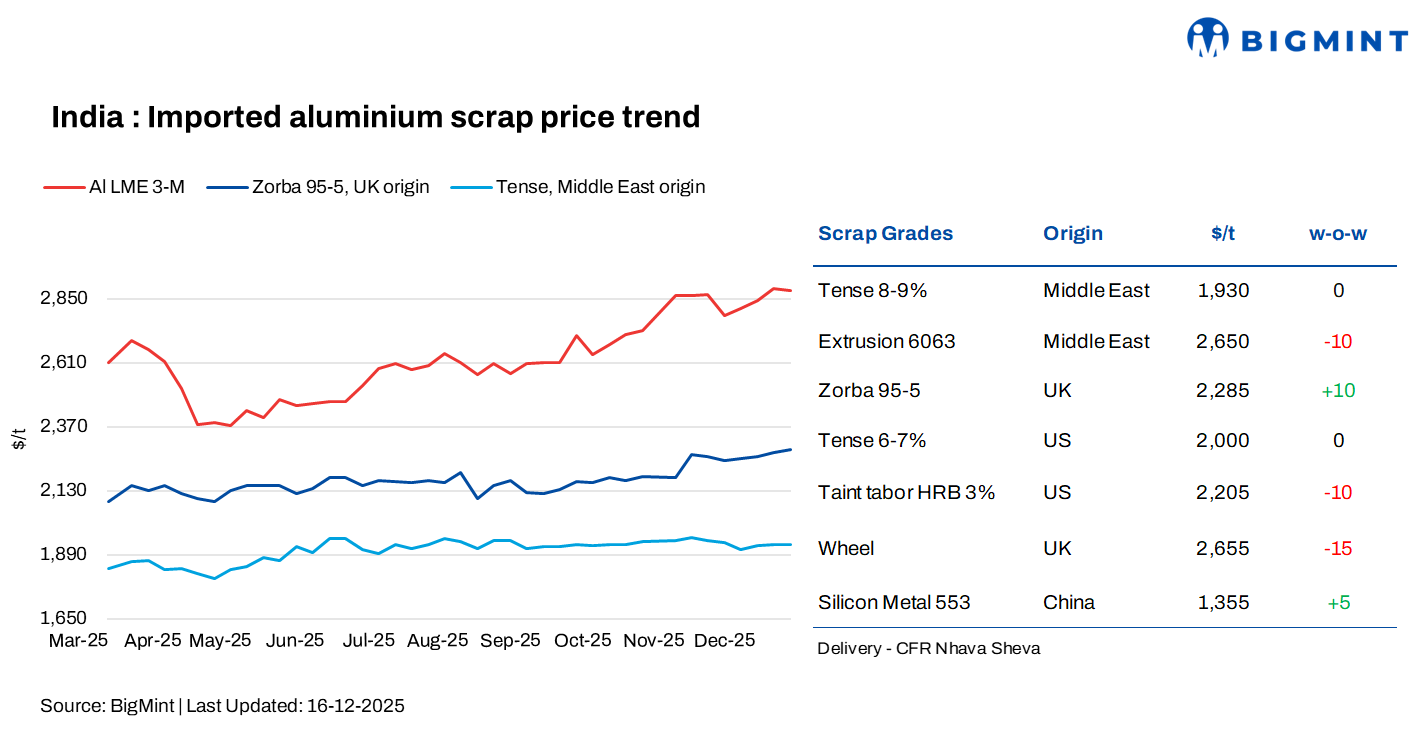

India's imported aluminium scrap prices were mixed in the week ended 16 December, amid largely stable LME prices, with selective gains and declines across key grades. BigMint assessed Middle East-origin Tense (8-9 per cent) at USD 1,930 per tonne, unchanged w-o-w, while US-origin Tense (6-7 per cent) also remained stable at USD 2,000 per tonne.

Image credit: BigMint

UK-origin Zorba 95/5 edged up by USD 10 per tonne to USD 2,285 per tonne, whereas US-origin Taint Tabor HRB (3 per cent) slipped USD 10 per tonne to USD 2,205 per tonne. Middle East-origin Extrusion 6063 declined USD 10 per tonne to USD 2,650 per tonne, while UK-origin Wheel prices eased USD 15 per tonne to USD 2,655 per tonne w-o-w.

LME prices nearly stable w-o-w; inventories fall

At the close on 15 December, LME aluminium three-month prices stood at USD 2,881 per tonne, easing by USD 15 per tonne from USD 2,896 per tonne recorded on 8 December. Meanwhile, inventories at LME-registered warehouses declined to 519,600 t, down by 6,200 t from 525,800 t a week earlier, indicating continued tightening in available supply.

LME aluminium prices remained largely rangebound in the week ended 15 December, supported by declining exchange inventories and recent US Federal Reserve rate cuts, which helped improve overall market sentiment. However, persistent demand concerns in China and expectations of a year-end seasonal slowdown limited any upside. Prices averaged around USD 2,880 per tonne during the week, while LME inventories continued to fall, reflecting ongoing supply tightness. Looking ahead, aluminium prices are expected to stay rangebound in the near term, with supply-side support offset by weak seasonal demand and thin year-end trading, while a clearer direction may emerge early next year as post-holiday demand and policy cues improve.

Market insights

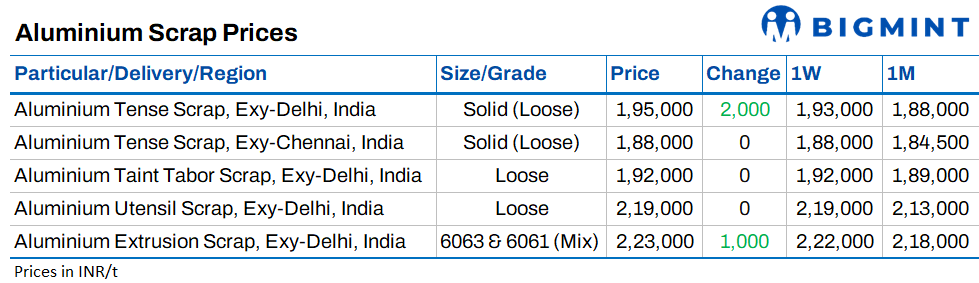

Imported aluminium market remained quiet during the week, with limited price movement. The domestic market stayed largely stable to slightly soft, despite a weakening rupee, as overall buying interest remained muted.

Buying activity continued to slow amid year-end seasonality, with only a few weeks left in the calendar year. Trading volumes softened as suppliers, particularly in Western regions, prepared for winter holidays, during which shipments are typically paused until after the New Year. This led to subdued negotiations and limited fresh bookings.

In the Indian market, demand eased further as several automobile manufacturers are expected to undertake planned maintenance shutdowns in December. This is likely to keep procurement activity subdued and scrap consumption lower through the month.

Image credit: BigMint

Amid the softer demand environment, domestic aluminium scrap prices remained largely rangebound w-o-w across most grades, in line with stable-to-rangebound imported scrap offers. Casting scrap prices edged up in Delhi, while prices in Chennai remained stable, supported by steady downstream demand.

Meanwhile, expectations of a potential US Fed rate cut lent support to global sentiment, but the impact was partly offset by rupee depreciation, which kept landed costs elevated and discouraged aggressive buying. Overall, market participants continue to adopt a cautious, wait-and-watch approach heading into year-end.

China silicon

According to BigMint's assessment, China-origin Silicon Metal 553 saw a marginal rise of USD 5 per tonne, assessed at USD 1,355 per tonne CFR Mundra.

Outlook

In December, imported aluminium scrap prices in India are expected to remain stable, tracking LME prices and weak year-end demand limit any strong upside. Buying activity is likely to stay muted through December due to holiday-led shipment pauses and planned maintenance shutdowns at auto OEMs. While expectations of a US Fed rate cut may lend some support to global sentiment, rupee depreciation could keep landed costs elevated, capping fresh bookings. Market activity is expected to pick up gradually only after the New Year, once operations and procurement normalise.

Note: This article has been issued by BigMint and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses