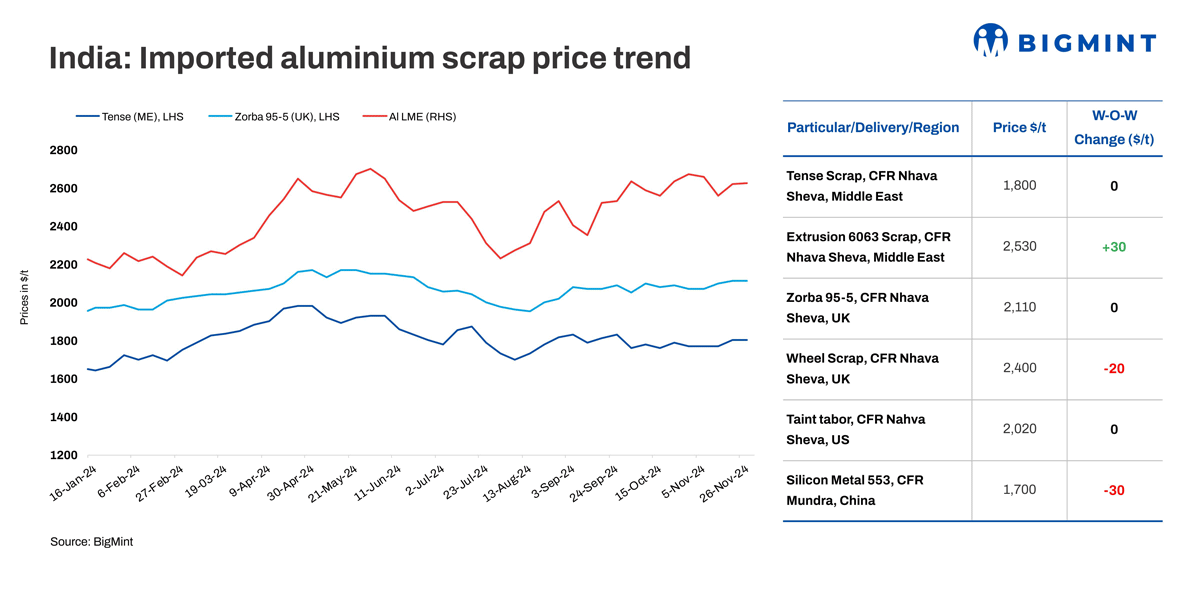

Imported aluminium scrap prices in India remained firm, with few grades edging lower by up to 1.5 per cent w-o-w. BigMint's benchmark assessment for tense scrap originating from the UAE stood at $1,800/tonne (t), firm w-o-w, while zorba 95/5 from the UK stood at $2,110/t, stable w-o-w, both prices CFR west coast, India.

Last week, aluminium prices surged following the Chinese finance ministry's announcement about eliminating export tax rebates on aluminium and copper semi-finished products. Effective 1 December 2024, the rebate will drop from 13 per cent to nil. This news drove London Metal Exchange (LME) aluminium prices to a six-month high of over $2,700/t.

However, prices have since retreated to around $2,600/t as the initial rally cooled, with market participants adjusting to the upcoming policy changes and focusing on current demand dynamics.

At the time of reporting, three-month aluminium futures on the LME stood at $2,623/t, down marginally by 1 per cent compared to the previous week's levels of around $2,640/t. Meanwhile, stocks at LME-registered warehouses stood at 706,000 t, falling by 1 per cent w-o-w from 713,900 t.

In the Middle East (ME), aluminium demand, particularly for Taint Tabor and Tense scrap, has increased due to the emergence of new recyclers and rolling mills. These developments are expected to support price growth in the near term. Domestic demand for Taint Tabor and Tense in exporting regions has also tightened supply, pushing export offers higher.

Meanwhile, sources highlighted that rolling mill items such as Taint Tabor performed well this week, supported by strong demand. However, the alloy market remains sluggish, reflecting weaker activity and subdued interest in this segment.

A recent deal for clean extrusion scrap was reported at $2,550/t CIF Nhava Sheva, indicating robust interest in the segment despite fluctuating global prices.

A prominent market player highlighted another emerging trend, "Thailand and Malaysia are emerging as a lucrative market for aluminium Zorba, offering realisations that are $60-70 higher compared to India. This price advantage, along with better freight benefits, is driving global sellers to prioritise trading Zorba with Thailand to maximise profits."

Domestic scrap prices stable

In the domestic market, tense scrap prices remained steady w-o-w in both Delhi and Chennai, while other grades witnessed a downtrend. According to BigMint's assessment, domestic tense scrap stood at INR 173,000/t ex-Delhi NCR and INR 174,000/t ex-Chennai.

China's silicon prices decline

According to BigMint's assessment, prices of China's 553-grade silicon dropped by $30/t w-o-w to $1,700/t CFR Mundra. Meanwhile, offers from the suppliers' side were at $1,750-1,770/t. However, bids were heard lower, at $1,670-1,680/t.

Outlook

Aluminium prices are expected to remain range-bound in the near term. With the onset of winter, supply from Western countries is likely to tighten, especially as the holiday season begins on December 15, leading to potential supply constraints. These seasonal factors may dampen trade activity, adding to market challenges.

Received under the content exchange agreement with BIGMINT

Top image credit: IndiaMART

Responses