您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

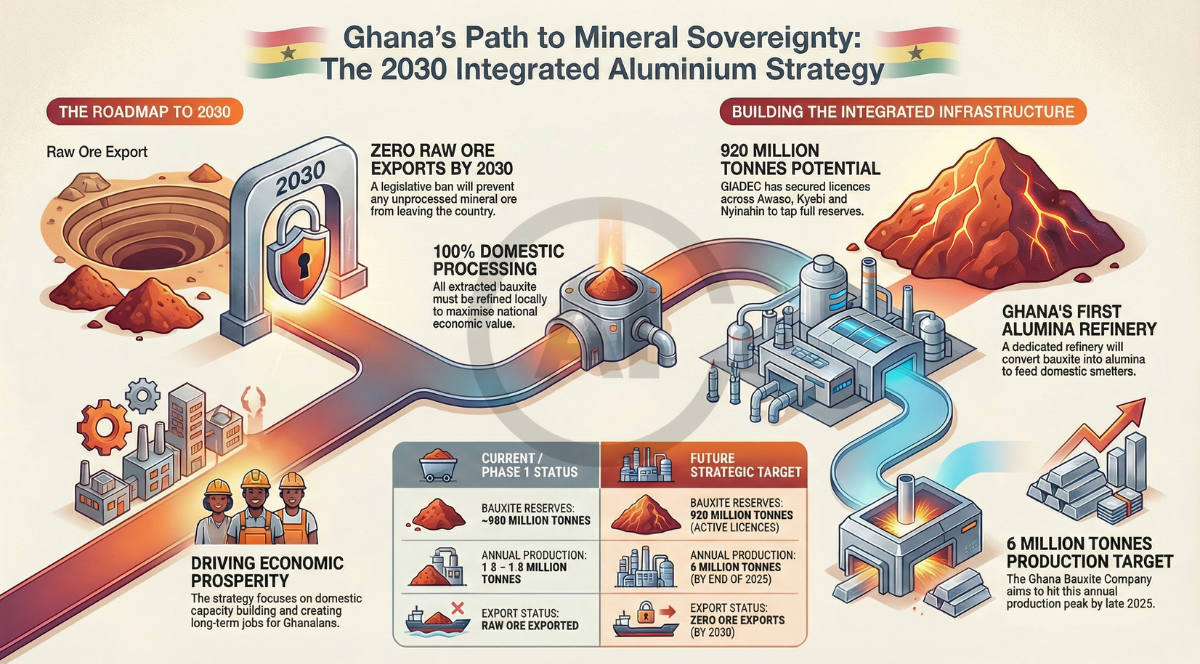

Ghana has a bauxite reserve of approximately 900 to 960 million tonnes, with the current production capacity ranging between 1.5 and 1.8 million tonnes. On February 14, at an Accra Reset Addis Reckoning event held in Addis Ababa, John Dramani Mahama, President of Ghana, announced the aim of preventing the export of raw minerals. He stated that “in 2030, there will be no mineral ore leaving Ghana.”

{alcircleadd}Explore- Most accurate data to drive business decisions with Global ALuminium Industry Outlook 2026 across the value chain

As local processing and domestic employment are the main drivers of this agenda, President Mahama asserted that the country “must process all that locally. That is the only way we can provide opportunities for our people,” boosting domestic capacity building and value addition.

The decision to secure bauxite within Ghana and on a larger scope, within Africa, begs the inevitable question – Has Ghana been working on a long-term plan to secure its bauxite resources to support domestic processing and employment?

The government’s strategy to ban exports

For the past several years, Ghana has been striving to acquire a principal position in the global bauxite industry. Consequently, the agenda has been in the works and can be dated back to 2024, since the tenure of the then-President, Nana Addo Dankwa Akufo-Addo, who announced the government’s motion for a Legislative Instrument to ban unprocessed bauxite export, along with other initiatives to safeguard domestic processing of minerals.

GIADEC initiatives for an integrated industry

Taking this agenda forward in early 2025, Mr Reindorf Twumasi Ankrah, Chief Executive Officer (CEO) of Ghana Integrated Aluminium Development Corporation (GIADEC), expressed his goal to establish “a functioning Integrated Aluminium Industry” in Ghana to support the local communities and strengthen the national economy.

