您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Hindalco Industries Ltd, the flagship metals company of the Aditya Birla Group, is facing twin challenges this quarter. Its US-based subsidiary, Novelis Inc., reported weaker-than-expected earnings, prompting several brokerage downgrades. At the same time, the company has rolled out a 100-day campaign aimed at helping shareholders recover unclaimed dividends.

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

Poor performance of Novelis in the quarter

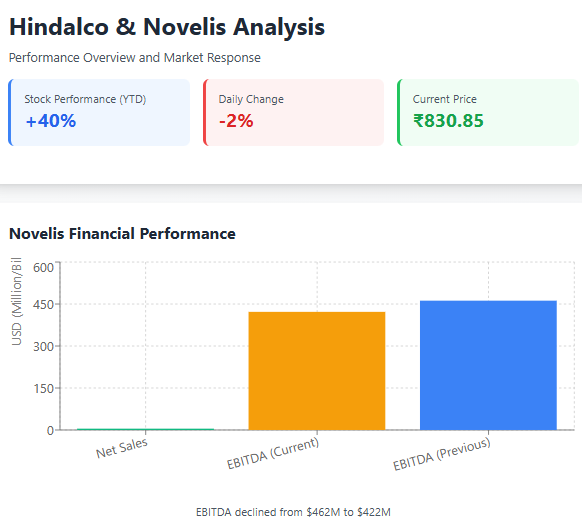

Novelis posted quarterly net sales of around USD 4.7 billion, marking a 10 per cent increase year-on-year. However, earnings before interest, tax, depreciation and amortisation (EBITDA) slipped to USD 422 million, compared with USD 462 million in the previous period.

The company took a USD 54 million hit from US import tariffs. A fire at Novelis’ Oswego plant is expected to weigh further on performance, with cash flow losses estimated between USD 550–650 million and an EBITDA impact of around USD 100–150 million.

Even though most of this may be recoverable through insurance, Novelis’ net debt climbed to about USD 5.8 billion, its highest in more than five years. The company’s Bay Minette project in Alabama has also seen costs surge from an original USD 2.5 billion to nearly USD 5 billion, due to inflationary pressures and project complexities.

Read More: Hindalco takes a close to $650 million brunt post Novelis' fire impact

Sneak peek at the brokerages' cut ratings

The subdued performance triggered a round of downgrades from analysts. Investec revised its rating to sell with a price target of USD 8.25 (approx), Axis Capital cut its call to USD 9.17 (approx),Nuvama moved to hold ABOUT USD 9.98, AND Equirus issued a reduced call at USD 9.40 (approx).

Hindalco’s share price dipped about 2 per cent, closing at USD 9.98 (approx) on the day of the results, although the stock remains up roughly 40 per cent year-to-date.

Hindalco’s ‘100 Days Campaign – Saksham Niveshak’

To revive this softening market sentiment, Hindalco is now launching the 100 Days Campaign, Saksham Niveshak - a shareholder assistance campaign running from 28 July to 6 November 2025 to raise awareness about personal finances.It helps shareholders to claim their unpaid dividends while updating crucial account details.

How does it help Hindalco’s shareholders?

The campaign helps shareholders to update their KYC details, specimen signatures as well as their bank account details with Hindalco, so that the future dividend payment can reach out directly to their accounts.

Steps for the shareholders to be a part of Saksham Niveshak

For shareholders holding physical shares, the following steps are required:

For shareholders with electronic holdings:

Submission process

Documents can be shared through any of the following options:

Shareholders are encouraged to complete their submissions by 6th November 2025 for smooth execution of the further process.

Don't miss out- Buyers are looking for your products on our B2B platform

Responses