您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

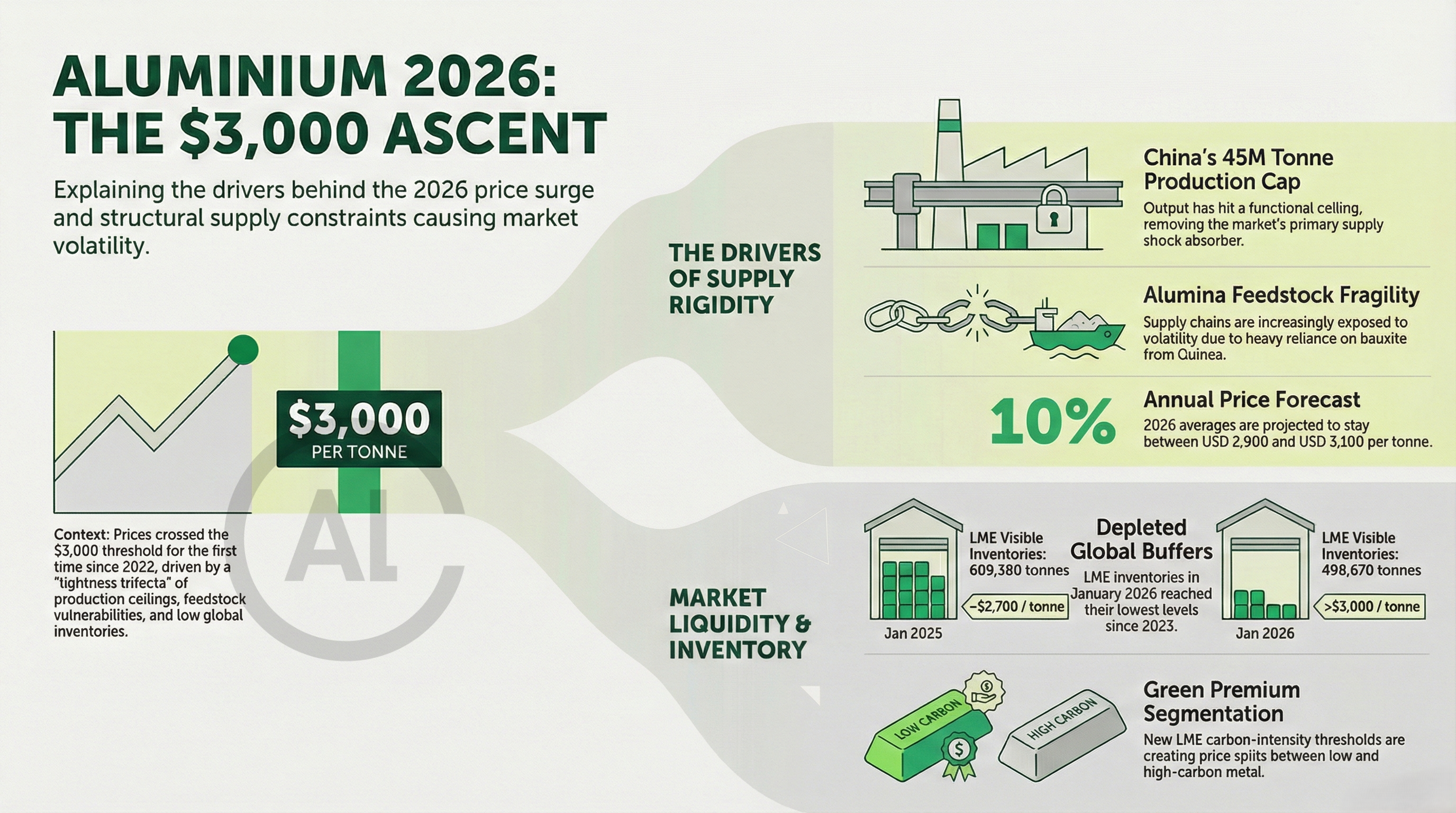

The London Metal Exchange (LME) aluminium contract entered 2026 with a bang of a hike, as in early January, the three-month contract crossed USD 3,000 per tonne for the first time since 2022, trading at USD 3,015.50 before extending gains later in the month. The move was not the product of speculative momentum alone. Back in 2022 production and energy costs, China’s production cap and Russia-Ukraine’s war imparted their fair share of spices into the price hike scenario. But this time, it reflected a convergence of constrained supply, tightening physical availability and US and EU’s policy-driven rigidity, consequently leading to altered price expectations for the rest of 2026.

{alcircleadd}For the global aluminium value-chain 2026 outlook, get our exclusive report “Global ALuminium Industry Outlook 2026"

Is the previous forecast annulled?

PricePedia’s December 9, 2025 publication put the 2026 outlook clearly in bullish territory, estimating roughly a 10 per cent rise in USD prices for the year versus the previous calendar year (2025).

The forecast places the expected annual average well above the mid-USD-2,700s that characterised much of last year. While PricePedia’s analysis extends beyond 2026, the first year of that outlook now warrants isolated attention. January’s price action has already validated the assumption that the aluminium market is entering 2026 without surplus capacity to dampen shocks.

Two sets of contemporary market signals explain why 2026 looks constricted and justify focusing the forecast on that single year. The first is supply rigidity centred on China and the alumina feedstock chain.

The first signal: China’s production ceiling removes the market’s shock absorber

Responses