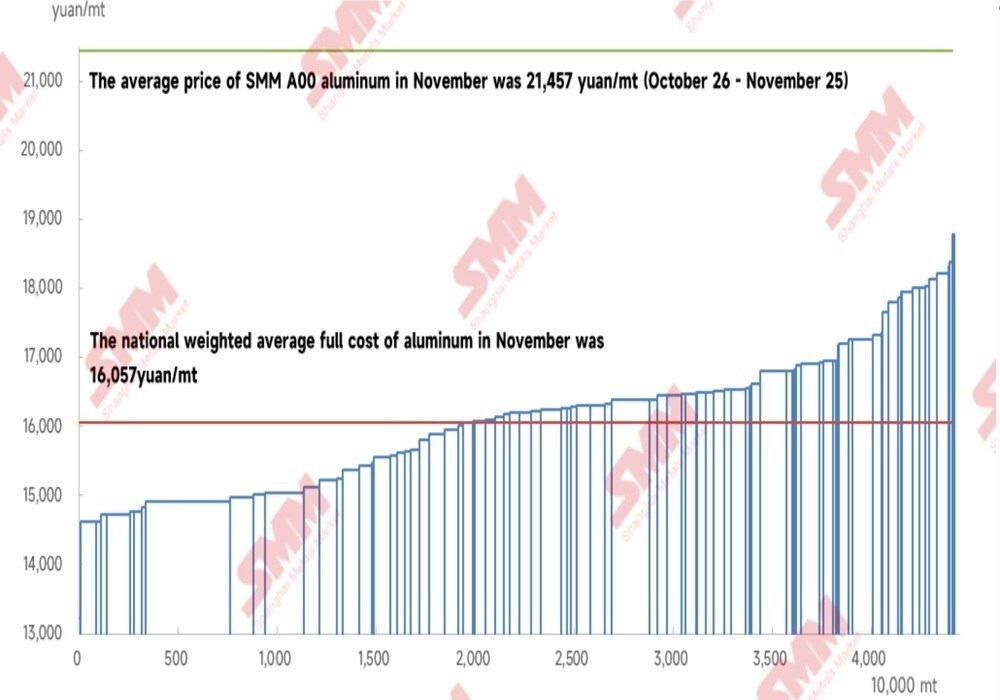

According to SMM data, the average tax-inclusive full cost for China's aluminium industry in November 2025 was RMB 16,057 per tonne, up 1.1 per cent m-o-m but down 21 per cent y-o-y. This was mainly due to a smaller-than-expected drop in the monthly average alumina price during the period, coupled with a significant increase in electricity costs in provinces with a high share of hydropower as the dry season approached, along with rising prebaked anode prices, leading to a m-o-m increase in total aluminium production costs. The SMM A00 average spot price in November was around RMB 21,457 per tonne (October 26–November 25), with the domestic aluminium industry averaging a profit of about RMB 5,400 per tonne.

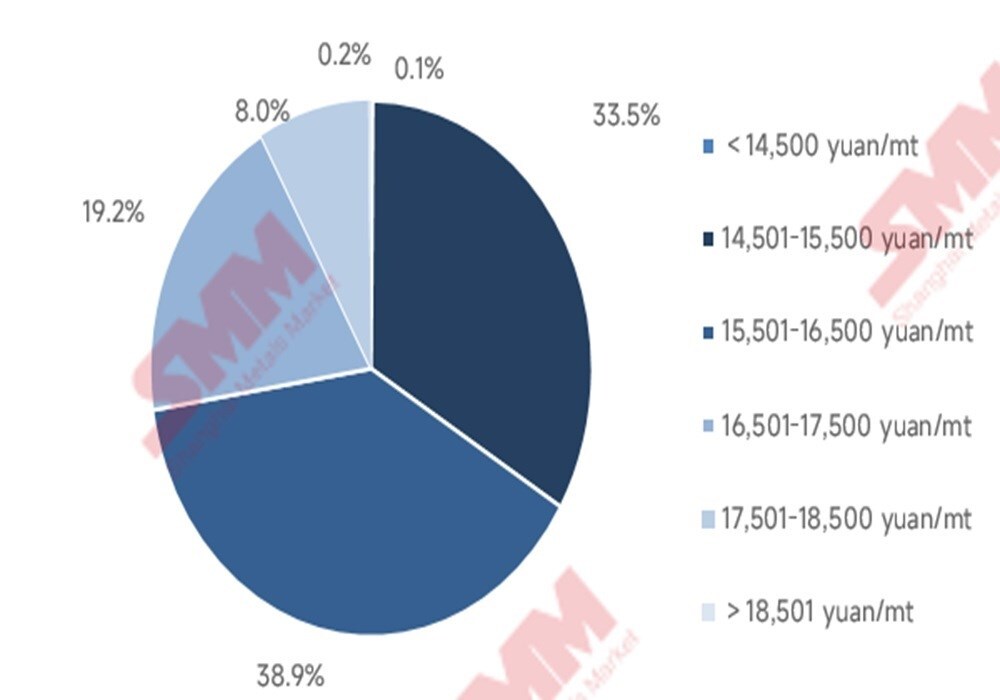

By the end of November 2025, domestic operating aluminium capacity reached 44.23 million mt. The lowest full cost of aluminium was about RMB 13,229 per tonne, while the highest full cost was about RMB 18,782 per tonne. Based on monthly average prices, 100 per cent of domestic operating aluminium capacity was profitable in November.

Cost breakdown:

Alumina raw material side, SMM data shows the average SMM alumina index in November was RMB 2,856 per tonne (October 26–November 25), down RMB 82 per tonne m-o-m. Throughout the month, the alumina market, both domestically and internationally, continued in surplus, but trading was sluggish, and prices fell less than expected. Entering December, no large-scale production cuts in alumina have been reported, but maintenance news from northern alumina enterprises has become more frequent. The import window for alumina remains open. Domestic alumina fundamentals are expected to remain in surplus in December, with the monthly average price projected to drop slightly m-o-m, and alumina costs for aluminium enterprises are expected to decline further.

Auxiliary materials side, prebaked anode prices rose in November due to higher costs, while fluoride salt prices fell as cost support weakened following a drop in raw material fluorite prices in late October. Overall, auxiliary material costs for aluminium production increased in November. In December, both prebaked anode and fluoride salt prices are expected to rise, leading to an anticipated increase in auxiliary material costs for aluminium production.

Electricity prices side, as the dry season approaches, electricity prices in provinces with a high proportion of hydropower have increased significantly, raising power costs for aluminium production in November. Entering December, power costs in these provinces are expected to rise further, and aluminium power costs are projected to continue increasing.

Overall, alumina raw material costs for aluminium in December are expected to continue a slight decline, while auxiliary material and power costs are projected to rebound. Among these, the impact from power costs is anticipated to be dominant, and aluminium costs are expected to rise slightly m-o-m. Overall, SMM forecasts that the average tax-inclusive full cost for the domestic aluminium industry in December 2025 will be around RMB 16,100-16,500 per tonne.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses