China and the United States have been vocal about shifting their focus to the recycled aluminium industry for quite some time. And why shouldn’t they? According to the International Aluminium Institute (IAI), rapid population and economic growth over the coming decades will push global aluminium demand to double by 2050, with 50-60 per cent of that demand expected to be met by recycled metal. The IAI also estimates that the global Recycling Efficiency Rate (RER) currently stands at 76 per cent, covering both new scrap and old scrap. The transportation sector leads aluminium recycling with an 86 per cent recovery rate, and among all end-use sectors, the automotive industry remains the single largest consumer of recycled aluminium. Having said that, at such a critical juncture for the global industrial progress, where do they stand today?

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

2015-2024: How production numbers reveal China’s recycling takeover

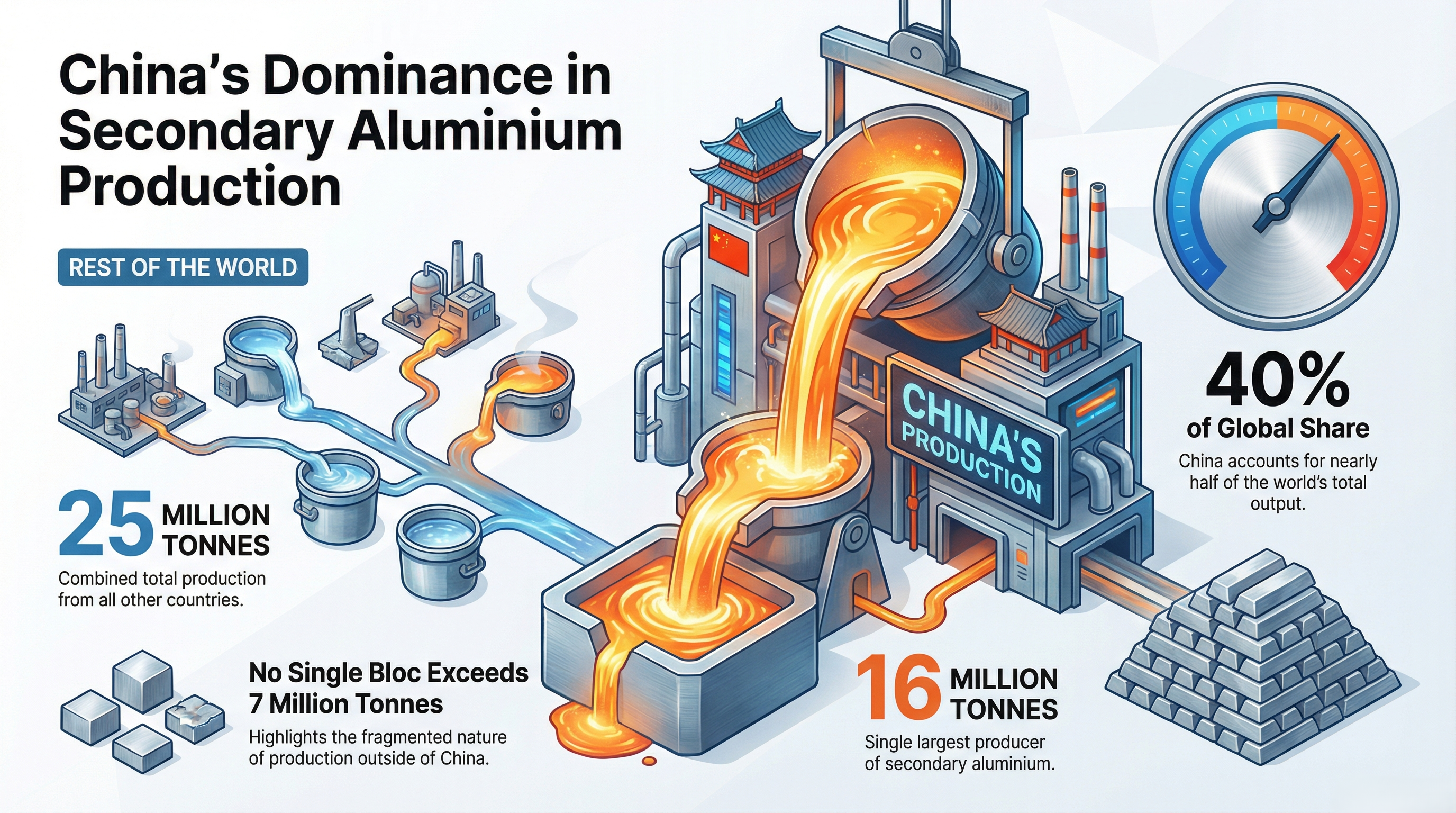

After dominating primary aluminium, the numbers from 2015 to 2024 now show that China is decisively pulling ahead in recycled aluminium as well.

In 2015, China’s secondary aluminium output stood at 8.98 million tonnes. By 2024, it is estimated at 15.84 million tonnes. That is a staggering 6.86 million tonnes of incremental recycled output in less than a decade — a growth rate of roughly 76 per cent. In nine years, China added twice the size of the current US secondary aluminium industry in net volume alone.

The scale shift is even more telling. In 2015, China’s recycled output was already 2.6 times larger than that of the US. By 2024, it is more than 4.4 times larger. This is not convergence. This is structural divergence.

In primary aluminium, China used coal power, industrial scale and state policy to overwhelm global supply. In recycled aluminium, it is deploying the same playbook, with scrap replacing bauxite. The only difference is speed: scrap supply grows more slowly than smelting capacity.

Responses