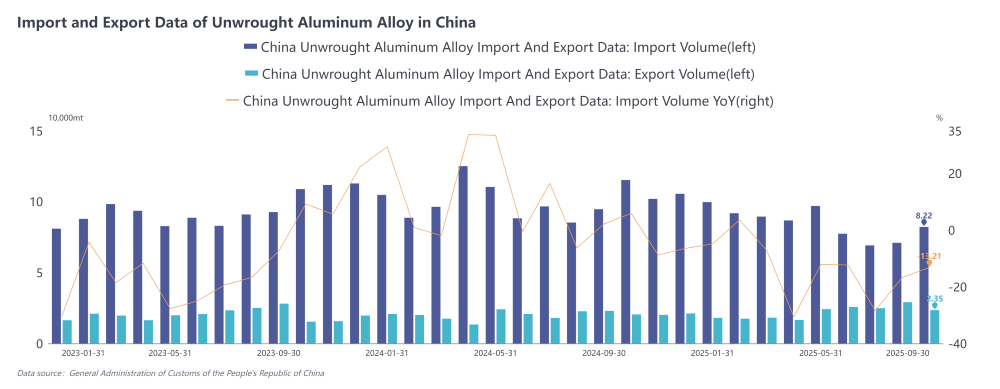

The General Administration of Customs recently released import and export data for September 2025. Customs data showed: In September 2025, unwrought aluminium alloy imports totalled 82,200 tonnes, down 13.2 per cent y-o-y but up 15.7 per cent M-o-M. Cumulative imports from January to September 2025 reached 764,700 tonnes, a decrease of 14.1 per cent YoY.

In September 2025, unwrought aluminium alloy exports amounted to 23,500 tonnes, up 2.1 per cent y-o-y but down 19.2 per cent MoM. Cumulative exports from January to September 2025 stood at 197,800 tonnes, an increase of 9.6 per cent YoY.

By import source, the top five countries for China's unwrought aluminum alloy imports in September 2025 were Russia (25,000 tonne, 30 per cent), Malaysia (23,600 tonne, 29 per cent), Thailand (10,500 tonne, 13 per cent), Vietnam (6,000 tonne, 6 per cent), and South Korea (2,400 tonne, 3 per cent), with the remaining sources accounting for less than 20 per cent. Compared with August, the rebound in September imports was mainly driven by increased imports from Russia, Thailand, and South Korea among the top five sources, while imports from Malaysia and Vietnam declined.

In September, Russia surpassed Malaysia for the first time to become China's largest source of unwrought aluminium alloy imports. By trade mode, Processing with Imported Materials accounted for 43 per cent of China's aluminium alloy imports from Russia (of which 63 per cent were sold to Henan Province), followed by Entrepot Trade by Customs Special Control Area, while Ordinary Trade accounted for only 1 per cent.

In September 2025, China's exports of unwrought aluminium alloy amounted to 23,500 tonnes, down 6,000 tonnes MoM, but remained at a relatively high level above 20,000 tonnes. By export structure, Japan ranked first with exports of 11,600 tonnes, though its share dropped to 49 per cent from 59 per cent in the previous month, followed by Mexico (16 per cent) and India (9 per cent) in second and third place, respectively.

Processing trade remained the primary export method. In September 2025, the top five provinces in China by unwrought aluminum alloy imports were Zhejiang (28,300 tonne, 34 per cent), Shandong (12,700 tonne, 15 per cent), Henan (10,600 tonne, 13 per cent), Jiangsu (6,900 tonne, 8 per cent), and Guangdong (5,400 tonne, 7 per cent), with the remaining provinces accounting for a combined 22 per cent.

Overall, in September 2025, China's imports of unwrought aluminium alloy continued to grow m-o-m but still fell 13 per cent Y-o-Y, while exports dropped back slightly m-o-m but maintained positive y-o-y growth for the seventh consecutive month. On the import side, September imports increased by 11,200 tonne from the previous month, with exports from Russia to Henan via Processing with Imported Materials being the main source of growth, while Ordinary Trade saw a m-0-m increase of about 1,063 tonne.

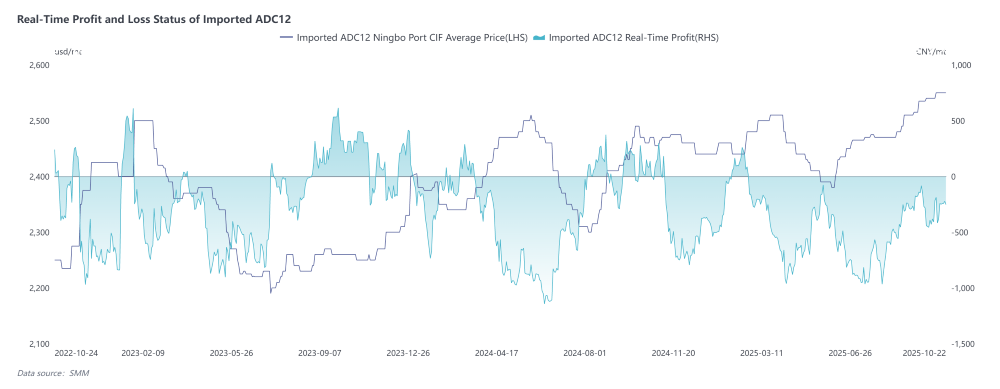

Since September, overseas ADC12 offers have risen to the range of USD 2,500–2,570 per tonne. Driven by rising domestic prices and a stronger RMB, import cost advantages have emerged. Combined with demand support from the September-October peak season, September imports showed a rebound trend, and October imports are expected to remain above 80,000 tonnes.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses