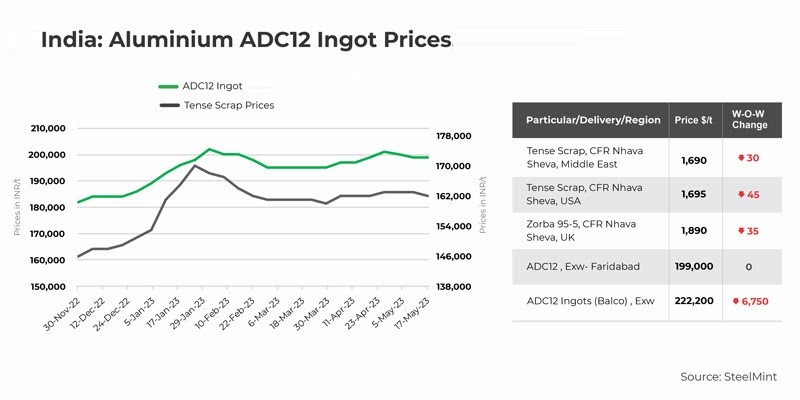

Aluminium alloy ingot (ADC12) prices remained stable W-o-W at INR 199,000 per tonne exw Faridabad due to limited transactions in the market. However, although some vendors quoted higher rates, actual transactions were reported to be in the range of INR 198,000 per tonne-200,000 per tonne after accounting for different discounts and concessions. Following price cuts by key alloy ingot players, purchasers grew cautious and hesitant to book to avoid future losses.

Aluminium futures on the London Metal Exchange remained range-bound, trading around US$2,270-US$2,280 per tonne. Stocks in LME-registered warehouses increased dramatically in an unexpected change of events, within a month, stock levels increased by 34,000 tonnes, reaching 562,450 tonnes.

The rise in stockpiles has produced a large supply-demand mismatch, placing downward pressure on future prices. The SHFE aluminium contract price was RMB 18,115 per tonne ($2,589 per tonne), an increase of RMB 115 per tonne ($16 per tonne) over the previous week.

Domestic aluminium scrap prices in India have remained range-bound date on date (d-o-d). Aluminium tense prices were INR 162,500 per tonne ($1,972 per tonne), while utensil prices were INR 173,500 per tonne ($2,105 per tonne) ex-Delhi (without GST). Despite the P1020 price hike by significant participants today, trading volumes were minimal.

According to the Society of Indian Automotive Manufacturers, annual automotive sales in April 2023 were down 2.3%. The total number of units sold in the month was 1,957,599, compared to 2,004,592 in the preceding month. It is crucial to watch such trends because they represent changes in consumer demand and market dynamics, which influence the automotive industry and related industries such as die casting. Domestic pricing may be put under pressure if key players decide to slash prices any more.

Received under the content exchange agreement with SteelMint

Responses