India's secondary aluminium market saw an increase in prices in April 2025, driven by rising demand and persistent shortage in raw material availability. This supply-demand imbalance pushed alloyed ingot prices higher, particularly in the northern and southern parts of the country.

Meanwhile, despite the shortage in scrap availability, aluminium scrap prices saw a minor correction aligning with LME aluminium prices. However, the prices were still on the higher side amid supply concerns and had not corrected as much as buyers expected.

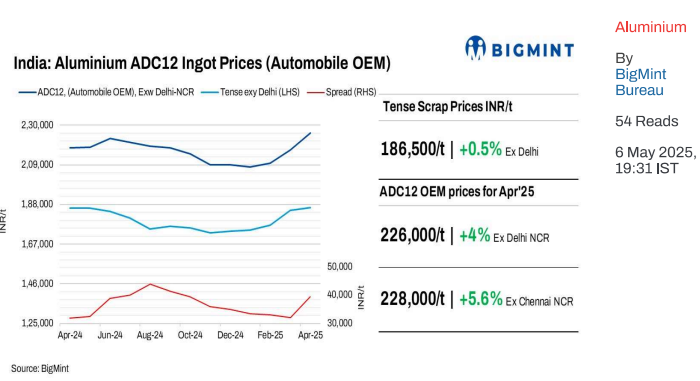

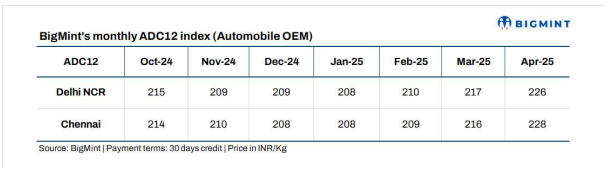

BigMint's last assessment for April for OEM-approved ADC12 in Delhi was at INR 226,000 per tonne and in Chennai at INR 228,000 per tonne, an increase of up to INR 12,000 per tonne m-o-m from March settlement levels.

India's largest automaker announced in May settlement prices for ADC12 which increased by INR 2,600 per tonne to INR 220,900 per tonne, driven by firm imported and domestic alluminium scrap prices amid shortages.

Consequently, the scrap-to-semi-finished spread narrowed by INR 3,420 per tonne M-o-M to INR 28,000-29,000 per tonne from previous month's INR 31,000-32,000 per tonne.

An alloy ingot producer said, "Suppliers are not willing to supply material below INR 230,000 per tonne due to the persistent shortage in scrap grades required for making ADC12. Despite the drop in LME aluminium levels, scrap prices have remained firm."

As per market feedback from north and south India, the offer levels for ADC12 (automobile OEM approved) grade stood between INR 233,000-236,000 per tonne. However, the OEMs in the north have been negotiating between INR 228,000-230,000 per tonne and in the south these are between INR 230,000-232,000 per tonne for May settlements.

An OEM from the southern region informed, "Sellers are quoting up to INR 236,000 per tonne for ADC12, with 30-day payment terms. But most negotiations are centered around INR 230,000232,000 per tonne, with many OEMs aiming to finalise purchases at no more than INR 232,000 per tonne for the month."

Inquiries for imported ADC12 from Malaysia and the UAE were reported, but deals could not be finalised due to BIS certification issues. Despite the FTA with Malaysia, which could offer cost advantage to OEMs and alloy makers, the lack of BIS approval has prevented imports. As a result, most market participants have refrained from pursuing import offers this month. Some suppliers are in the process of applying for certification to resolve the issue.

On 18 March BIS raided an aluminium alloy ingot manufacturer in Tamil Nadu's SIPCOT Industrial Park, Sriperumbudur, for suspected violations of the BIS Act, 2016, and the Aluminium Alloys Quality Control Order, 2023. The manufacturer was found producing and selling ingots without the required ISI mark and valid BIS licences.

Following this incident, most alloy makers have become wary about importing material without BIS certification.

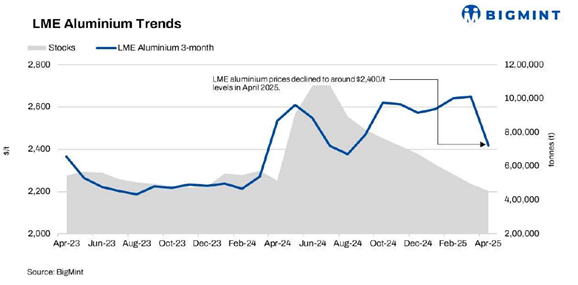

Imported aluminium scrap prices saw a slight dip in April, driven by a downtrend in futures. US-origin Tense scrap tags inched down by $30 per tonne to $1,900-1910 per tonne, while UK-origin Wheels dropped by $100 per tonne to $2,405 per tonne. Meanwhile, on London Metal Exchange (LME) three-month aluminium prices decreased notably by around 9 per cent, settling at $2,405 per tonne in April.

BigMint's assessment of Tense in Delhi was at INR 186,500 per tonne, and Chennai at 187,500 per tonne -- range-bound m-o-m. China-origin silicon 553 prices hovered at $1,420-1,430 per tonne CFR Mundra, down $20 per tonne M-o-M in April.

Despite the drop in scrap prices, domestic market sentiment remained strong driven by rise in May alloy ingot settlement prices announced by major automobile manufacturers and shortage of raw material like tense and taint tabor scrap in the domestic market.

Scrap imports rise, ingot imports fall in Mar'25

Aluminium scrap imports increased 20 per cent M-o-M to 144,500 tonnes in March 2025. Tense imports increased 27 per cent M-o-M to 19,000 tonne, while Taint Tabor was up by 32 per cent M-o-M to 35,500 tonnes.

In contrast, imports of key grades of semi-finished ingots like A356 decreased 18 per cent m-o-m while ADC12 and LM 24 volumes were at almost nil.

Automotive sector performance

India's vehicle retail sales rose by 7.6 per cent m-o-m in April to 22.87 lakh units, and 3 per cent Y-o-Y, according to FADA. Two-wheeler sales grew 11.84 per cent from March and 2.25 per cent from April 2024, reaching 16.86 lakh units. However, commercial vehicle sales dropped 4.44 per cent from March and 1.05 per cent Y-o-Y to 90,558 units. In March, overall retail sales fell 0.7 per cent Y-o-Y but were up 12 per cent from February. For FY'25, sales rose by 6.46 per cent, with rural markets outperforming urban ones.

In April, Maruti Suzuki India reported total sales of 179,791 units, reflecting consistent performance. This total comprises 142,053 units sold in the domestic market, 9,827 units delivered to other OEMs, and 27,911 units exported.

Outlook -- prices likely to firm up

The ADC12 alloy market is set for a short-term rise, driven by constrained availability of essential raw materials and price increases announced by major automakers for May settlements. Persistent scrap supply shortages and rising input costs are expected to further support this upward price trend.

Note: This article has been issued by BigMint and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses