您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

The traditional question, "Is demand going up or down?" is no longer relevant for the downstream aluminium industry. The better questions for 2026 are where demand stays steady, where it weakens, and which products show resilience even though the economy is not looking up.

{alcircleadd}Downstream is where aluminium turns into real revenue with extrusion orders, FRP deliveries, casting programmes, long-term OEM supply lines and so on. In 2026 and beyond, the demand will become even more uneven and selective, thereby creating clear pockets of strength and stress.

AL Circle’s flagship report Global Aluminium Industry Outlook 2026 highlights that the market is not collapsing; it’s splitting into winners and laggards.

This article is broken down into different downstream product demands, their end-use consumers, regional shifts and focuses, and one booming sector to look up to.

Downstream aluminium: From 2024 to 2026

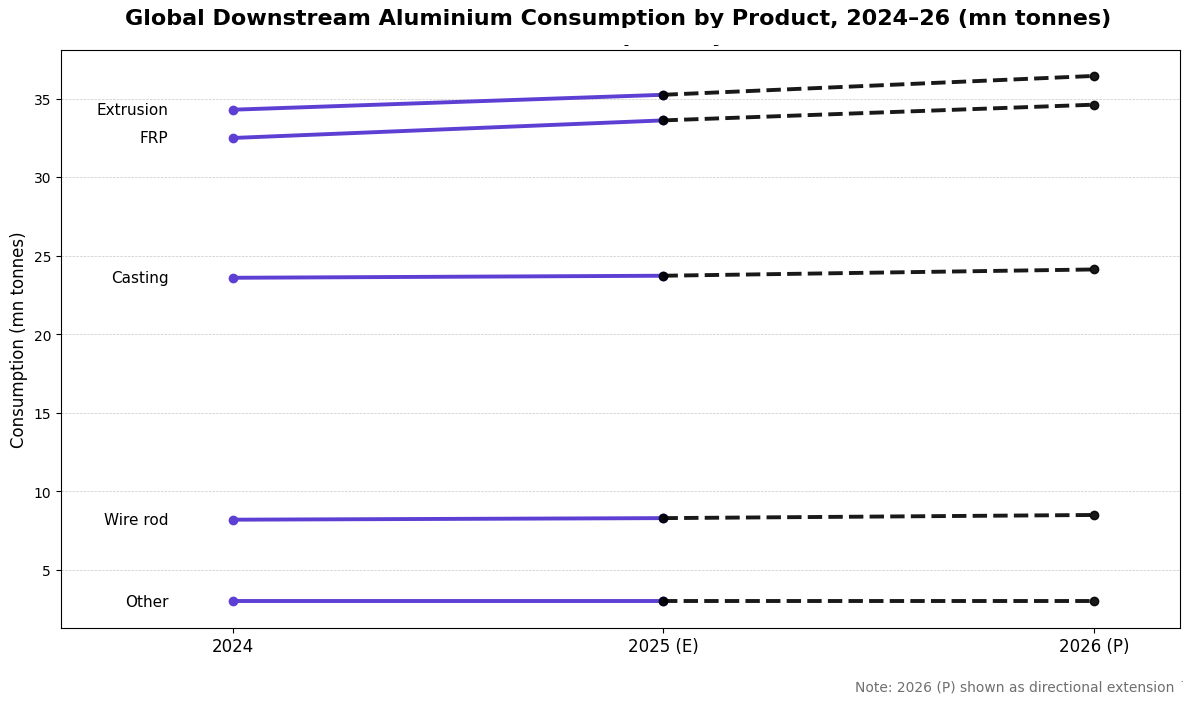

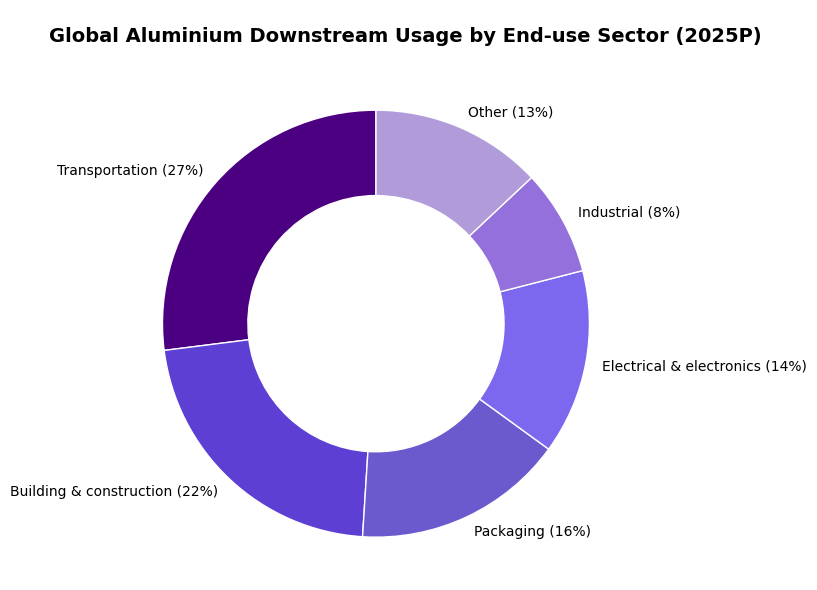

In 2024, downstream aluminium demand was led by extrusions (34%), followed by flat-rolled products including foil (32%), castings (23%), and wires & cables (8%).

That mix tells us something important. Downstream is not a single market. It is several markets running at the same time; each driven by different industries, different buyers, and different economic realities.

The Aluminium Outlook 2026 signals that 2025 has seen a marginal rise from 2024, and 2026 remains positive overall but with visible weakness in some regions, including North America and major European economies.

So the right strategic question now becomes: Which downstream segments are "structurally resilient" and which are "cyclically vulnerable"?

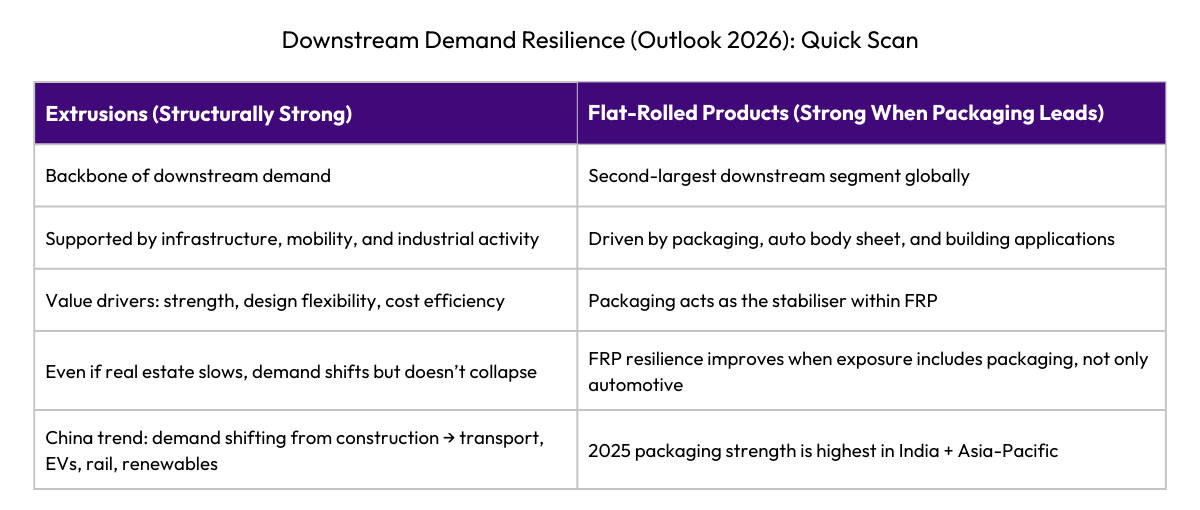

Extrusions remain structurally strong

Extrusions are the backbone of global downstream consumption and their resilience is tied to fundamentals that do not seem to be disappearing overnight: Infrastructure, transportation build-out, and industrial activity.

The Outlook 2026 notes that extrusions remain widely used across construction, transportation, and industrial applications due to their strength, design flexibility, and cost efficiency. Even when real estate slows in pockets, the demand graph supporting extrusions is changing, but not collapsing.

In China, for example, the Outlook 2026 observes a shift away from construction toward transport, EVs, rail, and renewables, which continues to support extrusions (and castings), even as growth is capped by weak real estate and policy constraints.

Key takeaway: Extrusions are likely to remain the "base load" of downstream demand, especially where infrastructure and mobility investments are still expanding.

Flat-rolled products (FRP) stay strong, especially where packaging is booming

FRP forms the second-largest downstream segment globally, driven by demand from packaging, automotive body sheets, and building applications. But even within FRP, packaging is the stabiliser.

The Outlook 2026 explicitly notes that global aluminium packaging demand in 2025 is strongest in India and Asia-Pacific, supported by growth in beverage cans, foil, food service, and pharma, backed by urbanisation and capacity additions.

In Europe and North America, packaging demand appears "resilient but constrained", however, growth visibility remains limited due to tariffs, energy costs, regulation, and inventory cycles (especially in Europe).

The takeaway: FRP resilience is strongest when you are tied to packaging demand, not just automotive cycles.

Aluminium downstream end-user sectors: 2026 demand resilience ranking

Packaging: Steady, scalable, and regionally stronger in Asia

Packaging keeps showing up as a demand anchor because it is supported by sustainability and recyclability advantages, and is less dependent on capital cycles than automotive or construction.

Automotive: Mixed signal, more vulnerable in mature regions

Europe’s automotive output is expected to decline 2.6% in 2025, with only a modest 1.9% recovery in 2026, remaining below pre-pandemic levels due to macro and trade headwinds.

North America shows a similar trend: packaging and infrastructure support demand, but higher tariffs and reduced EV incentives are weakening automotive-related FRP consumption in 2025.

Construction: Moderate recovery, but regionally uneven

Globally, construction output is expected to grow 3.3% in 2026, helped by easing financial conditions and gradual residential recovery, though civil engineering and non-residential growth may moderate under fiscal pressure.

Germany stands out as demand-constrained, with weak housing and commercial outlook, but building permits hint at a possible modest recovery next year.

Key takeaway: Packaging and electrification-driven applications look more dependable, while automotive and construction exposure needs sharper regional selection.

