您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Figures of the Union commerce and industry ministry indicated that aluminium exports from the country increased by 36 per cent in 2017-18, aided by global demand, which outstripped supply.

The declaration of US tariffs on aluminium and steel imports from most of the countries, a 21 per cent growth in aluminium prices on the London Metal Exchange (LME) to an average of $2,045 per tonne and over-supply to the domestic market helped exports to rise in the last financial year. The trend is expected to continue in 2018-19, because of the US sanctions on UC Rusal, one of the largest producers in April, which drove panic buying among aluminium buyers and lifted LME price and premiums to a height. This will also be driven by the trade tensions between the US and China. Aluminium prices were also strengthened by a rise in input costs as prices of raw materials like alumina, caustic soda, petroleum coke and coal tar pitch shot up during the period.

{alcircleadd}

According to the ministry figures in terms of volume, unwrought aluminium (alloyed and non-alloyed) exports rose from 1.22 million tonnes at the end of 2016-17 to 1.66 million tonnes in 2017-18, registering a rise of 36%. In terms of value the total export value stood at USD 3.54 billion compared to USD 2.1 million in 2016-2017. India exported about 1.37 million tonnes of non-alloyed aluminium and 293,000 tonnes of aluminium alloys .

In the same period, imports of unwrought aluminium (alloyed and non-alloyed) dropped by 14.7% to 360,000 tonnes from 422,000 tonnes in 2016-17. India imported about 276,711tonnes of aluminium alloys and 84,135 tonnes of non-alloyed aluminium. Aluminium Scrap import increased to 1.1 million tonnes in 2017-18 from 931,279 tonnes in 2016-17. India exported about 4,852 tonnes of scrap in 2017-18.

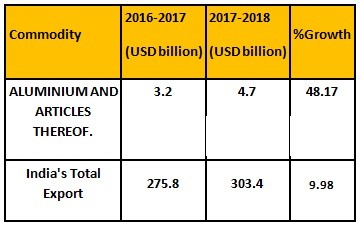

The value of total aluminium and aluminium products export stood at 4.7 billion compared to 3.2 billion in 2016-17.

The data shows that South Korea accounted for the largest export of Indian aluminium products (31%), followed by Malaysia (30 per cent) and the US (11 per cent).

India's production of primary aluminium grew 21 per cent year-on- in the last financial year to reach 3.3 million tonnes, the second largest producer of ex-China world after Russia. Domestic consumption stood at 2.08 million tonnes. Production is expected to be about 3.4 million tonnes in 2018-19.

The rise in aluminium production was driven by better operational efficiencies, capacity ramp up and optimum capacity utilisation.

Responses