2,420 per tonne on February 14. December 24 bid price and December 24 offer price declined by US$10 per tonne or 0.38 per cent to come in at US$2,588 per tonne and US$2,593 per tonne, respectively.

LME aluminium opening stock accumulated 24,825 tonnes to close above 600,000 tonnes. As per the data, the LME stock stood at 601,600 tonnes. Live warrants increased to 454,300 tonnes, while Cancelled warrants plunged to 147,300 tonnes.

LME aluminium 3-month Asian Reference Price slipped US$14.84 per tonne to come in at US$2435.66 per tonne.

SHFE aluminium price

On Wednesday, February 15, the SHFE aluminium benchmark price decreased by US$10 per tonne to settle at US$2,706 per tonne on Wednesday, February 15.

The most-traded SHFE 2303 aluminium contract opened at RMB 18,525 per tonne overnight before closing at RMB 18,540 per tonne, a drop of RMB 15 per tonne or 0.08 per cent.

The most-traded SHFE 2303 aluminium closed up 0.32 per cent or RMB 60 per tonne at RMB 18,595 per tonne, with open interest down 1,174 lots to 171,342 lots.

Responses