Primary Aluminium Imports: According to data from the General Administration of Customs, domestic primary aluminium imports in April 2025 reached approximately 250,500 tonnes, up 12.8 per cent M-o-M and 14.6 per cent Y-o-Y. From January to April, cumulative primary aluminium imports totaled about 634,300 tonnes, down 11.2 per cent Y-o-Y.

Primary Aluminium Exports: Data from the General Administration of Customs showed that domestic primary aluminium exports in April 2025 were approximately 13,700 tonnes, up 54.6 per cent M-o-M and 643.0 per cent YoY. From January to April, cumulative primary aluminium exports totaled about 34,500 tonnes, up approximately 139.6 per cent Y-o-Y.

Net Primary Aluminium Imports: In April 2025, domestic net primary aluminium imports were 236,800 tonnes, up 11.1 per cent M-o-M and 14.8 per cent Y-o-Y. From January to April, cumulative net primary aluminium imports totaled about 799,800 tonnes, down 13.6 per cent Y-o-Y.

(The above import and export data are based on HS codes 76011090 and 76011010.)

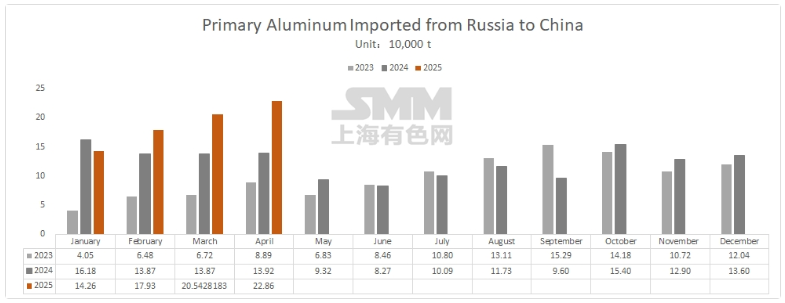

From the perspective of import source countries, the main sources of domestic primary aluminium imports in April 2025 were the Russian Federation, Indonesia, India, Malaysia, Australia, China, Iran, and other countries and regions. Among them, the total primary aluminium imports from Russia in April were approximately 227,000 tonnes, up 12.44 per cent M-o-M again, accounting for 90.3% of March's imports. In addition, primary aluminium imports from China in March were approximately 2,300 tonnes, down 44.32 per cent M-o-M. This portion was mainly aluminium ingots processed from Chinese alumina exported to Russia and then re-imported into the Chinese market. From the perspective of the origin of aluminium ingots, Russian aluminium ingots still dominated. Therefore, the total imports from Russia in April reached 228,600 tonnes, accounting for 91.26 per cent of the total domestic primary aluminium imports. Currently, overseas primary aluminium imports are in a loss-making state, with import losses fluctuating around RMB 1,000 per tonne. However, due to weak overseas demand and continuous destocking in the domestic market, overseas supplies are being stimulated to be shipped to China, entering the domestic spot market at an opportune time. Additionally, some processing plants have indicated an increase in manual processing orders on hand this year.

From the perspective of trade mode: In terms of the trade mode for primary aluminium imports in April, domestic primary aluminium imports operated at a loss with fluctuations. Suppliers' willingness to clear customs and ship to the Chinese market increased, and overseas supply in the spot market rose. In April, approximately 49 tonnes of barter trade was newly added.

SMM Commentary: Currently, aluminium prices still maintain the trend of overseas market outperforming domestic market. The domestic import window is closed, and import losses fluctuated at around RMB 1,000 per tonne. Coupled with weak overseas demand and domestic processors' increased willingness to process under manuals due to cost considerations, it is expected that domestic net primary aluminium imports will remain high in May.

Responses