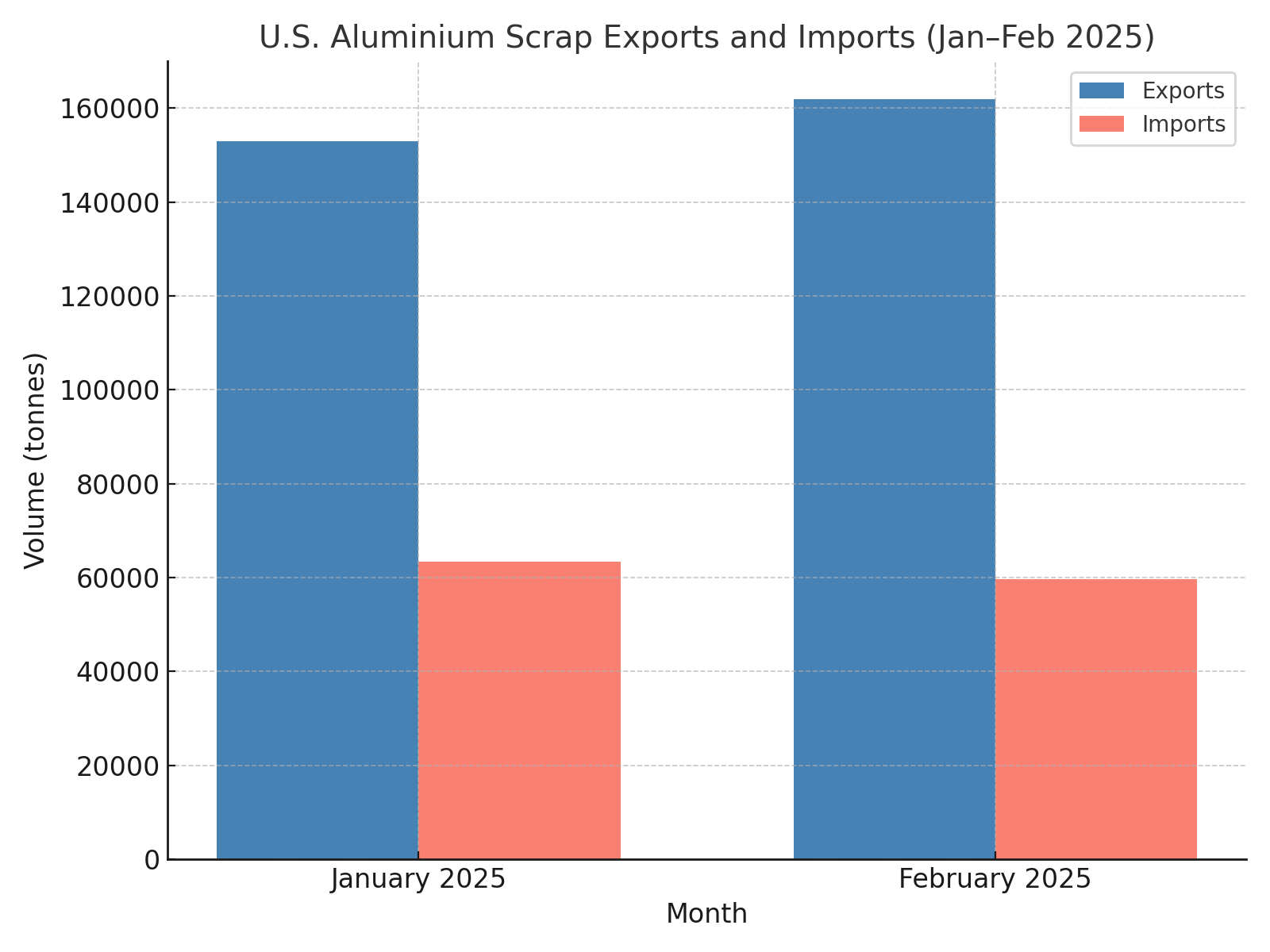

In February 2025, the United States recorded a 5.88 per cent month-on-month increase in aluminium scrap exports, reaching 162,000 tonnes compared to 153,000 tonnes in January, according to data published by the US Geological Survey (USGS). In contrast, aluminium scrap imports declined by 5.84 per cent month-on-month to 59,700 tonnes, down from 63,400 tonnes in the previous month.

On a year-over-year basis, both exports and imports demonstrated upward trends. Aluminium scrap exports rose by 2.53 per cent from 158,000 tonnes in February 2024, while imports surged by 24.8 per cent from 50,800 tonnes.

The uptick in export volume was likely driven by increased domestic aluminium scrap recovery, which totalled 321,000 tonnes in February, marking an 8 per cent rise from 297,000 tonnes in January. Of the total recovered volume, 50.46 per cent was exported. The remaining 159,000 tonnes constituted domestic inventory, compared to 144,000 tonnes held after exports in the previous month.

Mitigating trade imbalance with scrap recovery

The month-on-month increase in residual aluminium scrap retained in the domestic market post-export represented a strategic advantage for the United States, particularly in light of the impending 25 per cent import tariff on aluminium effective from March 12, 2025. This buffer in domestic supply might have helped mitigate the impact of reduced import volumes and supported continued industrial demand amid tightening trade conditions.

Events

Events

e-Magazines

e-Magazines

Reports

Reports

Responses