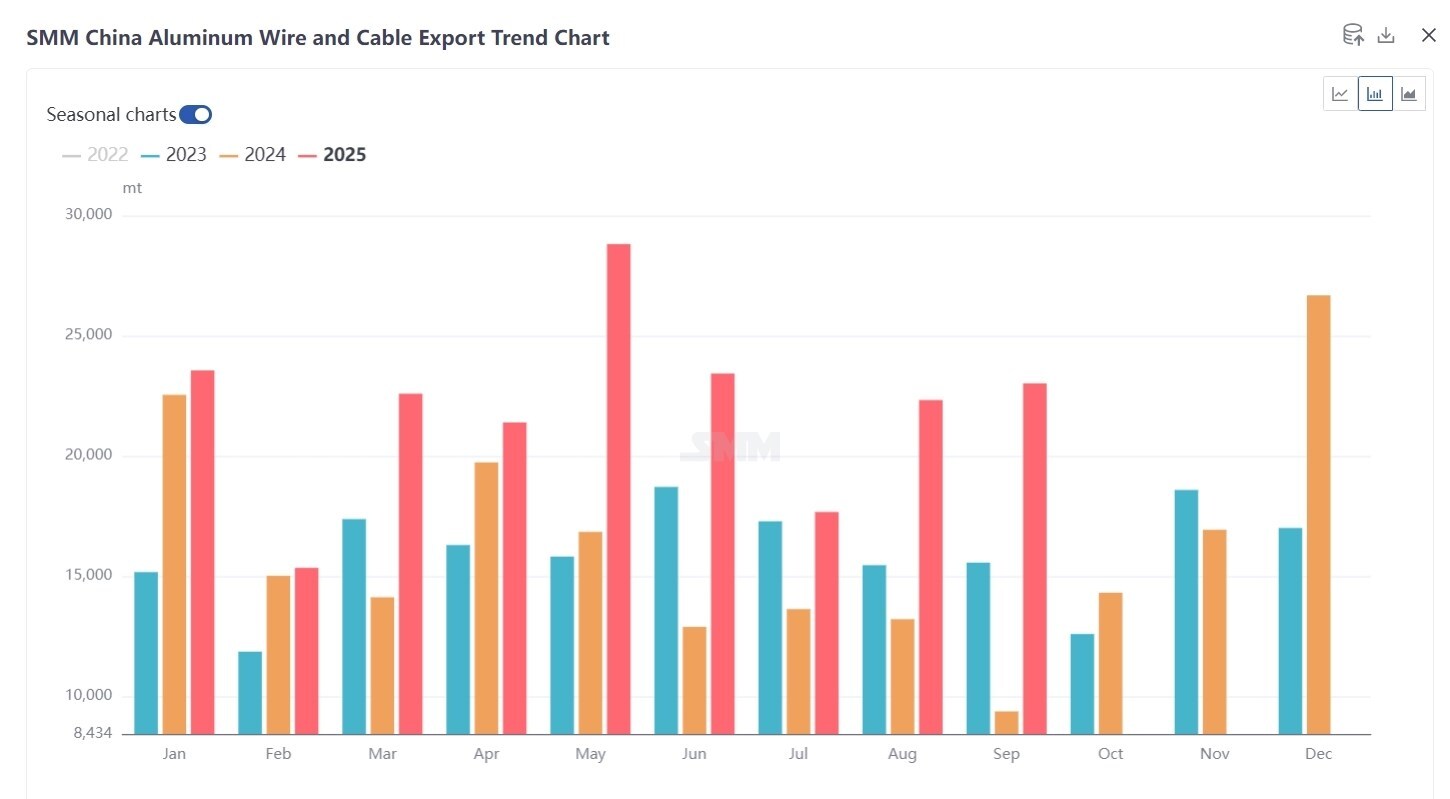

Customs data shows that China's aluminium wire and cable exports reached 23,000 tonnes in September 2025, up 3.1per cent m-o-m and 145per cent y-o-y. Cumulative exports for January-September totalled 198,000 tonnes, up 30.6per cent y-o-y from 151,600 tonnes in the same period of 2024. By product, exports of steel-core aluminium stranded wire reached 15,500 tonnes, up 4per cent m-o-m and 233per cent y-o-y, accounting for 67per cent of total exports; exports of aluminium stranded wire stood at 7,500 tonnes, up 2per cent m-o-m and 59per cent y-o-y, accounting for 33per cent of the total. (HS codes: 76141000, 76149000)

In September, Australia led China's aluminium wire and cable export markets with 1,942.1 tonne (8per cent share), up 66.7 tonne from the previous month. Finland ranked second with 1,930.8 tonne (8per cent share), posting a significant increase of 1,420.5 tonne m-o-m. Pakistan came in third with 1,857.7 tonne (8per cent share), up 1,857.7 tonne m-o-m. Strong demand emerged from multiple overseas markets, with countries such as Finland, Sweden, and Pakistan driving increased aluminium wire and cable demand due to infrastructure expansion and industrial development, becoming key drivers of China's export growth in September.

By export registration region, Jiangsu, Henan, and Beijing were the top three contributors. Jiangsu exported 8,433.997 tonnes, accounting for 36.6per cent of the total and demonstrating strong export advantages. Henan exported 4,362.429 tonnes, representing 19.0per cent and ranking second. Beijing exported 3,115.653 tonnes, accounting for 13.5per cent and ranking third. Additionally, Zhejiang, Chongqing, and other regions also contributed certain export shares, collectively shaping the regional pattern of China's aluminium wire and cable exports.

SMM Brief: Overall, China's aluminium wire and cable exports maintained optimistic growth in 2025, with cumulative exports in the first three quarters reaching 198,000 tonnes, up 30.6per cent y-o-y from 151,600 tonnes in the same period of 2024, nearly achieving the full-year 2024 export target. In terms of product structure, the pattern persisted over the past two months, with steel-core aluminium stranded wire accounting for two-thirds and aluminium stranded wire one-third of exports. This clearly indicates that the export growth is primarily boosted by strong overseas demand from power grid upgrades and energy infrastructure projects. Looking ahead to Q4 2025, supported by overseas market demand released amid accelerated global energy transition and stable domestic supply capacity, China's aluminium wire and cable exports are expected to maintain steady growth, with full-year exports likely to exceed 250,000 tonnes.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses