您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

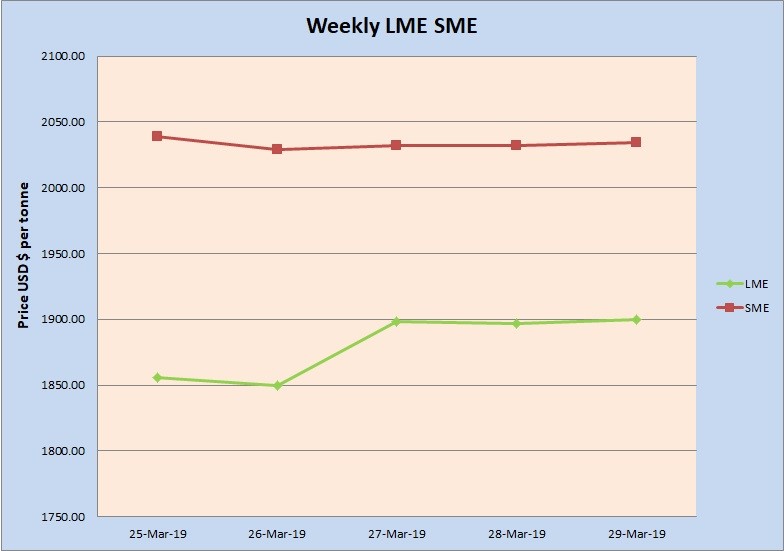

The US dollar traded lower in the beginning of the week as the US government bond yields extended their decline from last week on fears of slower global growth. The dollar then rose for three consecutive trading days and jumped to the highest since March 11. Base metals traded mixed over the week and both LME and SHFE aluminium moved within a tight range. Both the contracts did not register any sharp rise or fall.

LME aluminium closed Friday's trading slightly higher from previous closing to close at US$ 1900 per tonne. The weekly trading range was set at US$1,850- 1900 per tonne. The contract is likely to trade at US$1,850-1,920 per tonne over the next week.

{alcircleadd}

As on March 29, LME aluminium cash (bid) price stood at US$ 1899.50per tonne, LME official settlement price stands at US$ 1900 per tonne; 3-months bid price stands at US$ 1913 per tonne, 3-months offer price is US$ 1914 per tonne; Dec 20 bid price stands at US$ 2040 per tonne, and Dec 19 offer price stands at US$ 2045 per tonne.

The LME aluminium opening stock dropped to 1129175 tonnes. Live Warrants totalled at 723400 tonnes, and Cancelled Warrants were 405775 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1914 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange also hovered within a very close range over the week at US$ 2029-2039 per tonne.

The most active SHFE May contract rebounded from earlier lows to closed the trading day 0.26% higher at RMB13,730 per tonne yesterday. Temporary stable costs and recovering consumption kept SHFE aluminium robust. Traders are expected to take a wait-and-see stance in the last trading session before lower value-added taxes take effect next Monday. The contract is expected to trade rangebound above the 10-day moving average tonight.

Tight bauxite supplies lowered operating alumina capacity and supported domestic alumina prices. SMM reported on Thursday that social inventories of primary aluminium ingots in China shrank 56,000 tonnes in the week ended March 28, showing signs of recovering consumption. Those factors supported the China aluminium prices over the week. The SHFE 1905 contract is expected to remain firm in the coming week.

Responses