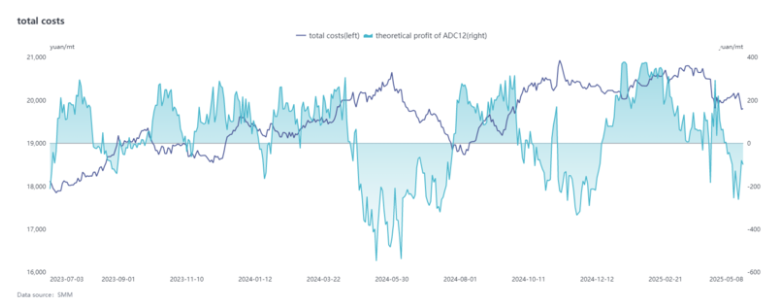

Impacted by the US reciprocal tariff, the most-traded SHFE aluminium contract began a sharp decline from above the RMB 20,000 threshold in early April, and then continued to oscillate within the range of RMB 19,000-20,000 per tonne. In April (calendar month), the SMM average spot aluminium price was recorded at RMB 19,952 per tonne, down 3.8 per cent M-o-M from the previous month. The price of ADC12 continued its downward trend from March, with the average price in April falling 2.5 per cent M-o-M. As of May 9, the SMM ADC12 quote fell RMB 700 per tonne MoM to RMB 20,200-20,400 per tonne.

On the cost side, at the beginning of the month, influenced by the correction of bulk commodities, the prices of raw materials such as aluminium scrap, copper, and silicon declined, driving down the overall cost of ADC12 and slightly improving the industry's theoretical profitability. However, in the latter part of the month, as trade tensions eased, the rebound in aluminium scrap and copper prices led to an overall increase in raw material costs. Although silicon prices continued to decline, constrained by the struggle to rise in the prices of alloy ingot finished products, the industry's profit margins narrowed again and gradually turned into losses.

Demand side, consumer demand remains weak, with the traditional peak seasons of "Golden March, Silver April" both failing to meet expectations. Orders from downstream buyers have weakened, and end-users have maintained a just-in-time purchasing rhythm. Moreover, fluctuations in aluminium prices have intensified market sentiment of wait-and-see. Additionally, the US tariff policy has suppressed orders for export-oriented die-casting enterprises, with some die-casting factories experiencing a 50 per cent or even greater decline in orders. The sustained pressure on the demand side has led to a significant price drop for ADC12 in April.

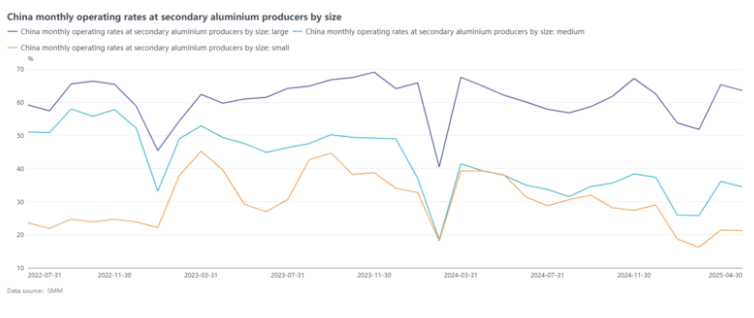

In terms of supply, the operating rate of the secondary aluminium alloy industry dropped back slightly by 1.58 percentage points MoM from March to 53.49 per cent in April, and declined by 3.52 per cent Y-o-Y. In April, domestic and overseas demand for secondary aluminium downstream products both contracted, leading to a reduction in orders for secondary aluminium plants. At the same time, intense low-price competition among enterprises exacerbated the situation, with the price of finished products falling more than the cost of raw materials, compressing profit margins. As a result, some enterprises were forced to cut production due to losses. Constrained by weak demand and cost pressure, the operating rate of secondary aluminium plants declined week by week in April. Enterprises alleviated inventory pressure through production cuts, leading to an overall contraction in industry supply. Entering May, the supply of raw materials in the market tightened, coupled with the increasingly pronounced effect of the off-season demand, the operating rate of the secondary aluminium industry is expected to continue to decline in May.

In May, as the circulation of aluminium scrap tightened compared to the previous period, its price resilience became prominent, and the cost side provided stronger support for the price of ADC12. However, the demand side found it difficult to achieve a substantive recovery amid the approaching traditional off-season and tariff policy pressures, constraining the upside room for ADC12 prices. The low operating rate pattern at the supply side will continue, coupled with the lingering trade policy risks on the macro front. It is expected that the price of secondary aluminium alloy will remain in the doldrums in the short term. Close attention should be paid to the fluctuations in raw material prices, changes in end-use consumption, and the transmission effect of tariff policies on export orders.

Responses