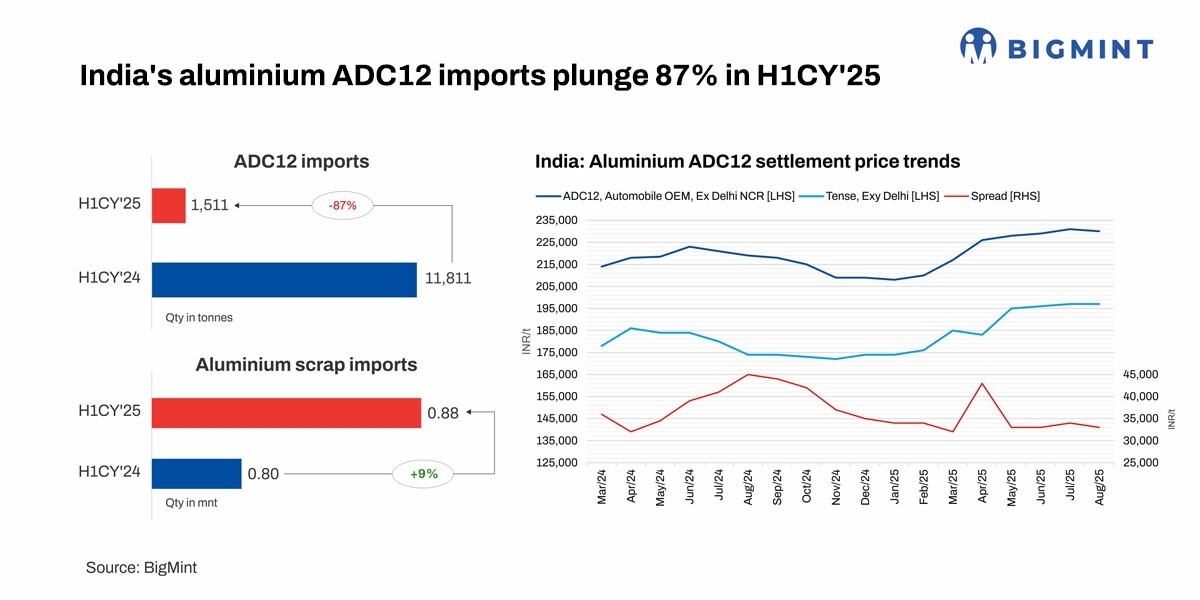

India's ADC12 alloy imports saw a sharp downturn in imports during H1CY'25, with volumes slumping 87 percent to 1,511 tonnes (t) from 11,811 t in H1CY'24.

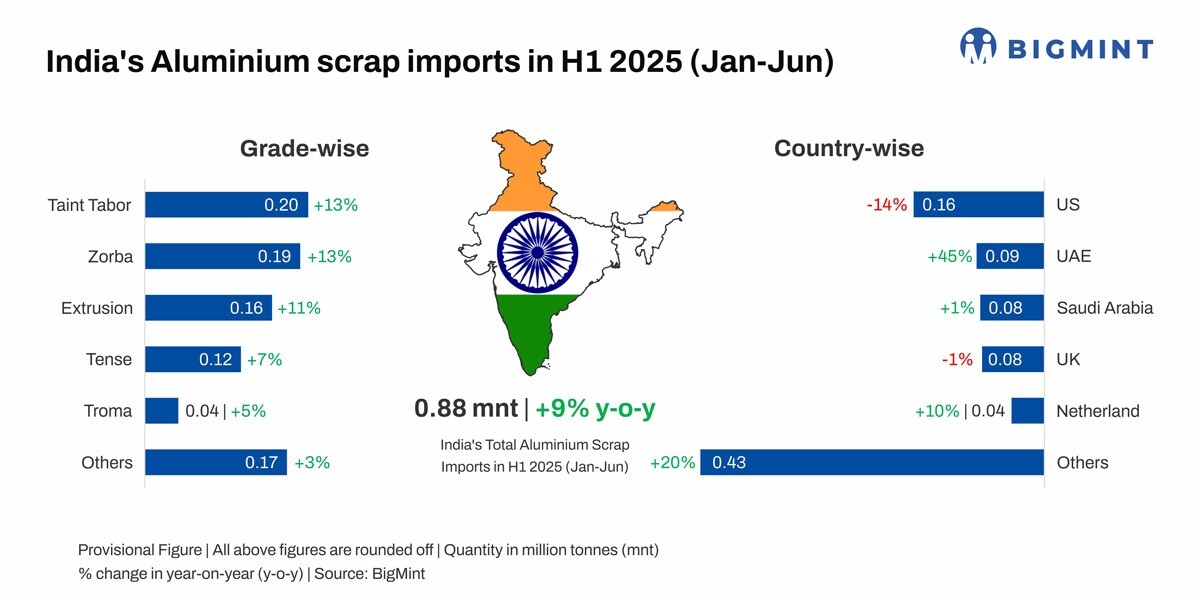

Instead, aluminium scrap imports swelled by 9 percent y-o-y to 0.88 million tonnes (mnt) in H1CY'25 from 0.81 mnt in H1CY'24. This growth was largely due to India compensating for the steep reduction in ADC12 alloy imports.

BigMint goes behind the scenes.

Why did ADC12 alloy imports plummet in H1CY'25?

Malaysia, historically India's leading source of ADC12 alloy products, recorded a sharp drop in shipments during H1CY'25. This was the primary contributor to the significantly lower ADC12 imports in H1CY'25.

Imports fell by 87 percent to 1,188 t, compared to 9,417 t in H1CY'24. The decline was primarily attributed to delays in obtaining Bureau of Indian Standards (BIS) certification, despite the presence of a free trade agreement (FTA) between the two countries.

Although several Malaysian producers had applied for BIS approval, they faced a protracted and stringent certification process, which significantly disrupted trade flows. All shipments from Malaysia during this period were directed exclusively to southern India due to regional proximity and exporters' strong ties with local buyers.

Why did aluminium scrap imports rise?

Due to lower imports of ADC12, a supply crunch emerged in the Indian aluminium scrap market. Consequently, India's scrap inflows increased, though demand remained higher than supply, leading to a persistent raw material tightness for domestic ADC12 manufacturers.

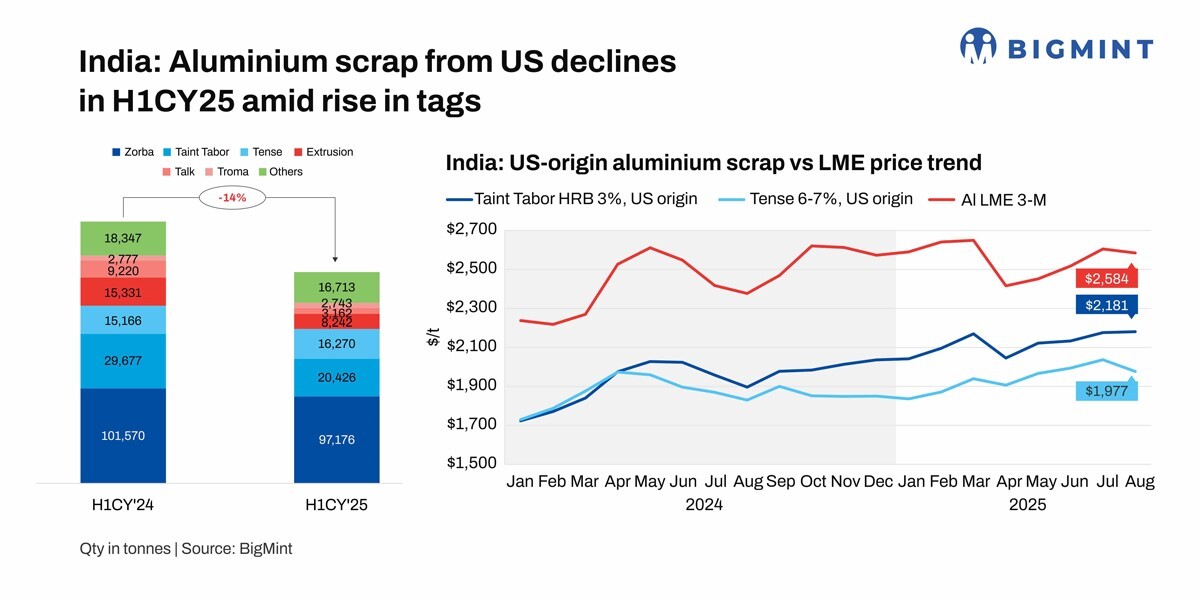

Notably, exports from the US, one of the leading suppliers to India, fell 14 percent y-o-y in H1CY'25, to 164,733 t from 192,088 t in H1CY'24. Concurrently, shipments increased from the Middle East (+18 percent ), Europe (+14 percent ), Asia (+46 percent ), and Oceania (+14 percent). Indian buyers likely procured more volumes from these regions as US cargo availability grew scarce.

The contraction in US exports follows the Trump administration's imposition and subsequent doubling of tariffs on steel and aluminium imports, initially set at 25 percent in March and later raised to 50 percent in early June.

The US began to consume more domestic scrap due to a 13 percent drop in finished aluminium imports, which fell to 0.80 mnt from 0.92 mnt in H1CY'25. As a result, US markets absorbed more domestic scrap, reducing export volumes.

The combination of rising local demand and more attractive domestic pricing significantly limited scrap availability for key export destinations, including India.

Despite a broader increase in India's overall aluminium scrap imports, shipments of key US-origin grades dropped notably in H1CY'25, reflecting the ongoing impact of evolving US trade policy.

Aluminium imported scrap prices remained firm through H1CY25, tracking strength on the LME and aligning with higher imported scrap prices. However, August saw a price correction amid uncertainties surrounding potential US tariff changes.

Domestic ADC12 tags firm up on supply crunch

India's ADC12 alloy prices strengthened through H1CY'25, supported by declining imports and persistent raw material tightness. According to BigMint data, Delhi NCR prices in June stood at INR 229,000/t -- a sharp rise of INR 21,000/t from INR 208,000/t in January. In Chennai, prices rose by INR 23,000/t over the same period, settling at INR 231,000/t.

The price spread between ADC12 and aluminium tense scrap remained steady at INR 32,000-34,000/t across both regions amid sustained cost pressures amid constrained scrap availability.

As per BigMint's July 2025 assessment, ADC12 prices in both northern and southern India held firm m-o-m at INR 231,000/t in Delhi and INR 233,500/t in Chennai, supported by steady scrap prices.

A leading Indian automaker increased its ADC12 settlement prices by INR 18,750/t from INR 208,000/t in January to INR 226,750/t in June. The upward trend continued in July, with contracts settling at INR 228,900/t, and in August, with prices at INR 229,750/t.

Market participants expect further hikes in September as spot prices remain above contract levels. Scrap shortages are likely to persist into H2CY'25, maintaining pressure on ADC12 availability and pricing.

Inventory crunch fuels scrap price surge

Global aluminium scrap prices surged in H1CY'25, driven by robust demand and a sharp decline in London Metal Exchange (LME) stockpiles. The average LME aluminium price rose to $2,544/t from $2,402/t in H1CY'24, while inventories dropped significantly by 32 percent, from 695,364 t to 474,091 t.

Reflecting this global trend, India also witnessed a notable rise in aluminium scrap prices -- both imported and domestic -- during the same period, aligned with the broader uptrend in LME prices.

Outlook

Looking ahead to H2CY'25, ADC12 imports are expected to increase as several Malaysian alloy ingot producers have reportedly received BIS certification. Sources indicate that three to four major Malaysian players have already secured approval, with more producers gradually being certified. This is likely to improve the availability of ADC12 imports in India in the coming weeks. Additionally, Indian buyers have shown renewed interest in sourcing ADC12 from the UAE, reflecting a broader effort to diversify import origins.

However, a significant price correction is unlikely. With the Indian festival season approaching, domestic demand is expected to remain strong, which should help support current prices despite the anticipated rise in supply.

Also read our report on recycled aluminium on: https://www.alcircle.com/specialreport/1348/world-recycled-aluminium-market-analysis-industry-forecast

Responses