Driven by the September peak season, primary alloy saw active production scheduling, sustained domestic demand recovery, and significant inventory drawdowns, though enterprises remained cautious about capacity expansion. Secondary alloy benefited from resilient downstream automotive demand, with large plants maintaining high operating rates; although small and medium-sized enterprises were constrained by raw materials and costs, low inventory provided support for the future.

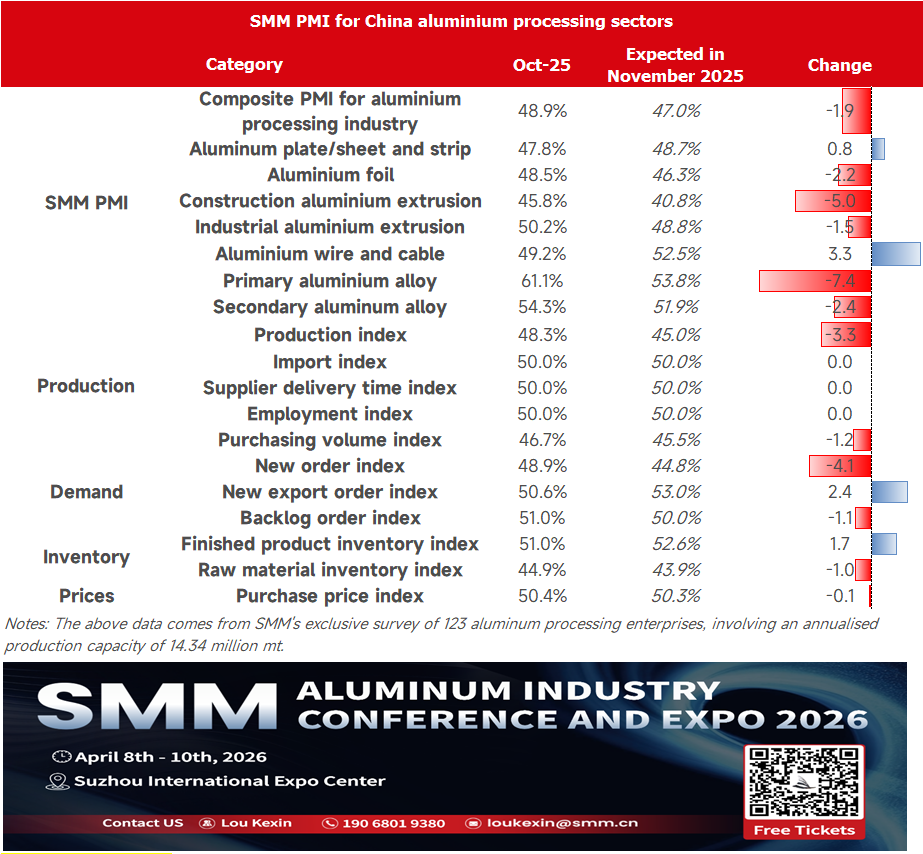

In October, the aluminium processing composite PMI fell 6.8 per cent points m-o-m to 48.9 per cent, dropping below the 50 mark. PMIs for most aluminium processing sectors declined significantly into contraction territory, mainly due to weakening end-use demand and high aluminium prices suppressing activity.

Primary alloy: In October, the primary aluminium alloy PMI reached 61.1 per cent, up 1.4 percentage points m-o-m from September, indicating a continued recovery in the industry. Sub-index analysis shows the production index surged to 74.1 per cent, while the new orders index rose to 68.8 per cent, reflecting active production scheduling by enterprises and sustained recovery in domestic demand against the backdrop of the September peak season. New export orders remained at the 50 mark, indicating stable external demand.

Notably, the finished product inventory index pulled back to 39.6 per cent. Combined with the purchasing volume index of 58.3 per cent, this suggests effective inventory reduction by enterprises and a more positive stockpiling sentiment. Although auxiliary indicators such as the import index and purchase prices remained at the 50 per cent threshold, the overall structure demonstrated active production and smooth inventory reduction.

However, the raw material inventory index held steady at 50.0 per cent, indicating that enterprises remain cautious about expanding production. Against a backdrop of weakened support from previous liquid aluminium conversion and persistent pressure from high aluminium prices, the industry has entered the traditional peak season, but cost-side pressures remain, and the foundation for overall improvement is not yet solid.

Looking ahead, as the industry enters the off-season in November, the PMI is expected to pull back slightly but remain above the 50 mark.

Secondary alloy: In October, the secondary aluminium industry PMI fell 6.9 percentage points M-o-M to 54.3 per cent, but remained above the 50 mark. Demand side, orders from downstream sectors such as automotive remained stable with a positive trend. Although the increase was limited, overall demand showed strong resilience. Supply side, the operating rate varied significantly among enterprises.

Some, especially large manufacturers, maintained high operating rates, but small and medium-sized enterprises faced multiple constraints: ① Holiday effect: The National Day holiday shortened effective production time; ② Raw material bottleneck: Tight market supply kept enterprise inventories persistently low, making restocking difficult and limiting capacity release; ③ Cost pressure: High raw material prices squeezed profits, and weak finished product price increases forced enterprises to proactively cut production; ④ Policy disruptions: Some enterprises in Henan, Jiangxi, and other regions continued production cuts or suspensions due to policy uncertainty; ⑤ Environmental constraints: Environmental protection warnings in Hebei and other regions triggered localized production restrictions by month-end. Inventory side, both raw material and finished product inventories remained at low levels.

Looking ahead to November, expectations of a push for annual targets by end-users at year-end are expected to boost secondary aluminium demand. Coupled with support from low inventory levels, the industry PMI is likely to maintain its expansion trend.

The PMI for the aluminium processing industry in October was recorded at 48.9 per cent, as the October peak season fell short of expectations and re-entered contraction territory. This was mainly due to factors such as aluminium prices fluctuating at highs, weak construction demand, and weakening export momentum. Looking ahead to November, the industry is expected to continue its divergent pattern, with the composite PMI likely to decline further to 47.0 per cent. From the perspective of core influencing factors:

- On the demand side, the transition from the peak to off-season, coupled with falling temperatures in northern regions, has led to persistently weak demand in construction and some industrial sectors.

- On the cost side, aluminium prices fluctuating at highs have suppressed downstream purchase willingness, squeezing enterprise profit margins.

- On the structural side, demand in areas such as new energy and automobiles remains relatively stable, providing important support for certain products.

Moving forward, close attention should be paid to the impact of aluminium price trends on downstream cargo pick-up sentiment and the marginal improvement in end-use demand.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses