The production base for the primary aluminium sector has long started shifting towards east for the availability of raw materials, power and labour. The production base lies in the east while the market lies in the west. However, most of the Asian countries are now shifting their focus towards developing the manufacturing sector encouraging value added applications of the metals they produce. This has been further reinforced by the protective trade policies in the west that are levying steep tariffs on products imported from east especially China.

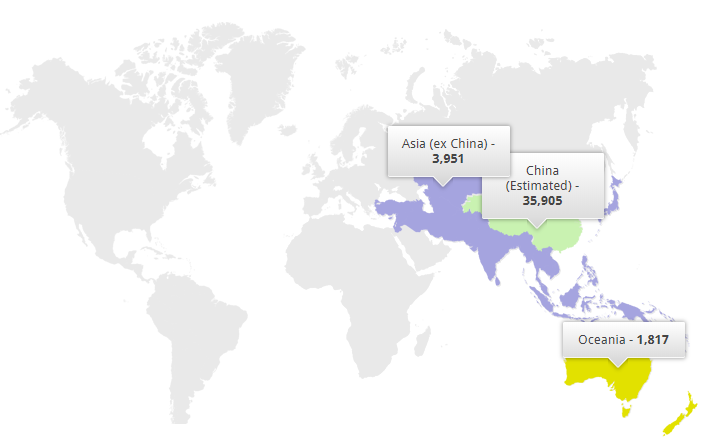

The Asia Pacific region roughly produced 42 million tonnes of primary aluminium in 2017 (IAI statistics). China produced about 36 million tonnes of it and India contributed about 3.2 million tonnes and Australia and New Zealand produced about 1.8 million tonnes. The rest contributed about 0.75 million tonnes.

{alcircleadd}

Asia-Pacific Primary Aluminium Production 2017

The aluminium market in the Asia Pacific region is driven by China, India, Australia, New Zealand Japan, North Korea, Singapore, Taiwan, Indonesia, Vietnam and Malaysia. The Russian Far East – a part of Eastern Siberia also falls under Asia Pacific. After the global economic slump of 2008 that continued almost till 2010, it was the expansion of the construction sector which acted as a key growth driver of the global aluminium industry. While the recession was strongly felt in the world's developed economies, particularly in North America and Europe, many of the developing economies in Asia Pacific suffered far less impact, particularly China and India whose economies grew substantially during this period.

Growth Drivers

According to a latest report, the global aluminium market is predicted to display a CAGR of 6.4% between 2017 and 2025. Progressing at this rate, the market will be valued at US$249.29 billion by the end of 2025 from US$143.87 billion in 2016.

Asia Pacific led the global aluminium market with more than 60% share equating to a value of about US$ 96770.9 million. Going forward, the region is expected to hold more dominance with growing GDP and more metal consumption. The booming construction sector in countries such as India, China, Malaysia, and Vietnam as a result of rapid industrialization and urbanization is benefitting the aluminium industry. This is having a positive bearing on the Asia Pacific aluminium market driving demand for extrusion, rolled and cast aluminium products.

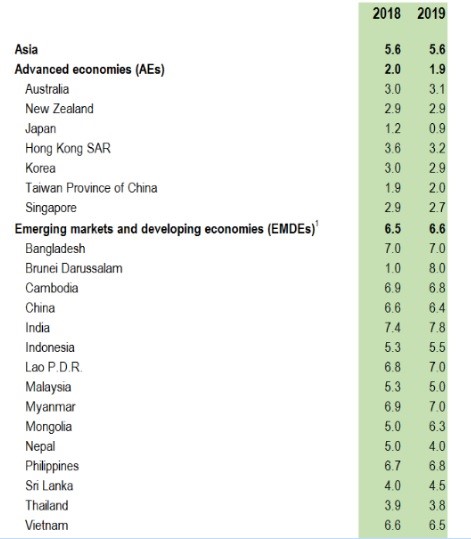

Asia Real GDP Growth (Image: IMF)

Rapid industrialization and urbanization in the emerging economies of Asia Pacific leading to the construction of commercial and residential buildings accounted for high demand for aluminium and aluminium alloys and semi-finished products like aluminium extrusion and sheets. This is mainly because of high durability and strength and low self-weight of aluminium and aluminium alloys that make them suitable for buildings and road infrastructures.

Though the construction growth has slowed down in the recent years, especially in China, another sector that is driving aluminium application currently in the Asia Pacific is the transport sector. GDP growth and rising income in the emerging economies of the region is leading to a substantial demand for automobiles and high demand for fossil fuels. Automobile manufacturers are focusing on lightweight cars to maintain fuel economy without compromising on design and size, hence; the shift from steel to aluminium. Be it cars, trains, aircrafts or trucks, the increasing use of aluminium to reduce fuel consumption, get better efficiency, and for design flexibility and after sale service is immensely benefitting the aluminium sector.

Major Countries

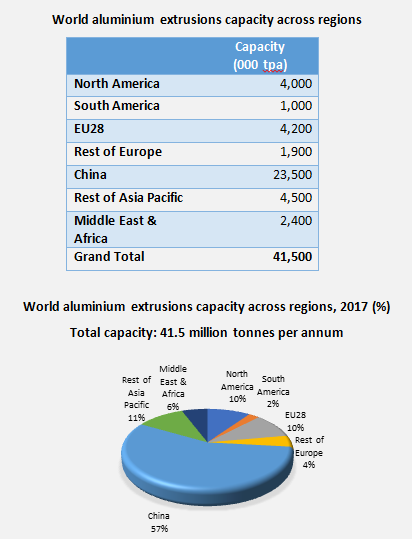

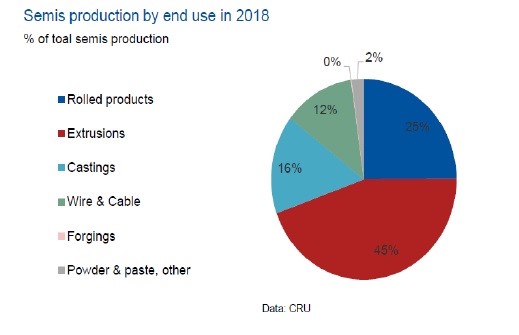

Along with primary aluminium production, the Asia-Pacific region produces a big chunk of semi-finished aluminium products, mostly rolled and extruded products along with casings. China apparently remains the top semi-finished aluminium producing country. Japan, South Korea, Indonesia, Malaysia, India and Australia have a fair share in the production. China remains the top extrusion producer while Japan remains the top country in the rolled product market leveraging on its expertise in aluminium alloys that play a significant role in manufacturing rolled products for high end applications. Other than Japan, none of the countries have been able to produce high strength alloy in the commercial scale that are suitable for high end applications in the aerospace and automotive sector. In the semi-finished sector, the Asia Pacific region primarily remains an extrusion product manufacturing hub.

Aluminium Extrusion Capacity Across Regions

China

Until 2015 since the recession in 2008, China was the world's fastest-growing major economy, with growth rates averaging 10% over 30 years. The growth has slowed down after the saturation of construction boom. The pace of growth in China’s economy accelerated in 2017 for the first time in seven years as exports, construction and consumer spending all climbed strongly. The National Bureau of Statistics announced that the economy expanded 6.9 per cent in 2017, up slightly from 6.7 per cent in 2016 and breaking a slower trend since 2011.

According to a CRU report, GDP growth shows that the growth was driven by stronger net external trade, whereas fixed asset investment (FAI) slowed toward the end of 2017. The real GDP growth rate in China according to IMF currently stand at 6.6% and expected to slow down further in 2019 to 6.4%.

China remains a global leader in the production and consumption of aluminium extrusion. There are more than 500 aluminium extrusion companies in China who account for about 50% of the global extrusions capacity equating to about 23.5 million tonnes. The aluminium extrusion consumptions in China are estimated at 17.8 million tonnes in 2018 which is forecast to grow at around 6.7% per annum in next five year. (AlCircle Report)

Recent investigations by the US commerce department on Chinese aluminium extrusions on allegations that Chinese manufacturers evade U.S. AD & CVD by shipping aluminium products through Vietnam and also by disguising primary aluminium as extruded profiles have already put pressure on Chinese aluminium extrusion exports. This has been further worsened by 10% tariffs imposed by the Trump administration on all imported aluminium and semi-finished aluminium.

Subject to technical restrictions, China has been unable to conduct mass production of aluminium alloy automotive sheet, especially the one used for car body. In order to meet China's huge demand, local producers represented by Southwest Aluminum and Nanshan Aluminum have enhanced R & D and production of automotive aluminium sheet.

Currently, aluminium alloy automotive sheet products used in China’s automotive industry chiefly rely on imports; sheet materials used in Japanese cars are primarily imported from Japan; while for American and German cars, European and American companies like ALCOA, Norsk Hydro and Novelis act as the suppliers.

Novelis’ Changzhou plant is China’s first manufacturing facility for heat-treated aluminium automotive sheet. The wholly-owned, $100-million plant has a capacity of 120,000 metric tons per year. The facility allows global customers to source locally-produced Novelis aluminium automotive sheet in China

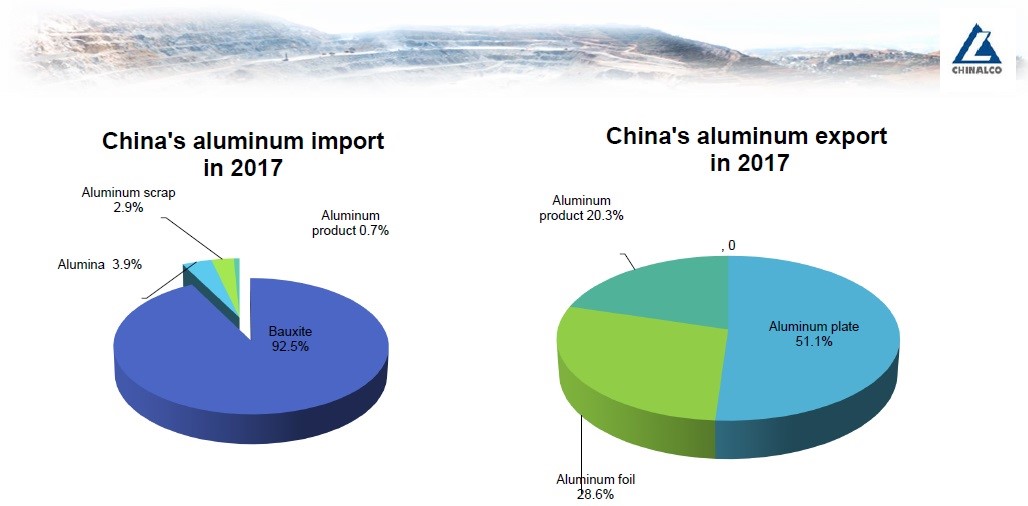

Chinese aluminium alloy automotive sheet manufacturers serve local carmakers. Aluminium rolling industry is mostly limited to aluminium sheet, plate and foils catering to packaging and construction sector. According to the latest CRU data, China’s FRP exports were up 25% YoY in 2017.

According to Aluminum Association data, U.S. imports of semi-fabricated aluminium products from China grew 183 per cent between 2012 through 2015 before levelling off in 2016. In February 2018, the U.S. Commerce Department slapped stiff duties from 49 per cent to 106 per cent on aluminium foil imported from China for selling the product in the U.S. below fair market value. Mexico also, on August 28 said it was starting an investigation into imports of a type of aluminium foil from China.

The fact that China’s semi-finished export has been restricted by the protective trade policies in the US and Europe, the country will either look at other destinations to export its semis or develop more applications to consume the stockpile.

China consumed about 35 million tonnes of primary metal in 2017. The consumption would see a slight drop in coming years as the country gradually transitions away from the construction-centric model of economic growth. However, transport sector will offset the slowdown in construction. Chinese government is heavily investing on automotive growth encouraging automakers to make lighter cars in order to shift to New Energy Vehicles from fossil fuel cars.

(To be continued in Part-2)

Responses