India

{alcircleadd}India holds the second position in the list of top 5 primary aluminium producers in the world. According to the annual reports of the three major aluminium producers in India, the total aluminium production stood at 3.39 million tonnes in 2017. Aluminium production in the country is currently outpacing the demand leading to an increase in exports. India's aluminium production is forecast to be stable at 3.42 million tonnes in the current FY.

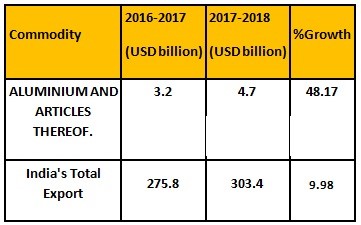

India's aluminium export

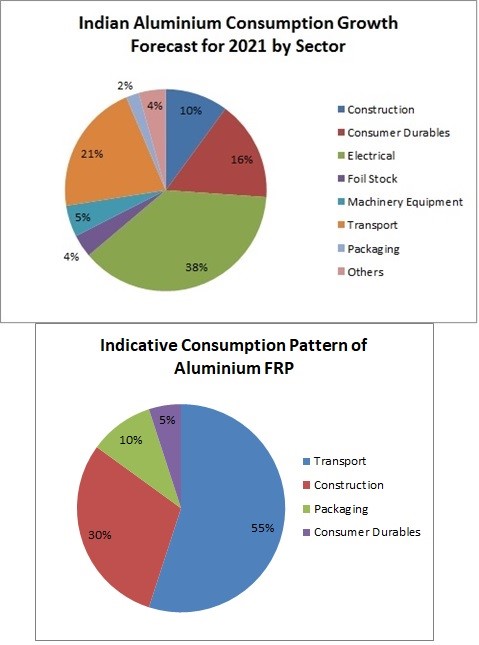

Domestic consumption of primary metal also showed an increase, from about 1.58 million tonnes in 2014-15 to 2 million tonnes at present. As forecasted by a 2016 report by Crisil, a research service, apparent aluminium consumption in India would grow from about 3.3 million tonne currently to 5.3 million tonnes in 2020-21.

Along with the power sector and building and construction sector, the aerospace & defence sector is creating some exciting opportunities for the aluminium alloy, extrusions, parts and additive manufacturers of the country. Plus, the government is also aiming at replacing all gasoline or diesel vehicles with electric vehicles by 2030; this would open up huge business prospects for the domestic automotive part makers as well as car makers in the country.

A look at the consumption pattern of aluminium in India would reveal that the greatest share goes into extrusions since they serve as the input materials for the manufacture of rods, plates, profiles and tubes that are used in Building & Construction sector- the largest aluminium end user industry in India. There are presently 250 odd active extruders producing a variety of complex extrusions in the country but not too many of them are engaged in the production of high-grade aluminium alloy extrusions.

The extrusion companies in India have installed presses ranging from 360 ton to 9000 ton. The Indian extrusion industry is moving towards the installation of larger presses. Jindal Aluminium remains the leading manufacturer of aluminium extruded profiles in India. With 128,000 tonnes per annum installed capacity (as per Indian Minerals Yearbook 2017 data) and 10 aluminium extrusion presses, the company is capable of producing a wide range of aluminium extruded profiles, In fact, if we talk about market share, JAL commands approximately 30% market share in India.

Large scale primary aluminium producers also have extrusion capacity of their own. Hindalco has an extrusion capacity of about 31,000 tonnes per annum while Balco has about 8000 tonnes.

India's overall aluminium flat rolled product demand is estimated in the range of 600,000-650,000 tonnes per year. India’s flat product consumption is limited to foils and to some extent in the transport sector. A recent study by Vedanta Aluminium showed that India’s aluminium consumption pattern will change with the changing demands. Transport sector demand will pick up with the changing fuel economy rules and growing demand for lighter cars.

Speciality aluminium alloy production, till date, remains a government-only pursuit where state controlled aerospace and defence entities have to rely on imports to meet their entire requirements. With new investments opportunities being created through programmes like ‘Make in India,’ the demand supply gap is likely to get narrowed down in the future. Nalco’s aluminium park in Angul and Hindalco’s downstream expansion in producing high-grade alloys are expected to boost consumption of rolled products.

In India, the wire and cables segment comprises nearly 40 per cent of the electrical industry and is estimated to grow at a CAGR of 15 per cent. With the Government now focusing on Make in India, the industry can grow at a similar rate over the next five years. That opens up a big market for the makers of aluminium wire rod which is a raw material for making aluminium cables and overhead conductors.

Japan

Japan remains the center for aluminium alloy rolled products. The country does not produce primary aluminium. The country produces and exports automotive aluminium sheet for use in packaging and for car bodies and batteries for electric cars. According to Japan Aluminium Association, Japan imported about 3 million tonnes of alloyed and non-alloyed aluminium in 2017 to feed their semi-finished sector.

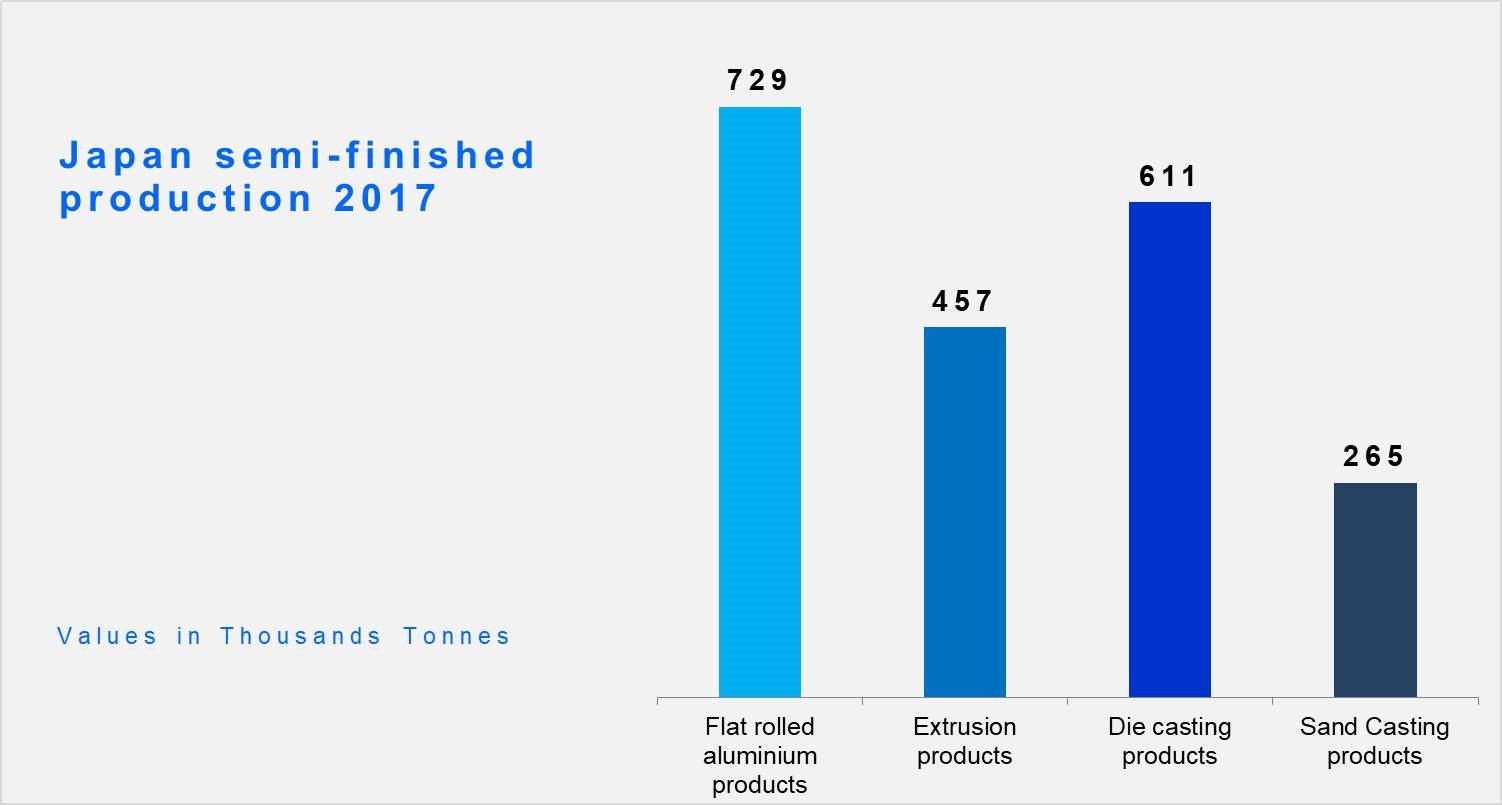

The country produced about 728,500 tonnes of flat rolled aluminium products in 2017, up 2.3 per cent from 2016. For the first seven months of 2018, the country produced 728, 000 tonnes of FRP. This indicates the volume is going to increase in 2018. Japan ships the largest part of its FRP to the packaging sector followed by transportation. The country exports about 300,000 tonnes of FRP and the rest are used domestically.

Japanese aluminium producers UACJ Corp is gearing up to meet an ever-increasing demand for FRP in the United States’ automotive industry. With an annual capacity for flat rolled products exceeding 1 million tons, UACJ is among the top-class aluminium rolling product manufacturers, not only in Japan but in the world.

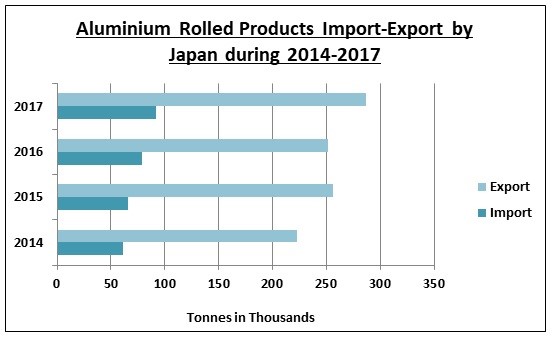

The domestic automotive market in Japan, on the other side, is not completely closed off to aluminium and is expected to begin using aluminium for structural frames in 2020 or 2021. Export and import of aluminium rolled products by Japan during 2014-2017 have trended as follows:

Image: AlCircle Report

Japan produced about 456,600 tonnes Extrusion products in 2017 and most of it is shipped domestically. The country also produced 611,000 tonnes of die casting products.

YKK AP, Japan is one leading group producing aluminium extrusions for building and construction sector. The company acquired the aluminium extrusions business of Bhoruka Aluminium (BAL) through its Singapore-headquartered holding company YKK Holdings Asia for $22.29 million.

Rest of Asia Pacific

Press Metal is the leading aluminium extruder in Malaysia with a 40,000-tonne capacity per annum and the company has aluminium smelting capacity of 760,000 tonne per annum. Press Metal has has been an aluminium supplier to Apple for the production of iPads and it also supplies to the solar sector. The company exports to Europe, Australia and New Zealand, becoming the first Malaysian company to sell aluminium products outside the country. The company considers transportation industry as the biggest driver of aluminium demand, along with construction, and expects aluminium to play a major role in the rise of electric vehicles. It’s expected to produce $2.3 billion in revenue in 2020 mostly driven by automotive demand.

The Indonesian government plans to boost aluminium production to 1.5-2 million tons per annum (MTPA) by 2025, from around 250,000 tonnes at present. State-owned aluminium producer PT Indonesia Asahan Aluminium (Inalum) produces both primary and alloyed products and represents the total production for the country. This is their attempt to enable producers to meet growing export market demand. According to the Industry Ministry, domestic aluminium demand currently reaches 900,000 tons per annum, far higher than domestic production. This demand is projected to increase in line with the expansion of the country’s economy.

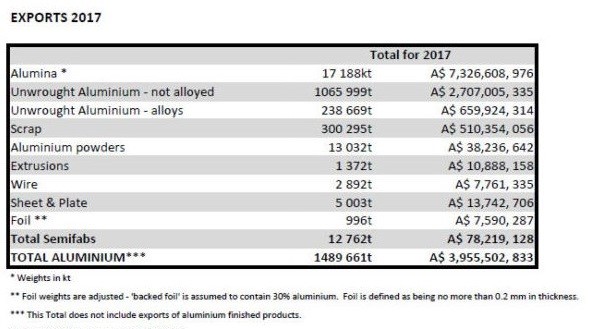

Australia Aluminium Export

Australia aluminium market is an export oriented one and mostly limited to upstream sector because of the abundance of bauxite and alumina. There are currently four aluminium smelters operating in Australia producing about 1.5 million tonnes of primary aluminium, of which approximately 1 million tonnes were exported in 2017. There is also one smelter operating in Invercargill, New Zealand. While the country exports it primary products and raw materials, most of the semi-finished products are imported. Australia imported about 263,405 tonnes of semi-finished aluminium products in 2017.

Other countries that play a significant role in aluminium market are South Korea and Taiwan. South Korea imports from India to feed its semi-finished industry in the rolled and extrusion sector. Taiwan ranks second in per capita aluminium consumption with a rate of about 33.3 kg. The island country has seen significant demand growth for aluminium alloy products in the domestic market.

Along with the growth of primary and downstream industry Asia Pacific remains a key market for secondary or recycled aluminium. Usage of recycled aluminium in the Asia Pacific region in 2017 was estimated at around 10.5 million tonnes and is forecast to reach 14.1 million tonnes by 2022, with a CAGR of 6.1%. Of the total global usage of recycled aluminium, the Asia Pacific region accounted for a major share of 51% in 2017. China is the major producer and consumer of recycled aluminium. The country has over 230 secondary aluminium producers.

To sum up, Asia Pacific remains the focus region for aluminium industry considering the quick GDP growth and infrastructural and manufacturing growth. Production of metal is growing and still has much more potential for further growth. Industrial growth is supported by industry-friendly government policies. The need of it is further reinforced by the current protective trade policies in the west compelling producers in the east looking for alternative markets. This leaves enough potential for the development of a parallel market for the aluminium produced in the region along with the growing export demand from Europe and North America.

Responses