您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

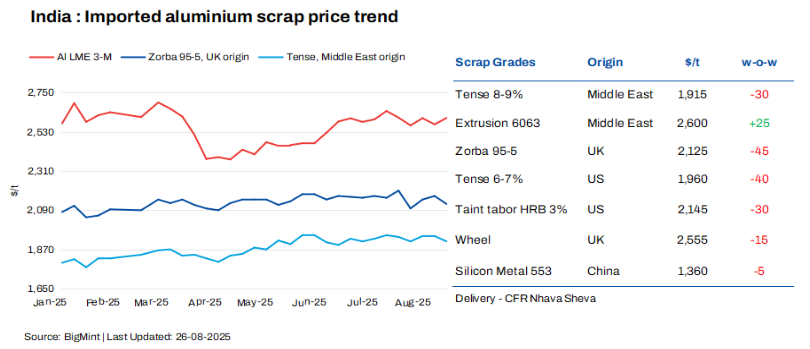

India's imported aluminium scrap prices declined by USD 40-45 per tonne W-o-W, despite an uptrend in London Metal Exchange (LME) prices. The overall aluminium scrap trade remained sluggish during the week, with limited buying interest across regions. Market participants highlighted cautious buying patterns.

Price assessments

BigMint assessed Tense scrap from the US at USD 1,960 per tonne, down by USD 40 per tonne W-o-W, while US taint tabor HRB (2-3 per cent) saw a drop of USD 30 per tonne, settling at USD 2,145 per tonne. Zorba 95/5 from the UK witnessed a reduction of USD 45 per tonne W-o-W. Meanwhile, extrusion 6063 witnessed a slight gain of USD 25 per tonne W-o-W.

LME prices rise W-o-W amid inventory outflows

At the time of reporting, LME aluminium prices stood at USD 2,608 per tonne, up by USD 36 per tonne W-o-W as compared to USD 2,572 per tonne last week.

Meanwhile, aluminium inventories at registered warehouses posted a marginal decline to 478,725 tonnes from 479,525 tonnes in the previous week.

Market insights

Aluminium scrap buying remained limited during the week, with cautious sentiment prevailing across regions. Market participants highlighted persistent challenges in procuring good-quality material.

Scrap grades originating from the UAE remained firm, supported by tight domestic availability. Export offers to India continued to stay on the higher side, further constraining buying activity. Meanwhile, Zorba was deemed unviable for the Indian market at present.

The Indian rupee continued to weaken, slipping for the fifth straight session to around INR 87.68 per USD, adding a currency-driven cost pressure for importers.

Market participants also pointed out that in some cases, attachments in UK-origin Taint Tabor and UK-origin Zorba deliveries were higher than indicated at the time of purchase, complicating procurement of quality material.

On the other hand, domestic Tense scrap prices edged lower by INR 1,000 per tonne W-o-W, with ex-Delhi at INR 196,000 per tonne and ex-Chennai at INR 199,000 per tonne amid improved scrap availability.

In the northern region of India, heavy rainfall dampened overall activity, adding to subdued trade volumes. Domestic Taint Tabor was assessed at INR 197,000-199,000 per tonne, while extrusion 6063 hovered in the range of INR 212,000-215,000 per tonne ex-Delhi.

In the semi-finished segment, ADC12 prices inched down m-o-m in August across both northern and southern regions, primarily due to a correction in scrap tags and hopes of an improvement in ADC12 imports.

BigMint's monthly assessment for the OEM grade of ADC12 stood at INR 230,000 per tonne in Delhi and INR 232,000 per tonne in Chennai.

Outlook

In the broader market, LME aluminium prices may find support as investors anticipate a potential US Fed rate cut following Chair Powell's dovish stance at Jackson Hole. A softer US dollar could improve sentiment for dollar-denominated metals, potentially leading to a slight uptick in LME aluminium and eventually lending support to scrap prices. However, policies and currency movements remain key factors to watch, keeping the outlook uncertain in the near term.

To get more insights into the aluminium recycling market, please read our report: World Recycled ALuminium Market Analysis Industry forecast to 2032 report

Note: This article has been issued by BIGMINT and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses