India's imported aluminium scrap prices declined by USD 30-40 per tonne W-o-W, primarily due to a downward trend in London Metal Exchange (LME) prices. Despite strong demand and ongoing supply constraints, prices continued to fall as subdued trading activity during the festive week limited any significant gains.

Price assessments

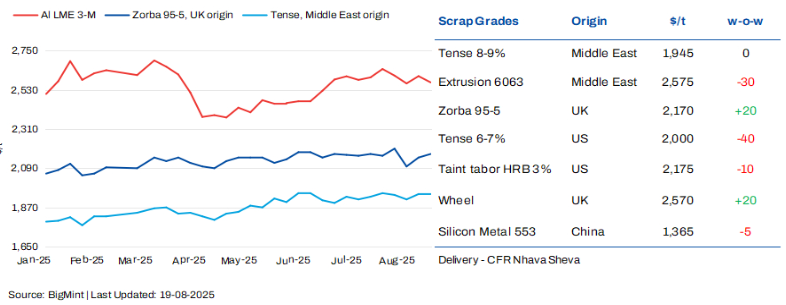

BigMint assessed Tense scrap from the US at USD 2,000 per tonne, down by USD 40 per tonne W-o-W, while US taint tabor HRB (2-3 per cent) saw a drop of USD 10 per tonne, settling at USD 2,175 per tonne. Meanwhile, Zorba 95/5 witnessed a slight gain of USD 20 per tonne W-o-W and extrusion from the UAE witnessed a reduction of USD 30 per tonne W-o-W.

LME prices down w-o-w amid inventory inflows

At the time of reporting, LME aluminium prices stood at USD 2,572 per tonne, down by USD 35 per tonne W-o-W as compared to USD 2,607 per tonne last week.

Meanwhile, aluminium inventories at registered warehouses increased by 1 per cent, rising to 479,525 tonnes from 477,100 tonnes the previous week, adding further pressure on LME prices.

Market insights

Aluminium scrap prices underwent a correction during the week, but the decline was not as steep as buyers had anticipated. Supplier offer levels remained firm, and bid-offer discrepancies were observed across certain grades.

Scrap grades originating from the UAE remained firm, supported by strong domestic market sentiment and a prevailing scrap shortage within the country. This shortage also kept export offers to India at elevated levels. Demand for UAE-origin Tense scrap remained strong, driven primarily by limited scrap arrivals from the US.

According to market participants in the UAE, a significant portion of domestic scrap has been exported to India due to robust demand. Indian buyers, particularly those based in the western region, have increased imports from the UAE, benefiting from shorter transit times and reliable supply.

On the other hand, domestic Tense scrap prices were stable w-o-w, with ex-Delhi at INR 197,000 per tonne and ex-Chennai at INR 200,000 per tonne, backed by consistent demand and tight availability.

In the semi-finished segment, ADC12 prices remain firm across both northern and southern regions, supported by strong domestic and imported scrap prices. Ongoing raw material shortages are likely to add further pressure, driving prices higher across regions.

To get live market update from industry expert, watch our upcoming webinar.

Note: This article has been issued by Bigmint and has been published by AL Circle with its original information without any modifications or edits to the core information.

Responses