According to the Shanghai Metals Market, China’s social inventories of aluminium ingot further lost 38,000 tonnes over a week across the eight major consumption areas, including SHFE warrants, to stand at 1.09 million tonnes as of Thursday, March 30. But it is to be noted that the weekly decline slowed down from the drop of 85,000 tonnes in the week of March 20-26.

The reason behind the back-to-back primary aluminium inventory fall is high aluminium prices, limited increase in downstream operations, and a lack of confidence for future orders, resulting in downstream buyers being cautious about buying. Output cuts by smelters and an increased share of molten aluminium threatening the production of ingots could extend the destocking of primary aluminium inventories till April.

Compared to Monday, March 27, China’s primary aluminium inventories on March 30 stood 20,000 tonnes lower than 1.11 million tonnes, found SMM.

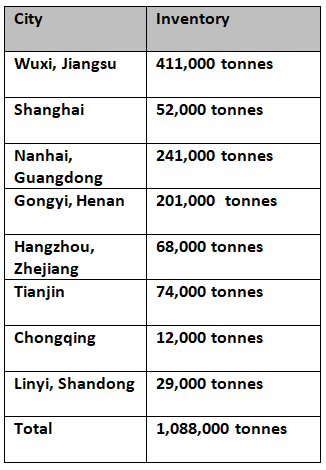

To know more about the current status of primary aluminium inventories across China, refer to the chart below:

In Nanhai, primary aluminium inventories fell the highest this week by 16,000 tonnes to peg at 241,000 tonnes, followed by the slump of 13,000 tonnes in Wuxi to 411,000 tonnes, learned the Shanghai Metals Market. In Gongyi and Hangzhou, aluminium ingot inventories decreased by 8,000 tonnes and 2,000 tonnes, respectively, to settle at 201,000 tonnes and 68,000 tonnes.

Meanwhile, in Shanghai, primary aluminium inventories inched up by 1,000 tonnes this week, ended March 30, to close at 52,000 tonnes, while the inventories in Tianjin, Chongqing, and Linyi remained restrained W-o-W at 74,000 tonnes, 12,000 tonnes, and 29,000 tonnes.

Responses