您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

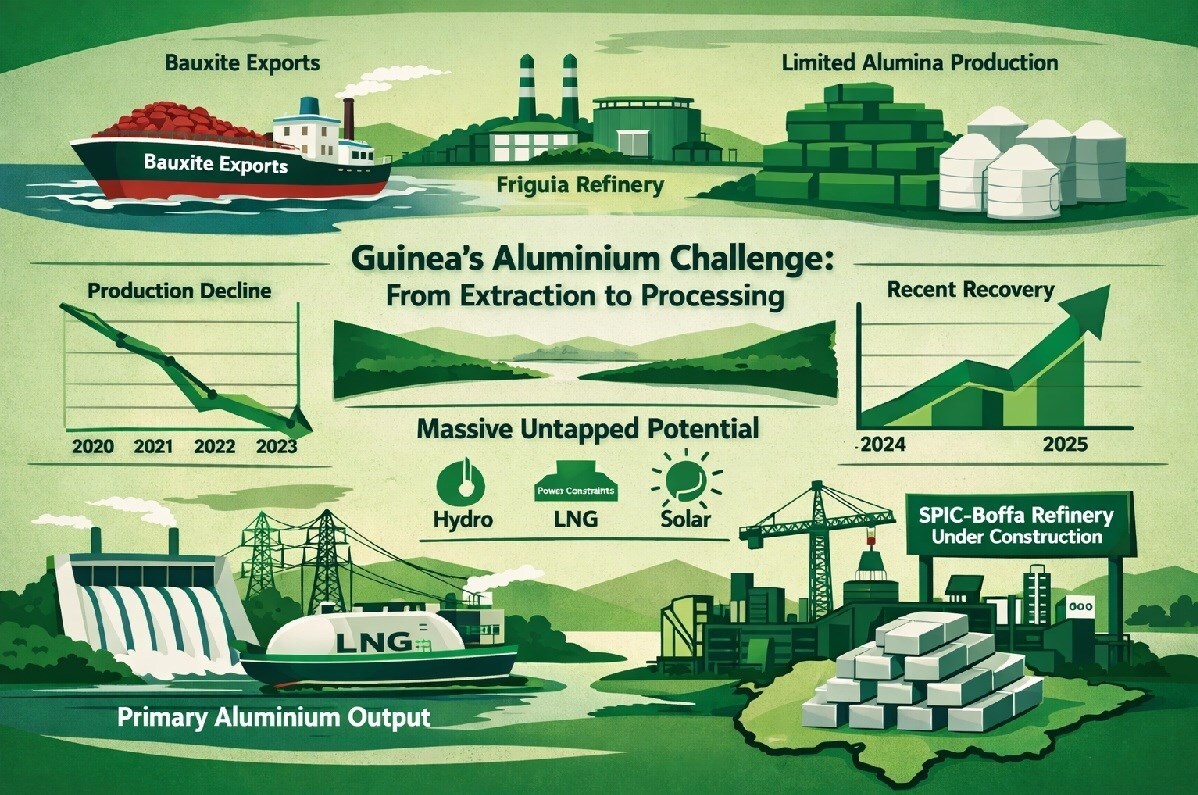

Ships leave Guinea’s ports every day loaded with bauxite destined for refineries thousands of miles away, while only a fraction of that ore is ever transformed at home. This contrast captures the essence of Africa’s aluminium story - a sector - rich in resources, steady in operations, yet still waiting for its value chain to come together.

{alcircleadd}Over the past five years, Africa’s alumina capacity has remained unchanged at 0.65 million tonnes, while production has followed a clear cycle of decline and recovery. Output eased from 0.439 million tonnes in 2020 to 0.414 million tonnes in 2021, reflecting a 5.7 per cent year-on-year decline. The downturn intensified in 2022, when production fell to 0.340 million tonnes, a sharper 17.9 per cent contraction from the previous year.

The decline extended into 2023, with output slipping further to 0.273 million tonnes, representing a 19.7 per cent year-on-year fall and marking the low point of the cycle. A recovery became visible in 2024, as alumina production rebounded to 0.338 million tonnes, an increase of 23.8 per cent from the prior year’s trough. Entering 2025, output is expected to improve modestly to 0.350 million tonnes, translating into a further 3.6 per cent year-on-year increase, though production remains well below installed capacity.

To know more about the global primary aluminium industry 2026 outlook, pre-book the report “Global Aluminium Industry Outlook 2026” at a special price.

Responses