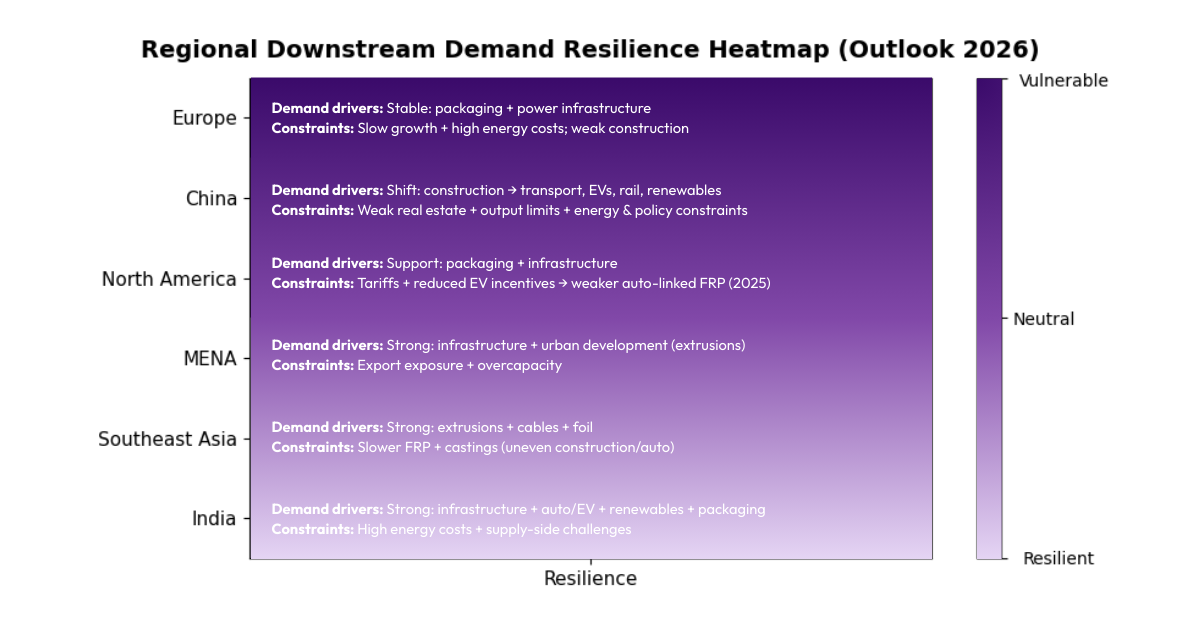

Regional contrast: India & Southeast Asia vs Europe & North America

India: One of the strongest downstream demand profiles

The Aluminium Outlook 2026 report hints at India’s demand will be being driven by infrastructure expansion, automotive and EV growth, renewables, and packaging, supporting aluminium consumption across products. But the market might witness some constrained by high energy costs and supply-side challenges.

This combination makes India a downstream "high confidence" market. It has multiple demand drivers running at once, not just one sector holding the story together.

Southeast Asia: Structurally rising, with selective segment strengths

Southeast Asia benefits from rapid urbanisation, infrastructure, and manufacturing growth, ensuring stronger demand for extrusions, cables, and foil, while FRP and castings grow more slowly due to uneven construction and auto markets.

Europe: Stable pockets, but weak cyclicals

Europe remains subdued due to slow growth and high energy costs. Construction and EV-related automotive show restraints while packaging and power infrastructure provide stability.

North America: resilience in packaging + infrastructure, vulnerability in auto-linked FRP

North America sees packaging and infrastructure support, but the Outlook 2026 also flags pressure from higher tariffs and reduced EV incentives, which impacts FRP consumption in automotive in 2025.

The hidden resilience driver: Electrification demand is building underneath

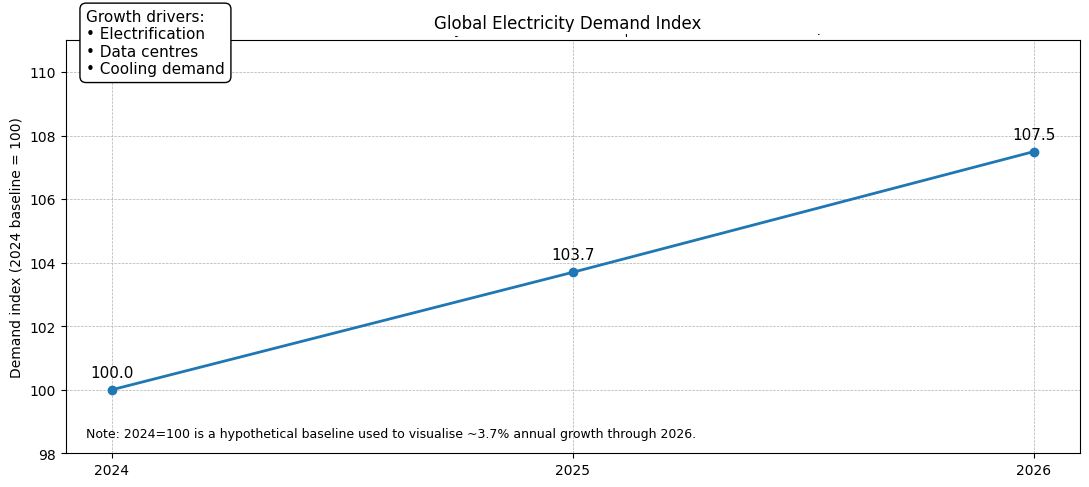

One demand signal downstream players should not ignore is electricity infrastructure. The Outlook 2026 signals that global electricity demand continues growing at 3.7% through 2026, driven by electrification, data centres, and cooling demand.

This matters for downstream because wire rods are underpinned by growth in power transmission, electrification, and renewable infrastructure.

So while construction and auto can wobble, grid-driven aluminium demand tends to keep moving, which is a major strategic buffer for downstream players exposed to cables, wire rod, and electrical applications.

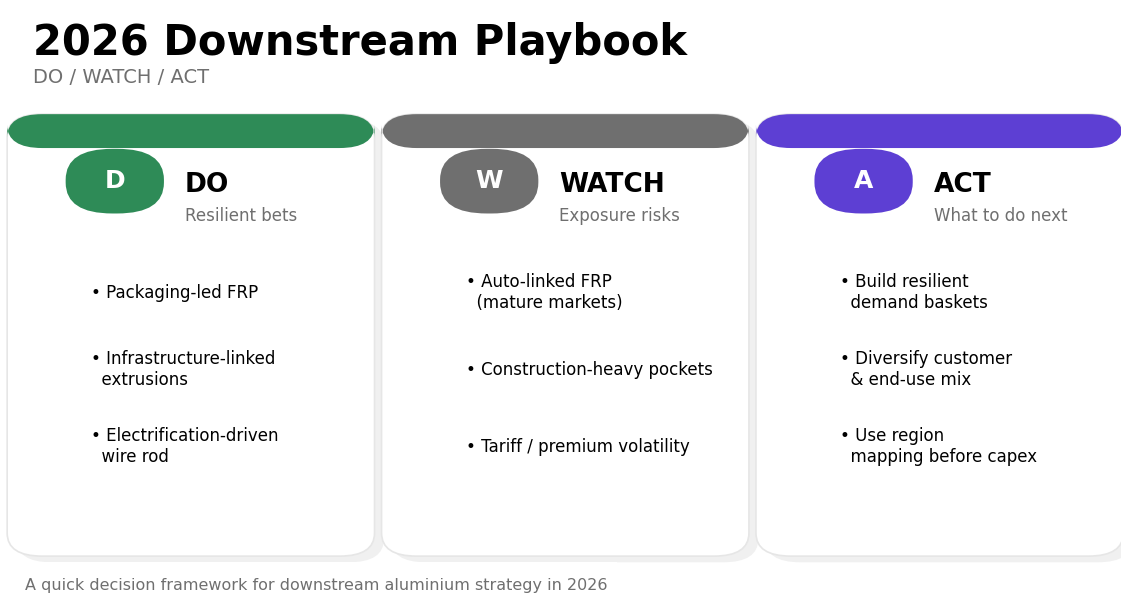

What downstream companies should do differently in 2026

If you are serving OEMs, fabricating semi-finished products, or running capacity-heavy downstream assets, here are the decisions that matter most in a fragmented demand environment.

1) Prioritise “resilient demand baskets”

Build your portfolio around segments the Outlook 2026 flags as structurally supported:

2) Avoid being over-dependent on one end-use cycle

If your FRP exposure is primarily automotive in Europe or North America, the risk profile is simply higher in 2025–26.

3) Treat regional demand mapping as a capex filter

Where you add capacity matters as much as what you produce. India and Southeast Asia show stronger structural momentum

Europe and parts of North America require selective bets. For example, packaging and grid-linked demand are safer anchors here.

How the Global Aluminium Industry Outlook 2026 helps downstream decision-makers

The most valuable insight in a year like 2026 is not "one growth number". It is granularity.

The full Global Aluminium Industry Outlook 2026 goes beyond broad statements by mapping demand region-wise and end-use-sector-wise. It also offers granular analysis across extrusions, FRP, castings, wire rods, and other downstream industries.

The Outlook 2026 report also provides major country-level trade analysis, evolving trade dynamics, and regional case studies to help downstream businesses understand where competitiveness is shifting and why.

For downstream leadership teams, it becomes a practical advantage and a clearer basis to decide which markets to prioritise, where to diversify customers, and which product mix stays defensible when growth becomes unpredictable.

Ultimately…

Downstream aluminium demand into 2026 is not “weak” or “strong” in a single direction. It is selective.

Companies that treat 2026 as a (product+region) optimisation problem and not a blanket demand forecast will be better positioned to protect utilisation, stabilise margins, and build durable OEM relationships.

And that is exactly the kind of decision clarity the Global Aluminium Industry Outlook 2026 is designed to deliver.

Responses