The bauxite market in the year 2018 had been found following a steady pace. There were some developments and expansions on existing mines, while some notable deals and new projects crossed the path across the world. The price in the China market also displayed steadfast growth throughout the year, with some short restraints and intermediate drops. In fact, Shanghai Metals Market had anticipated in July that bauxite would gain in the near term as more regulations on open-cut mining were put forward. Most bauxite mines in Shanxi and Henan provinces adopted opencast mining, SMM learned. Read through the article to know more about the developments and updates in the bauxite industry over the year.

Bauxite price trend

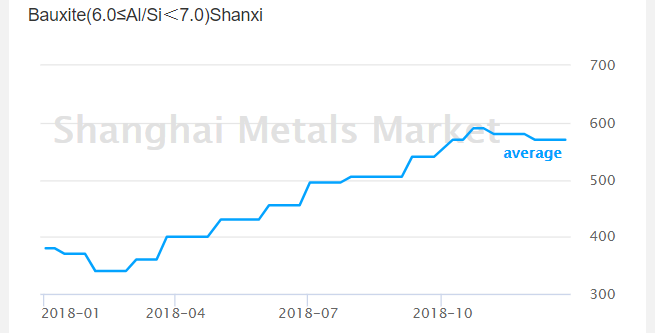

{alcircleadd}The bauxite price in China started at RMB 380 per tonne at the beginning of the year. While the price showed a sluggish trend in February and the beginning of March, it started rebounding in the latter of half of March to RMB 400 per tonne, followed by RMB 455 per tonne in early June, RMB 495 per tonne in July and so on and so forth. So far, the highest price this year had been RMB 590 per tonne between October 22 and October 29. Currently, the bauxite price in China is hovering at RMB 570 per tonne.

According to the Shanghai Metals Market, tight supplies in the market due to the government’s strict approach to illegal mining accounted for the price hike primarily. In Henan, captive mines at some alumina refineries had been shut down, SMM learned. However, in the latter half of the year, supply shortages eased as some miners in Shanxi and Henan resumed output. But yet the price continued to be at highs because of winter stockpiling across alumina producers.

Global bauxite production

The BMI research team had anticipated in April that bauxite production would likely grow globally over the years owing to the estimated increasing production in India, and as the upcoming projects lined up in Australia and Indonesia reappeared in the market following the end of the mineral ore export ban. According to BMI, the relaxation of the ban on bauxite exports allowed many companies to have a robust return to the market.

Australia, the world’s top bauxite producer, was also expected to hold its ground and make a strong presence in China market maintaining a steady output growth. But China’s bauxite production was forecast to remain stagnant over the years due to the deteriorating quality of reserves and government-led initiative to consolidate the section. BMI had further foreseen China’s bauxite output to edge higher from 66.1 million tonnes in 2018 to 76.9 million tonnes in 2027, an average annual growth of 1.7 per cent.

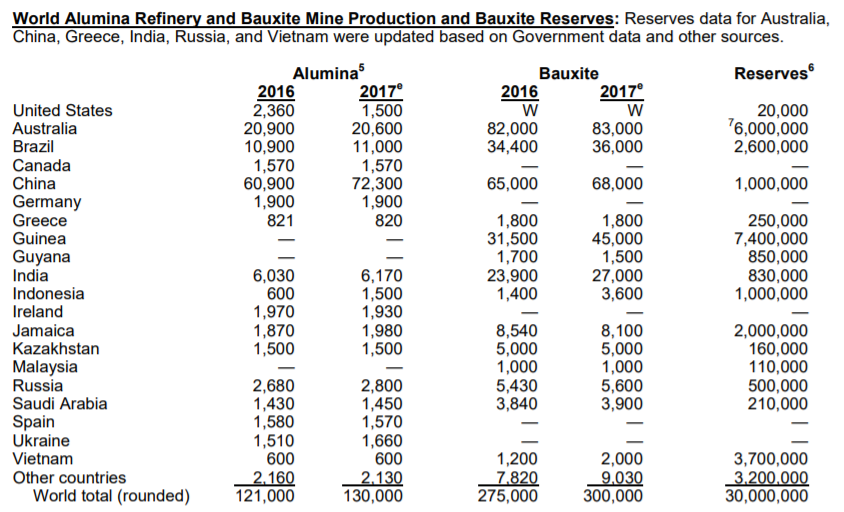

In the year 2017, the world’s total bauxite production was at 300 million tonnes, in comparison to 275 million tonnes in 2016. This year the world’s bauxite production is expected to be at par or even more with new investments and expansions.

New investments and expansions

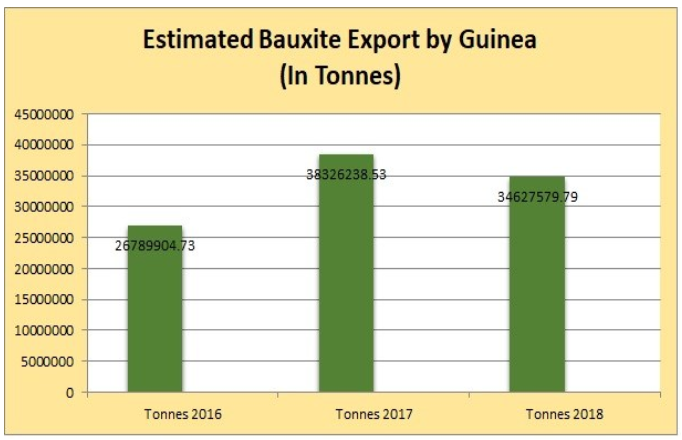

Guinea, Africa’s top bauxite producer with the production more than doubled last year to about 50 million tonnes, approved plans of a Netherland-based company Emirates Global Aluminium (EGA) to develop a bauxite mine and alumina refinery worth US$1.4 billion in Guinea. The construction work of the project got reportedly completed by 50 per cent around the month of June 2018. The first bauxite exports from the company’s Guinea Alumina Corporation (GAC) project is expected during the second half of 2019.

Nalco was also included in the squad that eyed the possibility of gaining access to bauxite deposits in the West African country. The company also decided to bid at the auctions of 21 bauxite blocks to be put up for allocation by the governments of Jharkhand, Chhattisgarh, and Madhya Pradesh.

The state-owned Odisha Mining Corporation (OMC), on the other hand, received clearances for Kodingamali bauxite mine. The Jamaican government signed an agreement with China's Gansu Provincial government to develop a $6 billion industrial park and Special Economic Zone around the JISCO/ALPART alumina refinery in Nain, St Elizabeth so that they could generate optimum revenue from their bauxite reserves.

Besides, Metro Mining commenced mining operations at the Bauxite Hills Mine, with an initial rate of 2 million tonnes per annum and later on, ramping up to 6 million tonnes a year. Its first shipment was purchased by China’s Xinfa Group. The news also crossed our path in the early June that Indian operators were going to relaunch the long-awaited Cameroon Alumina Limited’s (CAL) bauxite mining project.

Vedanta Limited for the very first time this year received bauxite from OMC’s Kodingamali mines. The company was optimistic about getting a total of 3 million tonnes of bauxite from OMC by the end of the year.

Canyon Resources raised US$5 million from institutional and sophisticated investors for developing Minim Martap Bauxite Project in Cameroon. In the mid of the year, Aluminium Corp of China (Chalco) signed an agreement with Guinea government to develop the Boffa bauxite project in the west of the country. The project holds around 1.75 billion tonnes of bauxite, with an estimated annual production of 12 million tonnes, which is expected to start by the end of 2019. Australian Bauxite also reported in July that its subsidiary ALCORE received the minimum funding to start Stage 1 of the project. The budget set for the Stage 1 operation is A$2.5 million.

The Government of Ghana signed a deal with China’s Sinohydro Corporation Limited, under which the former would supply bauxite to the latter in exchange of funds for the infrastructure projects in Ghana, including roads, bridges, interchanges, hospitals, housing, rural electrification.

The twist and turns in the market

Bauxite mining operators and settlers in Bukit Goh, Malaysia, which once used to be a lucrative spot for bauxite mining activities, still rested in uncertainty over bauxite mining in 2018, even after the mining moratorium ended on June 30. However, a month later, the Malaysian government again extended the moratorium until the end of 2018. In the meantime, the Pahang government officially declared to not issue export licenses to any firms that violate the moratorium period.

Besides new developments, expansions, and investments, the year 2018 also included a few protests and strikes over various issues at different bauxite plants.

As per the report on September 24, production at the New Day Aluminium Limited bauxite plant was put on hold, as almost 200 hourly-paid workers went on strike for approximately four hours.

Bauxite mining workers in Raipur had also reportedly refused to work as a form of protest demanding full wages and alleging that the contractor appointed by Chhattisgarh Mineral Development Corporation (CMDC) was treating them unfairly and giving insufficient money.

The Windalco bauxite plant in Ewarton, St. Catherine, also started witnessing a growing tension between its management and the production workers over outstanding retroactive salary payments from late December 2018.

On November 27, Maharashtra Pollution Control Board ordered the closure and stopped water and electricity supply to the Hindalco Industries Limited’s bauxite mine near Kolhapur in Maharashtra. The Bombay High Court on December 5 also granted an interim stay on that order.

Trade Focus: Guinea remains at the top

Guinea had been racing past many countries to become the key bauxite exporter globally. The year 2018 also kick-started with the country’s big plans. One of its bauxite mining companies La Guineenne des Mines (GDM) announced the shipment of their first bauxite consignment from a western Boke project on February 1. The miner said it aims to export 2 to 4 million tonnes of bauxite this year. According to the global trade data, Guinea’s total bauxite export is expected to reach an estimated 50 million tonnes in 2018 and the revenue is estimated to stand at US$ 425 million. In July, Guinea shipped 2.96 million tonnes of bauxite to China. The volumes accounted for 40.6% of the overall imported bauxite to China in July.

Another key bauxite exporting country Australia’s bauxite export market was pegged at around US$30 million in 2018. After reaching an estimated 24 million tonnes in 2017, total bauxite export from the country is expected to total at 21 million tonnes this year. Rio Tinto started shipping bauxite from its US$1.9 billion Amrun project in Queensland and the first shipment arrived at the Port of Gladstone in early December.

Brazil’s bauxite exports totalled 597,503 tonnes in March 2018, against 671,882 tonnes in the same period last year, found the country’s foreign trade ministry, MDIC.

China – the bauxite importer

Chinese customs data showed that the country’s bauxite imports in February grew 43.7% year on year to stand at 6.1 million tonnes. In July, China imported 7.28 million tonnes of bauxite, down 2.2% month on month but up 18.2% year on year, customs data showed. In the first seven months of this year, China imported 49.58 million tonnes of bauxite, up 29.8% from a year ago. Bauxite imports from Australia grew 13.6% to 2.61 million tonnes in July, accounting for 35.8% of the overall imported volume. Imported bauxite prices averaged $53.8 per tonne in July, up 1.8% from June and 7.3% from the same period in 2017.

In August, China’s bauxite imports increased 8.4% 7.89 million tonnes after a month-on-month drop. This brought the overall imports during the first eight months up 28.5% on the year, to 57.47 million tonnes.

Conclusion:

2018 can thus, be concluded as a competitive year for the bauxite industry, with new developments, expansions, and investments. The lowest price that bauxite touched this year was RMB 340 per tonne and the highest was RMB 590 per tonne, with no significant drops in the intermediate period. New agreements and investments occurred that expect to ramp up the production of the ore. For instance, Australia’s Metro Mining in August announced the negotiation of two new agreements for the lion’s share of the firm’s expected production through 2019. Rio Tinto’s bauxite production also recorded a growth in Q2 and H1 2018. The output of the ore at Rio in Q2 2018 was 13.3 million tonnes, 3 per cent higher from Q2 2017. The company shipped 8.7 million tonnes of bauxite to third parties in Q2 2018, 10% higher than Q2 2017 due to firm demand. Rio Tinto’s Gove Operations also bagged a prestigious award at the 2018 Chief Minister’s Northern Territory Export and Industry Awards as a world-class bauxite producer in the global aluminium industry.

Responses