In June 2025, GIADEC acquired six new bauxite mining licences, offering a major boost to that vision and realising the nation’s full bauxite mining potential of 920 million tonnes (approx.) at three of its major locations, viz., Awaso, Kyebi and Nyinahin.

This achievement was closely followed in June by the inauguration of a new governing board of GIADEC, wherein Emmanuel Armah-Kofi Buah, Minister of Lands and Natural Resources, stressed the need for value addition through not only safeguarding raw bauxite but also by scaling up local refining and aluminium production to attain a comprehensive approach to the fully integrated aluminium industry for the country.

GBC eyes production ramp-up

Another essential mark on the roadmap was the target of the Ghana Bauxite Company Limited (GBC) to achieve a production of 6 million tonnes, set for completion by the end of 2025. Ramping up production consistently since 2022, after the handover of the company’s stakes from the Bosai Group to the Ofori-Poku Company Limited (OPCL), Ghana has emerged as a competent bauxite resource base in the African landscape.

Planning the country’s large-scale alumina refinery

The latest report in January 2026 saw an investor selection committee formed in Ghana for the setup and development of the country’s first-ever large-scale alumina refinery to reduce the import of finished products at a higher value and make a more judicious and localised use of its bauxite production so that the alumina can be directly fed to the smelter.

Minister of Gambia on shared aim: Keeping bauxite within Africa

In an interview with AL Circle conducted at the India Energy Week 2026, Lamin K. Marong, Principal Energy Officer, Ministry of Petroleum Energy and Mines, Republic of Gambia, explained Africa’s collective goal to secure its critical mineral reserve. He mentioned that the US President Donald Trump’s assumption of presidential responsibilities has unfolded “disruptions in the whole market when it comes to the critical minerals.” Such consequences have provided “a wake-up call to Africa.” Therefore, now the domestic industries want to “take charge.”

He elaborated on the essentiality to protect domestic production, “because our people need jobs. Our people need to develop. They also need to see economic prosperity.” Hence, “without adding value to those resources, we are basically depriving our people from benefiting from,” he added.

Commenting on the limited processing capacity, he emphasised the room for collaboration between “resource-consuming nations and those who are producing some of those resources.”

Also read: VALCO remains state-owned: GIADEC chief addresses TDC land issue and aluminium park plans

Ghana’s stance: Domestic circulation or Guinea 2.0?

Interestingly, at this very juncture, Guinea comes to mind. A nation housing 25 per cent of the global bauxite reserves with an annual production capacity of 182.8 million tonnes, Guinea exports 74 per cent of its produced bauxite. In 2025, over 127 million tonnes of Guinea’s total exports were shipped to China. As part of a 20-year deal signed in 2017, China invested USD 20 billion in Guinea’s bauxite mining infrastructure development, particularly in the Boffa region.

Inevitably, China becomes the key player in controlling Guinea’s movements as regards bauxite production and export, with companies like CHALCO and China Power Investment Corp.

Coming back to the export scenario in Ghana, the country has been exporting all of its produced bauxite. Going back further in 2018, in the Phase One of Sinohydro Bauxite Barter Arrangement, signed between the two nations, Beijing was to fund USD 2 billion worth of rail, road and bridge networks in exchange for access to 5 per cent of Ghana’s bauxite reserves, the course of repayment to continue for 15 years approximately. As of December 2024, Ghana exported 168,000 tonnes of bauxite to China, which already accounts for roughly 10 per cent of Ghana’s total bauxite production.

Guinea, in an effort to boost domestic industrialisation and job creation instead of simply acquiring currency in exchange for raw bauxite, has revoked the mining license of around 46 to 53 companies, including Emirates Global Aluminium (EGA). However, with the lion’s share in bauxite import, it is evident that Guinea’s bauxite movements are majorly monopolised by China, despite Guinea’s decision to keep the bauxite production within the country.

While China is striving for a global monopoly in bauxite resources and controlling Guinea’s operations, would Ghana, in the face of its long-term contract with China, despite GIADEC’s efforts toward an integrated aluminium industry, be a reflection of Guinea, with the majority of its bauxite draining into the Chinese yard, although slowly but steadily?

Must read: Key industry individuals share their thoughts on the trending topics

Responses