您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

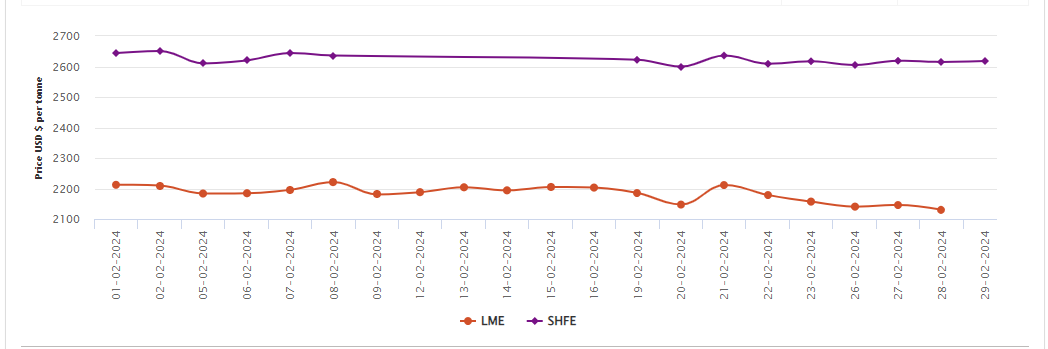

LME aluminum opened at US$2,203.50 per tonne on Wednesday, February 28, with its high and low at US$2,203.50 per tonne and US$2,177 per tonne, respectively, before closing at US$2,191 per tonne, down 0.41 per cent.

LME aluminium cash bid price shed off US$15.50 per tonne or 0.72 per cent to stand at US$2,129.50 per tonne, while LME aluminium official settlement price lost US$16 per tonne or 0.75 per cent to settle at US$2,130 per tonne.

3-month bid price and 3-month offer price shrank by US$18 per tonne and US$17.50 per tonne, respectively, to rest at US$2,180 per tonne and US$2,181 per tonne, respectively. December-25 bid price and December-25 offer price closed the day at US$2,398 per tonne and US$2,403 per tonne, respectively, down by US$15 per tonne from the previous day.

LME aluminium opening stock moved up significantly by 9,000 tonnes to amount to 591,675 tonnes as of February 28. Live Warrants and Cancelled Warrants totalled 393,075 tonnes and 198,600 tonnes, respectively.

LME aluminium 3-month Asian Reference Price decreased US$9.37 per tonne to peg at US$2,186.86 per tonne.

SHFE aluminium price

The SHFE aluminium benchmark price grew slightly by US$3 per tonne on Thursday, February 29, to reach US$2,618 per tonne.

Overnight, the most-traded SHFE 2404 aluminium contract opened at RMB 18,765 per tonne, with high and low at RMB 18,820 per tonne and RMB 18,750 per tonne before closing at RMB 18,805 per tonne, up 0.08 per cent.

Responses