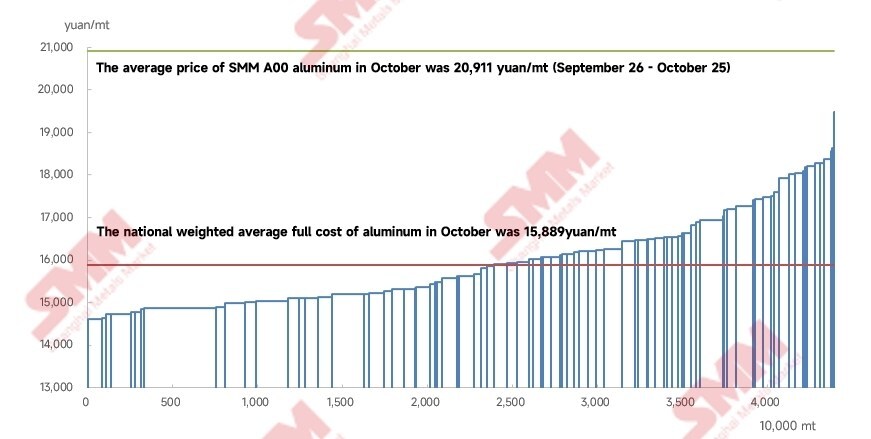

According to SMM data, the average tax-inclusive full cost of China's aluminium industry in October 2025 was RMB 15,889 per tonne, down 1.8 per cent M-o-M and 13.3 per cent Y-o-Y, mainly due to the decline in the average monthly spot alumina price during the period, leading to lower costs. SMM data showed that the monthly average of the SMM alumina index in October was RMB 2,938 per tonne (September 26–October 25), down RMB 175 per tonne M-o-M, and the weighted average alumina cost for the national aluminium industry fell 5.5per cent M-o-M. The average SMM A00 spot price was approximately RMB 20,911 per tonne (September 26–October 25), with the average profit in the domestic aluminium industry reaching about RMB 5,022 per tonne.

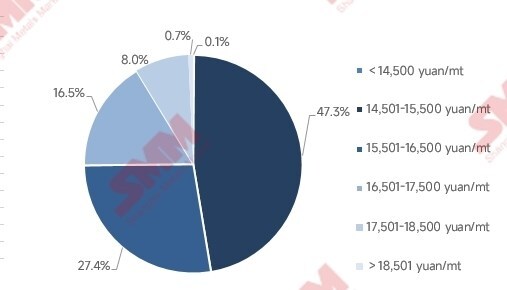

By the end of October 2025, domestic operating aluminium capacity remained at 44.05 million tonnes, with the lowest full cost at about RMB 13,230 per tonne and the highest full cost at about RMB 19,477 per tonne. If calculated based on the monthly average price, 100per cent of the operating aluminium capacity in China was profitable in October.

Cost side,

For alumina raw materials, SMM data indicated that the monthly average of the SMM alumina index in October was RMB 2,938 per tonne (September 26–October 25). During the month, the fundamental supply-demand balance for alumina both domestically and internationally remained in surplus, with domestic spot alumina prices continuing to decline, leading to a further drop in the monthly average price.

Entering November, no large-scale production cuts in alumina have been reported, and the import window for alumina remained open, sustaining the surplus in domestic alumina fundamentals. However, sellers held prices firm and were reluctant to sell, while some aluminium plants began winter stockpiling, leading to a slight increase in demand. By early November, the decline in spot alumina prices slowed, with prices stabilising in some regions. Nevertheless, as absolute prices were lower than the previous month, the average alumina price in November is expected to decline M-o-M, and alumina costs for aluminium enterprises are projected to decrease further.

In the auxiliary materials market, prices for prebaked anodes and fluoride salts rose simultaneously in October, directly increasing auxiliary material costs for aluminium. In November, market trends diverged: prebaked anode prices continued to rise, supported by earlier cost increases, while fluoride salt prices fell due to weakening cost support from softer fluorite prices in late October. Overall, auxiliary material costs for aluminium in November still showed an increasing trend.

For electricity prices, rates remained largely stable in October. Entering November, with rising coal prices and the approaching dry season, power costs are expected to increase.

Overall, alumina costs were projected to continue declining in November, while auxiliary material and power costs were expected to rebound. Among these factors, the impact from alumina was anticipated to dominate, and aluminium costs were forecast to experience a slight further decrease. In summary, SMM estimated that the average tax-inclusive full cost for the domestic aluminium industry in November 2025 would be around RMB 15,600-16,000 per tonne.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses