您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

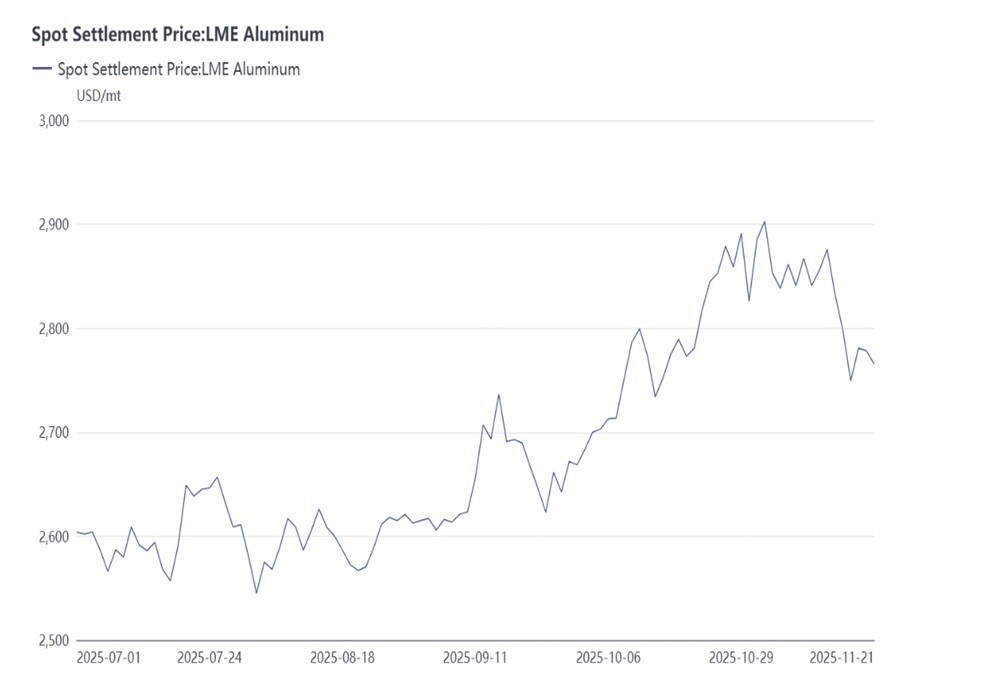

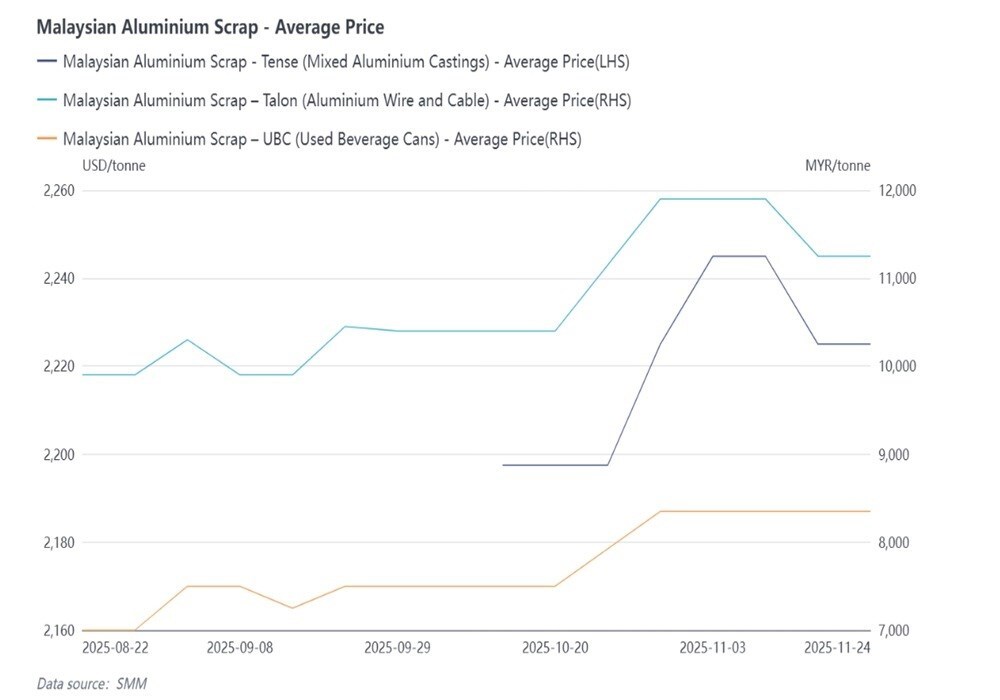

Since the LME aluminium price began its upward trend in October 2025, SMM research shows that the trading volume of scrap aluminium and recycled aluminium alloys in Southeast Asia, especially Thailand and Malaysia, has declined due to factors such as rising aluminium prices and natural disasters. From October 1st to 31st, LME aluminium prices climbed from USD 2683.5 per tonne to USD 2885 per tonne, and fluctuated between USD 2840 - USD 2875 per tonne for most of November, before falling back to USD 2749.5 per tonne at the end of the month. Although Southeast Asian scrap aluminium prices are not directly linked to LME prices, their trends are still mainly influenced by LME price fluctuations. Therefore, scrap aluminium prices in Thailand and Malaysia also rose in tandem during October and November. According to SMM survey data:

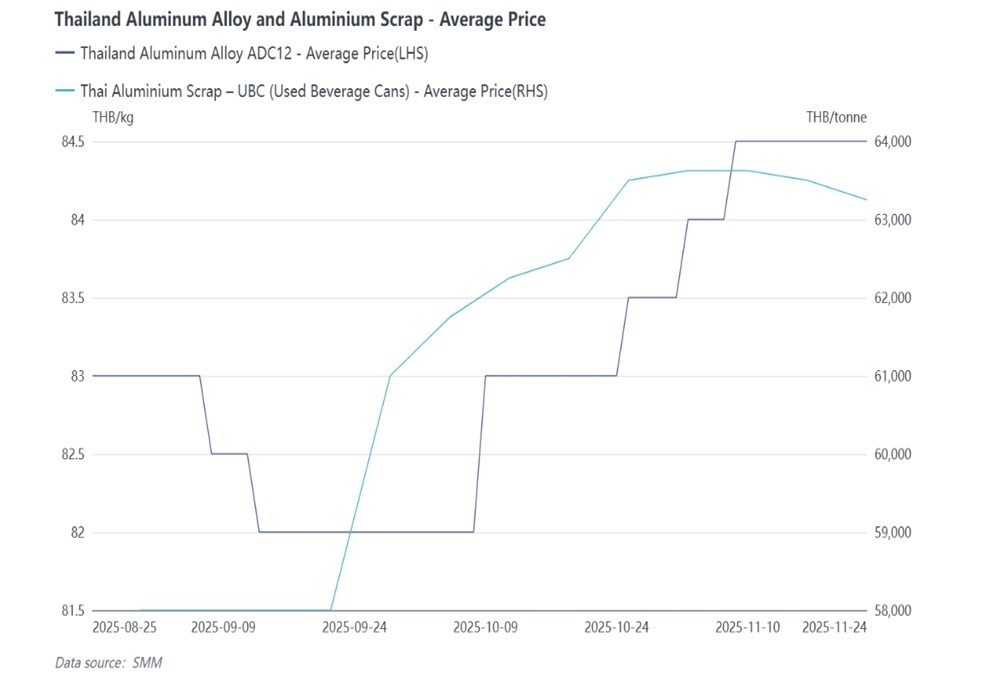

During the same period, the price of recycled aluminium alloy ingots in Southeast Asia also showed a similar trend. SMM research shows that the price of ADC12 in Thailand gradually increased from 82 baht per kg in early October to 83 baht per kg, and then steadily climbed to 84.5 baht per kg between October and November. The rising price of scrap aluminium has increased the cost of recycled aluminium alloys such as ADC12, leading downstream companies in Thailand and Malaysia, especially automobile manufacturers, to reduce their purchases of raw materials such as ADC12. As a result, some ADC12 producers are facing sales pressure and have had to reduce or halt production.

Meanwhile, local scrap aluminium traders began to follow their EU counterparts in adopting a stockpiling strategy, hoping to profit from rising aluminium prices in 2026 when the EU's Carbon Border Adjustment Mechanism (CBAM) and scrap aluminium export tariffs drive up prices. Although LME aluminium prices saw a significant correction at the end of November, the continuous heavy rainfall brought by the northeast monsoon caused flooding in many parts of Thailand and Malaysia, severely restricting and even delaying trading activities in scrap aluminium and recycled aluminium alloys. Looking ahead, SMM expects trading volume in Southeast Asia to see a slight rebound in December 2025, but overall it will still be significantly constrained by LME aluminium price fluctuations. More traders may be inclined to continue stockpiling in anticipation of rising aluminium prices in 2026, while buyers will maintain reduced or suspended production due to sluggish trading in both upstream and downstream sectors. With the formal implementation of the EU CBAM policy in 2026, scrap aluminium, due to its low-carbon properties, is expected to return to high-frequency trading, but global export restrictions and conservative trade policies in Europe and the US may bring uncertainty to overall import and export opportunities.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses